CT DRS Schedule CT-SI 2014 free printable template

Show details

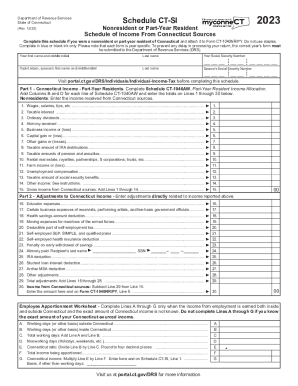

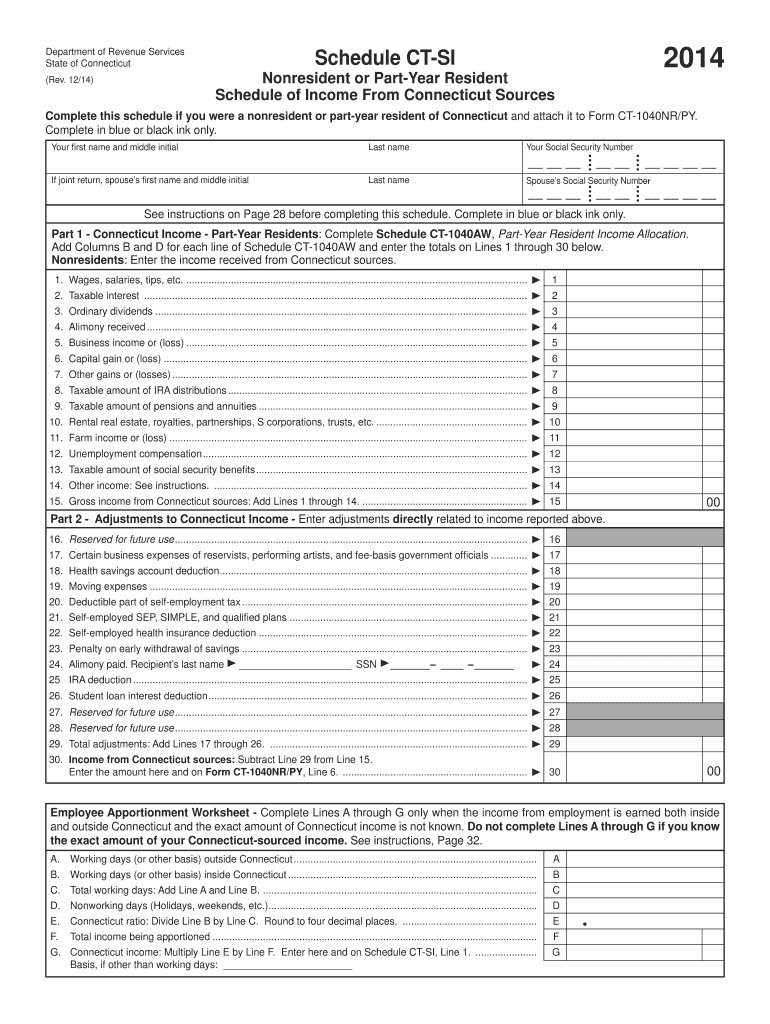

Department of Revenue Services State of Connecticut 2014 Schedule CT-SI Nonresident or Part-Year Resident Schedule of Income From Connecticut Sources (Rev. 12/14) Complete this schedule if you were

pdfFiller is not affiliated with any government organization

Instructions and Help about CT DRS Schedule CT-SI

How to edit CT DRS Schedule CT-SI

How to fill out CT DRS Schedule CT-SI

Instructions and Help about CT DRS Schedule CT-SI

How to edit CT DRS Schedule CT-SI

To edit the CT DRS Schedule CT-SI, access the form using a PDF editor like pdfFiller. Utilize the editing tools to fill in or change any required information. Ensure that all entries are legible and accurate to avoid complications during processing.

How to fill out CT DRS Schedule CT-SI

Filling out the CT DRS Schedule CT-SI requires accurate and timely information. Follow these steps:

01

Gather all necessary documents including income statements and tax identification numbers.

02

Enter personal identification information in the designated sections at the top of the form.

03

Provide details pertaining to income, deductions, and credits as applicable.

04

Review the completed form for accuracy before submission.

About CT DRS Schedule CT-SI 2014 previous version

What is CT DRS Schedule CT-SI?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About CT DRS Schedule CT-SI 2014 previous version

What is CT DRS Schedule CT-SI?

CT DRS Schedule CT-SI is a tax form used by certain taxpayers in Connecticut to report specific types of income and calculate their state tax obligations. This form is integral for ensuring compliance with state tax regulations.

What is the purpose of this form?

The primary purpose of the CT DRS Schedule CT-SI is to provide the Connecticut Department of Revenue Services (DRS) with detailed information about a taxpayer's supplemental income. This includes income from sources such as rental properties, royalties, and other non-wage income, helping to determine correct tax liabilities.

Who needs the form?

Individuals who receive supplemental income must file the CT DRS Schedule CT-SI if their total income exceeds certain thresholds set by the state. This typically includes self-employed individuals, landlords, and those receiving other types of non-wage income.

When am I exempt from filling out this form?

Taxpayers may be exempt from filling out the CT DRS Schedule CT-SI if their supplemental income falls below the filing thresholds. Additionally, individuals who only receive wages from employment and have no other source of income do not need to submit this form.

Components of the form

The CT DRS Schedule CT-SI comprises several key sections, including personal information, income sources, deductions, and calculations for tax owed. Each section must be completed accurately to ensure proper processing by the DRS.

What are the penalties for not issuing the form?

Failure to file the CT DRS Schedule CT-SI when required can result in significant penalties, including fines and interest on any unpaid taxes. Additionally, the DRS may pursue collections for any taxes owed, compounding financial burdens for non-compliant taxpayers.

What information do you need when you file the form?

When filing the CT DRS Schedule CT-SI, you will need the following information:

01

Your Social Security Number or Employer Identification Number.

02

Details of all sources of supplemental income received during the tax year.

03

Deductions, credits, and any relevant tax documents, such as W-2s or 1099s.

Is the form accompanied by other forms?

The CT DRS Schedule CT-SI may need to be accompanied by other relevant forms, such as the Connecticut Income Tax Return. Review specific submission requirements to ensure all necessary documentation is included to avoid processing delays.

Where do I send the form?

The CT DRS Schedule CT-SI should be sent to the Connecticut Department of Revenue Services. Ensure you verify the appropriate mailing address based on the instructions provided for that tax year to guarantee timely processing.

See what our users say