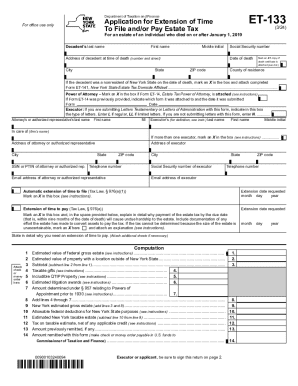

Who needs an ET-133 form?

This form is completed by the personal representative of the deceased individual, an authorized attorney, certified public accountant, or other person with power of attorney.

What is the purpose of the ET-133 form?

The application for Extension of Time to file and/or pay estate tax is completed if the executor of an estate needs some time (not more than six months) for filing and paying the real estate tax return. The executor has to provide the reasons why the extension of time is required. In case the application is approved, the executor can file or pay the tax return within six months.

What documents must accompany the ET-133 form?

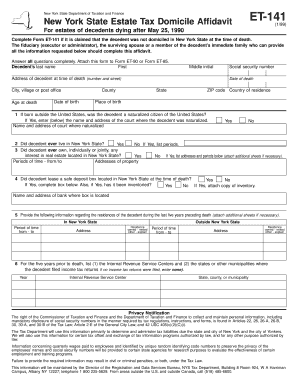

The application may be accompanied by a number of documents including Form ET-14 (Estate Tax Power of Attorney, Letters Testamentary or Letters Administration, Form ET-415 (Application for Deferred Payment of Estate Tax), Form ET-141 (New York State Estate Tax Domicile Affidavit), checks, money order, and other relevant attachments.

When is the ET-133 form due?

This form should be filed within nine months of the date of individual’s death. The extension of time to file a tax return may not exceed six months (except on some occasions).

What information should be provided in the ET-133 form?

The executor should provide the following details:

- Information about the deceased (name, social security number, address, date of death)

- Information about the authorized representative and the executor (name, address, SSN, email)

- Type of extension (extension of time to file or extension of time to pay)

- Detailed description of the reason for the extension

- Computation section (estimated value of federal gross estate, estimated value of property, taxable gifts, etc.)

The executor should also certify the application with a signature and date it.

What do I do with the form after its completion?

The completed application is forwarded to the NYS Estate Tax, Processing Center, Albany NY.