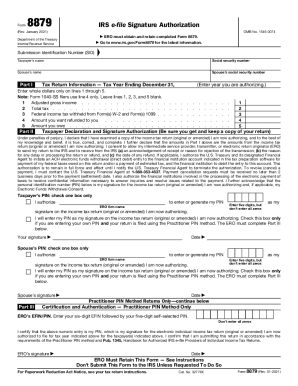

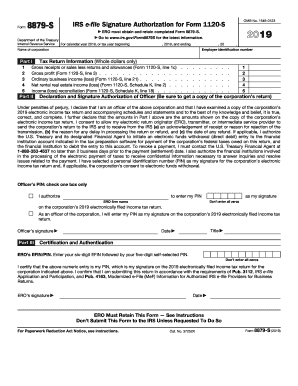

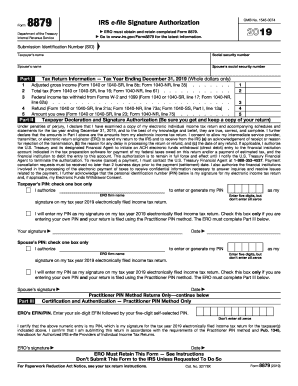

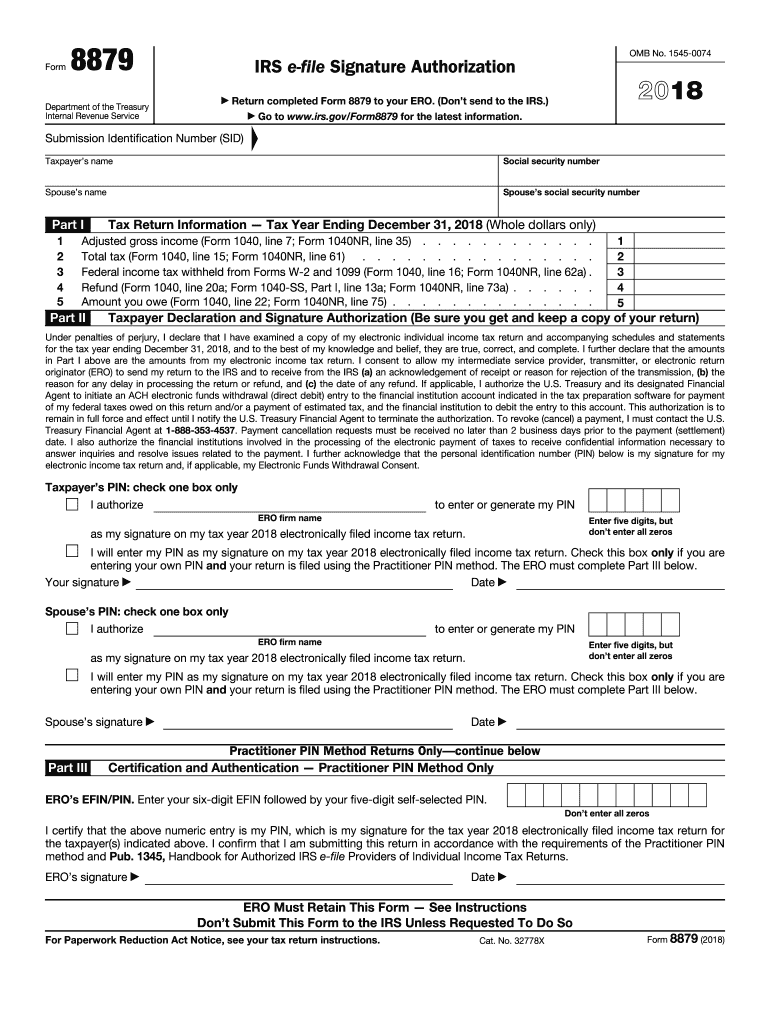

IRS 8879 2018 free printable template

Instructions and Help about IRS 8879

How to edit IRS 8879

How to fill out IRS 8879

About IRS 8 previous version

What is IRS 8879?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

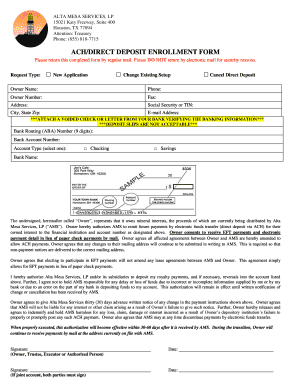

Is the form accompanied by other forms?

FAQ about IRS 8879

What should I do if I realize I've made a mistake after filing IRS 8879?

If you discover an error after filing IRS 8879, you can submit a corrected version of the form to amend your filing. Make sure to clearly indicate the corrections made. It's essential to keep records of the previous submission and the amended form for your reference.

How can I verify the status of my IRS 8879 submission?

To verify the status of your IRS 8879 submission, check the tracking feature provided by the e-filing service you used. If issues arise, such as rejection codes, refer to common solutions for rejections or contact customer support for assistance with your submission.

What privacy measures should I consider when filing IRS 8879 electronically?

When filing IRS 8879 electronically, ensure you use a secure internet connection and trusted tax software. Also, be aware of the data retention period and consider how long the data is stored. Protect your sensitive information by taking necessary steps to secure your data against unauthorized access.

Are there any specific service fees for e-filing IRS 8879?

Yes, certain e-filing services may charge a fee for electronically submitting IRS 8879. It's important to check with your chosen service provider for details on any applicable fees and understand their refund policy if your submission is rejected.

How should I handle an IRS notice received after filing IRS 8879?

If you receive an IRS notice after filing IRS 8879, read the notice carefully to understand the issue. Prepare the necessary documentation to respond appropriately, and follow the instructions provided in the notice to resolve any discrepancies or additional requirements from the IRS.

See what our users say