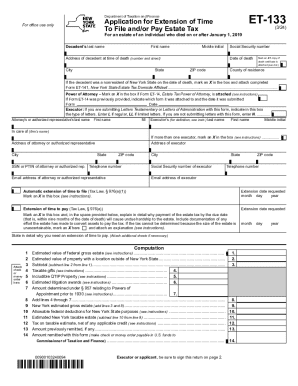

NY DTF ET-133 2019 free printable template

Show details

When to file You must file Form ET-133 within 9 months of the date of death. If there is no numerically corresponding day in the ninth month the last day of the ninth month is the due date. Signature Date ET-133 4/14 back Who may file Form ET-133 Instructions The executor who is required to file the estate tax return for the decedent s estate may file Form ET-133 to request an automatic extension of time to file or to apply for an extension of time to pay the estate tax or both under section...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY DTF ET-133

Edit your NY DTF ET-133 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY DTF ET-133 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY DTF ET-133 online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit NY DTF ET-133. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF ET-133 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY DTF ET-133

How to fill out NY DTF ET-133

01

Obtain the NY DTF ET-133 form from the New York State Department of Taxation and Finance website.

02

Fill in your personal information, including your name, address, and identification number.

03

Follow the instructions for each section carefully, providing necessary details about your income and withholdings.

04

Calculate your total credits and any tax liabilities as instructed in the form.

05

Sign and date the form to verify that all information provided is accurate.

06

Submit the completed form to the appropriate tax office as specified in the instructions.

Who needs NY DTF ET-133?

01

Any individual or business entity that has received a credit or refund for New York State taxes should file the NY DTF ET-133.

02

This form is necessary for those who need to report tax credits or adjustments for prior tax years.

Fill

form

: Try Risk Free

People Also Ask about

How much are estate taxes in NY?

The estate tax rate in New York ranges from 3.06% to 16%. Estates over $5.92 million are subject to this tax in 2021, going up to 6.11 million in 2022.

How much can you inherit tax-free in NY?

While New York doesn't charge an inheritance tax, it does include an estate tax in its laws. The state has set a $6.11 million estate tax exemption, meaning if the decedent's estate exceeds that amount, the estate is required to file a New York estate tax return.

How much is NY state estate tax?

What is the New York estate tax rate? The top New York estate tax rate is 16%. The top rate only applies when the New York taxable estate is over $10,100,000 million. Dollars below that amount are subject to tax at graduated rates, starting at 3.06% for the first $500,000.

How do I file an extension for an estate tax return?

Use Form 4768 to: Apply for an automatic 6-month extension of time to file Form 706, Form 706-A, Form 706-NA, or Form 706-QDT. Apply for a discretionary (additional) extension of time to file Form 706 (Part II of Form 4768). Apply for a discretionary (for cause) extension of time to file Form 706.

What is the NYS estate tax exemption for 2022?

For dates of deaththe basic exclusion amount isJanuary 1, 2022, through December 31, 2022$6,110,000January 1, 2021, through December 31, 2021$5,930,000January 1, 2020, through December 31, 2020$5,850,000January 1, 2019, through December 31, 2019$5,740,0005 more rows

How much can you inherit without paying taxes in 2022?

For 2022, the federal estate exemption is $12.06 million, and it will increase to $12.92 million in 2023. Estates smaller than this amount are not subject to federal taxes, though individual states have their own rules. Internal Revenue Service.

Do I need to file an estate tax return in California?

A California Estate Tax Return, Form ET-1, is required to be filed with the State Controller's Office, whenever a federal estate tax return Form-706 is filed with the Internal Revenue Service (IRS).

What happens if a tax return is not filed for a deceased person?

If the ITR is not filed, the legal heir is liable to pay the penalty or fines. They may also face penal consequences. However, they are only responsible to pay the taxes or penalties to the extent of the money he has inherited. The penalty to be paid by the heir depends on the tax liability of the deceased person.

How do I file a deceased person's New York State tax return?

You must file Form ET-706 within nine months after the decedent's date of death, unless you receive an extension of time to file the return. An extension of time to file the estate tax return may not exceed six months, unless the executor is out of the country.

Can I electronically file a tax return for a deceased person?

Can a tax return for a deceased taxpayer be e-filed? Yes, it can. Whether e-filed or filed on paper, be sure to write “deceased” after the taxpayer's name. If paper filed, also include the taxpayer's date of death across the top of the return.

Do you have to pay taxes on inheritance in New York?

While New York doesn't charge an inheritance tax, it does include an estate tax in its laws. The state has set a $6.11 million estate tax exemption, meaning if the decedent's estate exceeds that amount, the estate is required to file a New York estate tax return.

How much inheritance is tax free in New York State?

Generally, for NY estate tax purposes, if the value of assets passing to beneficiaries other than a spouse or charity is below a certain threshold ($6.11 million in 2022), the assets are fully exempt from tax and no NY estate taxes will be due.

How do I avoid estate tax in NY?

One way to preserve this amount is by establishing a trust equal to the estate tax exemption (federal or NY). Transfers to these trusts leave an individual's estate and are technically subject to the estate tax (or gift tax).

How much is the estate tax in New York?

What is the New York estate tax rate? The top New York estate tax rate is 16%. The top rate only applies when the New York taxable estate is over $10,100,000 million. Dollars below that amount are subject to tax at graduated rates, starting at 3.06% for the first $500,000.

Can I file a 1041 extension?

An extension may be requested in the following manner: Filing an extension request electronically via the Louisiana Department of Revenue's Online Extension Filing application or through the taxpayer's account on LaTap.

What is the New York State estate tax exemption for 2022?

For dates of deaththe basic exclusion amount isJanuary 1, 2023, through December 31, 2023$6,580,000January 1, 2022, through December 31, 2022$6,110,000January 1, 2021, through December 31, 2021$5,930,000January 1, 2020, through December 31, 2020$5,850,0005 more rows

How do I file a tax return for a deceased person?

In general, file and prepare the final individual income tax return of a deceased person the same way you would if the person were alive. Report all income up to the date of death and claim all eligible credits and deductions.

Do I have to file an estate tax return in Florida?

Florida tax is imposed only on those estates subject to federal estate tax filing requirements and entitled to a credit for state death taxes (Chapter 198, F.S.). Estate tax is not due if a federal estate tax return (Form 706 or 706-NA) is not required to be filed.

What is the due date of an estate tax return can the due date be extended How is the return return extended how long can the return be extended?

The due date of the estate tax return is nine months after the decedent's date of death, however, the estate's representative may request an extension of time to file the return for up to six months.

What is the NY state estate tax exemption?

What is the current exemption from New York estate tax again? The current New York estate tax exemption amount is $6,110,000 for 2022. Under current law, this number will remain until January 1, 2023, at which point it will rise again with inflation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my NY DTF ET-133 in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your NY DTF ET-133 and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I edit NY DTF ET-133 from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your NY DTF ET-133 into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I create an electronic signature for signing my NY DTF ET-133 in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your NY DTF ET-133 and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

What is NY DTF ET-133?

NY DTF ET-133 is a form used by New York State to report and claim a refund for tax withheld from a nonresident employee's wages.

Who is required to file NY DTF ET-133?

Nonresident employees who have had New York State income tax withheld and wish to claim a refund must file NY DTF ET-133.

How to fill out NY DTF ET-133?

To fill out NY DTF ET-133, enter your personal information, details of the tax withheld, and the reason for claiming a refund. Follow the instructions provided on the form.

What is the purpose of NY DTF ET-133?

The purpose of NY DTF ET-133 is to provide a mechanism for nonresidents of New York State to request a refund of New York income tax withheld from their wages.

What information must be reported on NY DTF ET-133?

The information that must be reported includes the employee's name, address, Social Security number, employer's name, tax withheld amounts, and the reasons for the refund request.

Fill out your NY DTF ET-133 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DTF ET-133 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.