CT DRS CT-1041 2014 free printable template

Show details

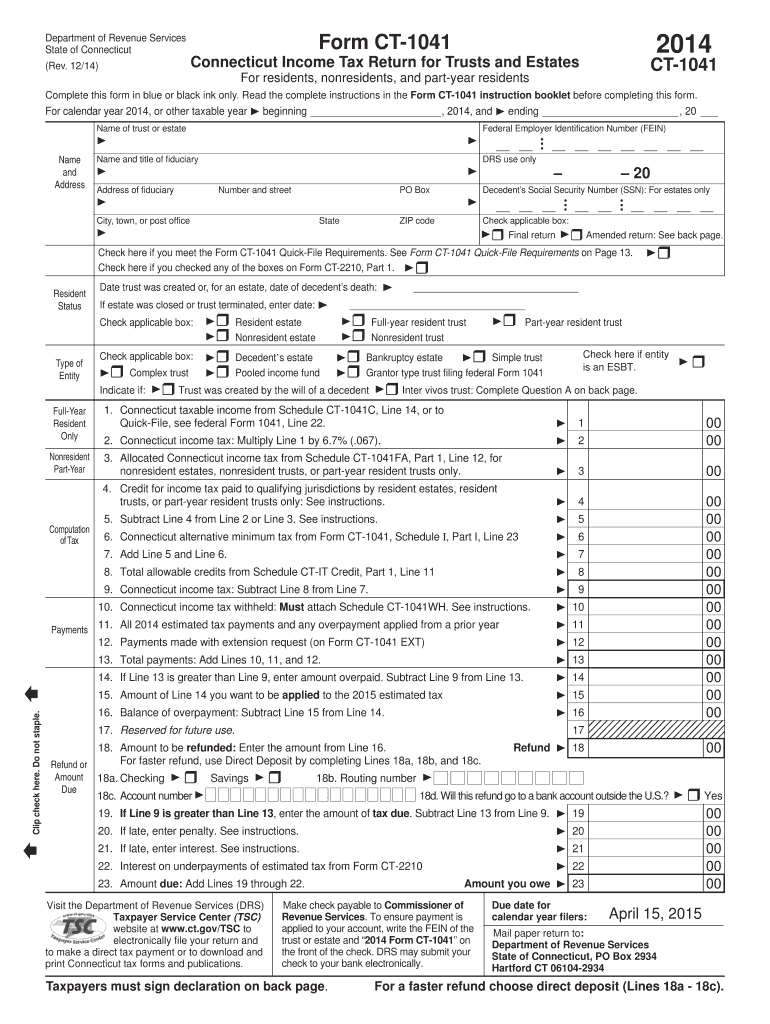

Amount you owe 23 Make check payable to Commissioner of Revenue Services. To ensure payment is applied to your account write the FEIN of the trust or estate and 2014 Form CT-1041 on the front of the check. Part-Year Quick-File see federal Form 1041 Line 22. Payments 11. All 2014 estimated tax payments and any overpayment applied from a prior year 12. Payments made with extension request on Form CT-1041 EXT 13. Total payments Add Lines 10 11 and ...

pdfFiller is not affiliated with any government organization

Instructions and Help about CT DRS CT-1041

How to edit CT DRS CT-1041

How to fill out CT DRS CT-1041

Instructions and Help about CT DRS CT-1041

How to edit CT DRS CT-1041

Edit the CT DRS CT-1041 tax form by using pdfFiller, which allows you to fill out, sign, and make necessary changes easily. Start by uploading your existing form to the platform, then utilize the editing tools to input corrected information as needed. Once edited, review the document for accuracy before saving it as a new version or submitting it.

How to fill out CT DRS CT-1041

Filling out the CT DRS CT-1041 tax form involves several key steps aimed at ensuring accurate reporting. Follow these steps for completion:

01

Access the form either online or through a printed version.

02

Gather all necessary financial documents, including records of payments and purchases that need to be reported.

03

Begin by entering your entity information, such as name and address, in the designated fields.

04

Proceed to report the income or payments made during the tax year in the appropriate sections of the form.

05

Review the completed form for any missing information before submission.

About CT DRS CT- previous version

What is CT DRS CT-1041?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About CT DRS CT- previous version

What is CT DRS CT-1041?

The CT DRS CT-1041 is the Connecticut Department of Revenue Services tax form used primarily for reporting income by certain types of trusts and estates in the state of Connecticut. This form ensures accurate income declaration and compliance with state tax laws.

What is the purpose of this form?

The purpose of the CT DRS CT-1041 tax form is to enable fiduciaries of estates and trusts to report income that is taxable to these entities. By filing this form, fiduciaries can calculate the tax owed, ensure compliance with tax obligations, and provide detailed financial information to the state.

Who needs the form?

The CT DRS CT-1041 form is required for fiduciaries managing estates and taxable trusts that earn income during the tax year. This includes executors, administrators, trustees, or any individuals responsible for managing a decedent’s estate or trust income.

When am I exempt from filling out this form?

Exemptions from completing the CT DRS CT-1041 include situations where the trust or estate does not generate taxable income during the year. Additionally, if an estate is under a specific income threshold of $1,000, it may be exempt from filing, but it's advisable to consult the latest state guidelines for specifics.

Components of the form

The CT DRS CT-1041 comprises various sections that require detailed reporting. Key components include the party identification, income assessments, deductions available for the trust or estate, and any taxable or exempt distributions made during the tax year. Each section must be completed accurately to ensure compliance.

What are the penalties for not issuing the form?

Failing to file the CT DRS CT-1041 form can result in significant penalties, including fines imposed by the Connecticut Department of Revenue Services. These penalties can escalate depending on the duration of the delay and the amount of unreported income.

What information do you need when you file the form?

When filing the CT DRS CT-1041, you will need to gather essential information, including the trust or estate's identifying details, total income received, allowable deductions, and distributions made to beneficiaries. Accurate financial records help facilitate this information gathering.

Is the form accompanied by other forms?

When submitting the CT DRS CT-1041, you may need to submit various supportive documents depending on your situation. For example, if deductions are claimed, additional forms may be required to substantiate these claims. Always refer to the latest filing guidelines for specifics.

Where do I send the form?

The completed CT DRS CT-1041 form should be mailed to the Connecticut Department of Revenue Services. Ensure that the address is current by checking the state's official website or consulting the most recent filing instructions, as these details may change periodically.

See what our users say