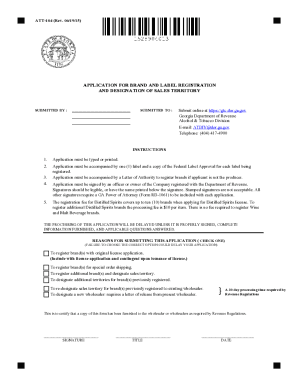

GA DoR ATT-104 2013 free printable template

Show details

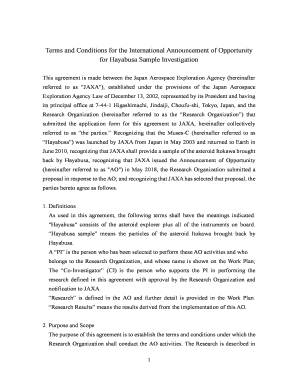

EXCLUDES WINE SPECIAL ORDER SHIPPING. THE PRODUCER IS DETERMINED BY NAME INDICATED ON LABEL. 2. A SEPARATE FORM MUST BE COMPLETED FOR EACH GEORGIA DISTRIBUTOR BEING DESIGNATED BY A SUPPLIER WITH A SEPARATE REGISTRATION FOR EACH WAREHOUSE LOCATION. EXCLUDES WINE SPECIAL ORDER SHIPPING. Ga.gov Georgia Department of Revenue E-mail ATDIV dor. ga.gov Telephone 404 417-4900 INSTRUCTIONS Application must be typed or printed. Signatures should be legible or have the name printed below the signature....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign GA DoR ATT-104

Edit your GA DoR ATT-104 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your GA DoR ATT-104 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit GA DoR ATT-104 online

To use the professional PDF editor, follow these steps below:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit GA DoR ATT-104. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

GA DoR ATT-104 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out GA DoR ATT-104

How to fill out GA DoR ATT-104

01

Obtain the GA DoR ATT-104 form from the official Georgia Department of Revenue website.

02

Read the instructions provided with the form carefully to understand the requirements.

03

Fill out the personal information section, including your name, address, and contact information.

04

Enter the details related to the tax year and the type of tax or credit you are claiming.

05

Provide any necessary supporting documentation as required by the form.

06

Review the completed form for accuracy and ensure all required fields are filled.

07

Sign and date the form where indicated.

08

Submit the completed form via mail or electronically according to the submission guidelines.

Who needs GA DoR ATT-104?

01

Individuals who are filing specific tax claims or credits in the state of Georgia.

02

Tax professionals assisting clients with Georgia tax matters.

03

Business owners who need to report certain tax information to the Georgia Department of Revenue.

04

Any resident or entity that needs to provide information requested by the Department of Revenue.

Fill

form

: Try Risk Free

People Also Ask about

What is the Kentucky Department of Revenue voluntary disclosure Program?

The Kentucky Voluntary Disclosure Program (VDP) is designed to promote compliance and to benefit taxpayers who discover a past filing obligation and liability that has not been discharged. It applies to taxpayers that have failed to file returns and pay any taxes due to the Kentucky Department of Revenue (DOR).

What is the purpose of the voluntary disclosure Program?

The Voluntary Disclosures Program (VDP) grants relief on a case by case basis to taxpayers and registrants who voluntarily come forward to fix errors or omissions in their tax filings before CRA knows or contacts them about it.

What is IRS voluntary disclosure?

What is a Voluntary Disclosure? A voluntary disclosure occurs when a taxpayer provides information that is truthful, timely, and complete. The taxpayer must cooperate with the IRS in determining his or her correct tax liability and make arrangements to pay the IRS in full.

What is the voluntary disclosure program in Louisiana?

What is voluntary disclosure? Voluntary disclosure is the process of reporting undisclosed liabilities for any tax administered by the Department. Taxpayers may anonymously enter into agreements and voluntarily pay their taxes with a reduced or no penalty. In most cases, taxpayers enjoy a limited “look-back” period.

What is the penalty for voluntary disclosure with the IRS?

Offshore Penalties Under the updated IRS Voluntary Disclosure procedures the taxpayer does not have a set penalty. Rather, the IRS agent will follow the rules of the IRM (Internal Revenue Manual). Under the IRM, a person is (generally) subject to a 50% penalty on the highest year's unreported balance.

What is an example of a voluntary disclosure?

Types and examples Voluntary disclosures can include strategic information such as company characteristics and strategy, nonfinancial information such socially responsible practices, and financial information such as stock price information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my GA DoR ATT-104 in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your GA DoR ATT-104 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I fill out GA DoR ATT-104 using my mobile device?

Use the pdfFiller mobile app to fill out and sign GA DoR ATT-104 on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I complete GA DoR ATT-104 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your GA DoR ATT-104. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is GA DoR ATT-104?

GA DoR ATT-104 is a form used for reporting certain tax-related information to the Georgia Department of Revenue.

Who is required to file GA DoR ATT-104?

Individuals, businesses, or entities that meet specific criteria set by the Georgia Department of Revenue are required to file GA DoR ATT-104.

How to fill out GA DoR ATT-104?

To fill out GA DoR ATT-104, individuals should carefully follow the instructions provided on the form, ensuring all required information is accurately completed.

What is the purpose of GA DoR ATT-104?

The purpose of GA DoR ATT-104 is to collect data for tax compliance and to assess the tax obligations of filers in the state of Georgia.

What information must be reported on GA DoR ATT-104?

The information that must be reported on GA DoR ATT-104 typically includes identification details of the filer, financial information, and any pertinent tax information as required by the Georgia Department of Revenue.

Fill out your GA DoR ATT-104 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

GA DoR ATT-104 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.