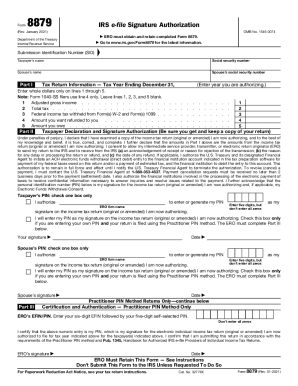

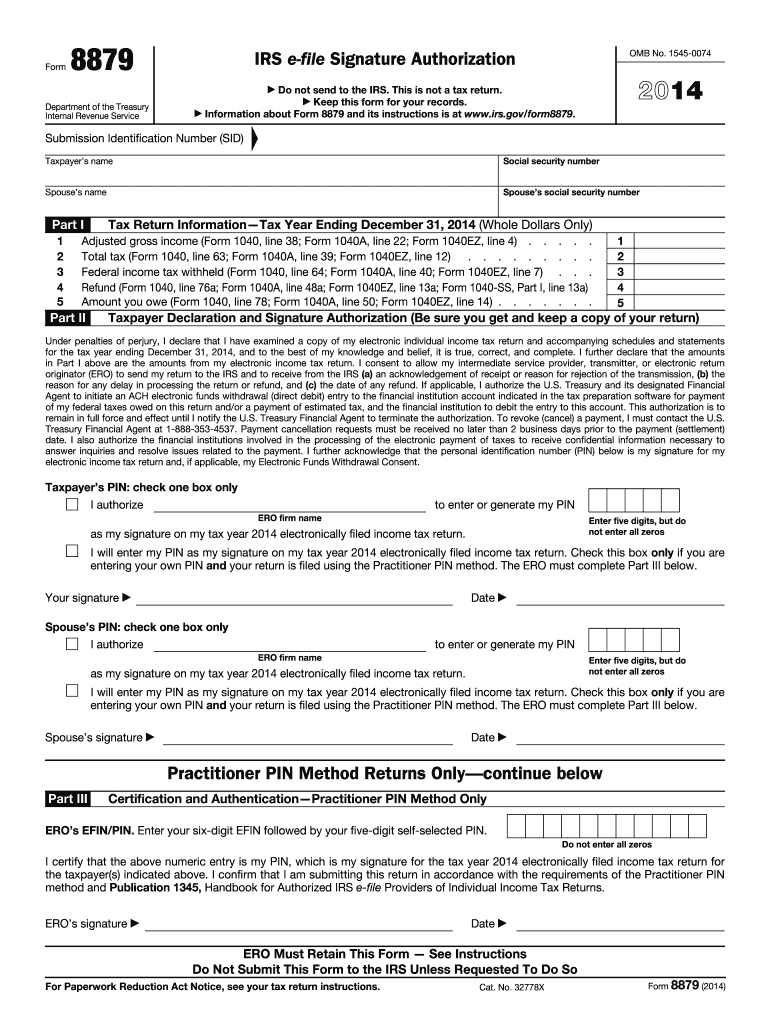

IRS 8879 2014 free printable template

Instructions and Help about IRS 8879

How to edit IRS 8879

How to fill out IRS 8879

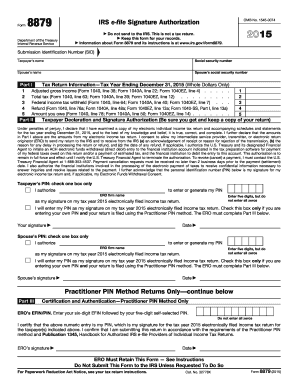

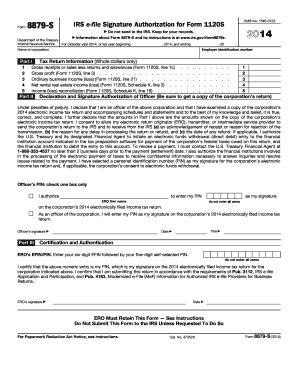

About IRS 8 previous version

What is IRS 8879?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 8879

What should I do if I realize I've made an error on my filed 2014 form 8879?

If you've discovered a mistake after submitting your 2014 form 8879, you should consider filing an amended return to correct the error. It's important to follow the IRS guidelines for amendments, which may vary based on the nature of the error. Keep copies of the original and amended forms for your records to ensure you have documentation for any future inquiries.

Can I check the status of my submitted 2014 form 8879?

You can verify the status of your submitted 2014 form 8879 through the IRS e-file application. If there are any issues, such as rejection due to an invalid e-signature, you will typically receive a notice stating the reason for the rejection. It's important to address these issues promptly to avoid delays in processing.

What are the common pitfalls that filers face with the 2014 form 8879?

Common errors with the 2014 form 8879 include incorrect e-signatures, mismatched taxpayer identification numbers, and not validating information before submission. To avoid these mistakes, double-check all information, ensure the e-signature meets IRS standards, and consult relevant documentation if needed.

Are there any specific requirements for e-signing the 2014 form 8879?

E-signatures on the 2014 form 8879 must comply with IRS regulations, ensuring they are secure and properly documented. It’s essential to use an IRS-approved method for electronic signatures and retain records of consent and authentication to protect your privacy and data security.

What steps should I take if my 2014 form 8879 submission is rejected?

If your 2014 form 8879 is rejected, review the notice for specific error codes and instructions. Correct the issues noted—often related to documentation or e-signature problems—and resubmit the form as quickly as possible to avoid further delays in the processing of your tax return.

See what our users say