GA DoR ATT-104 2015-2025 free printable template

Show details

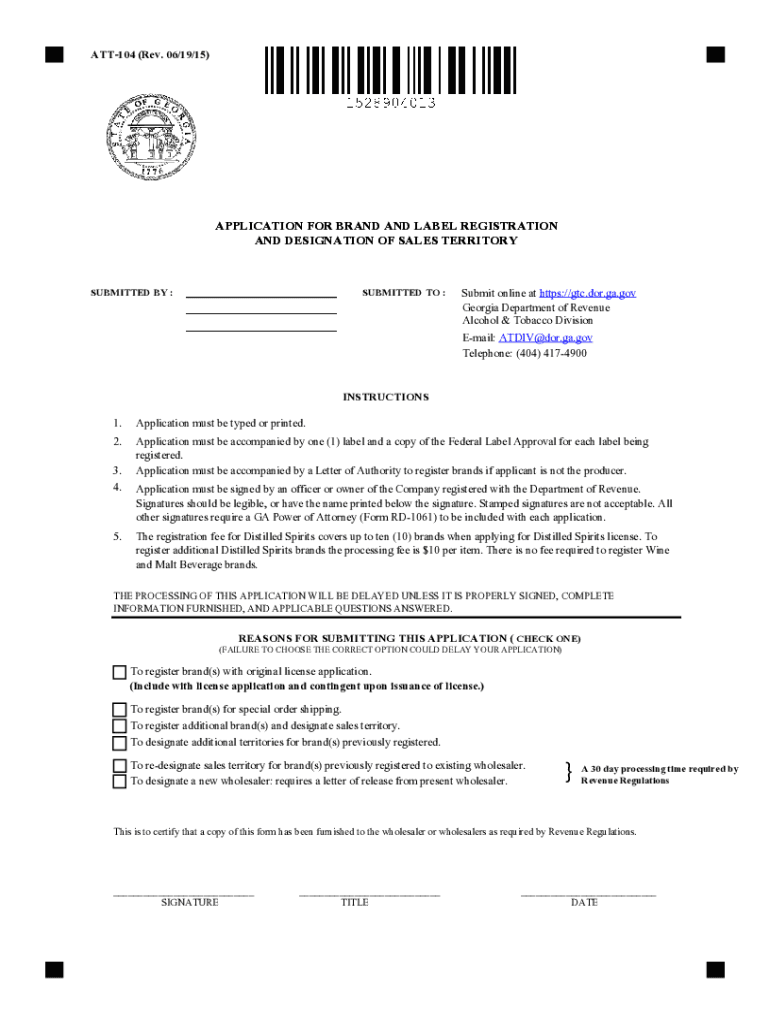

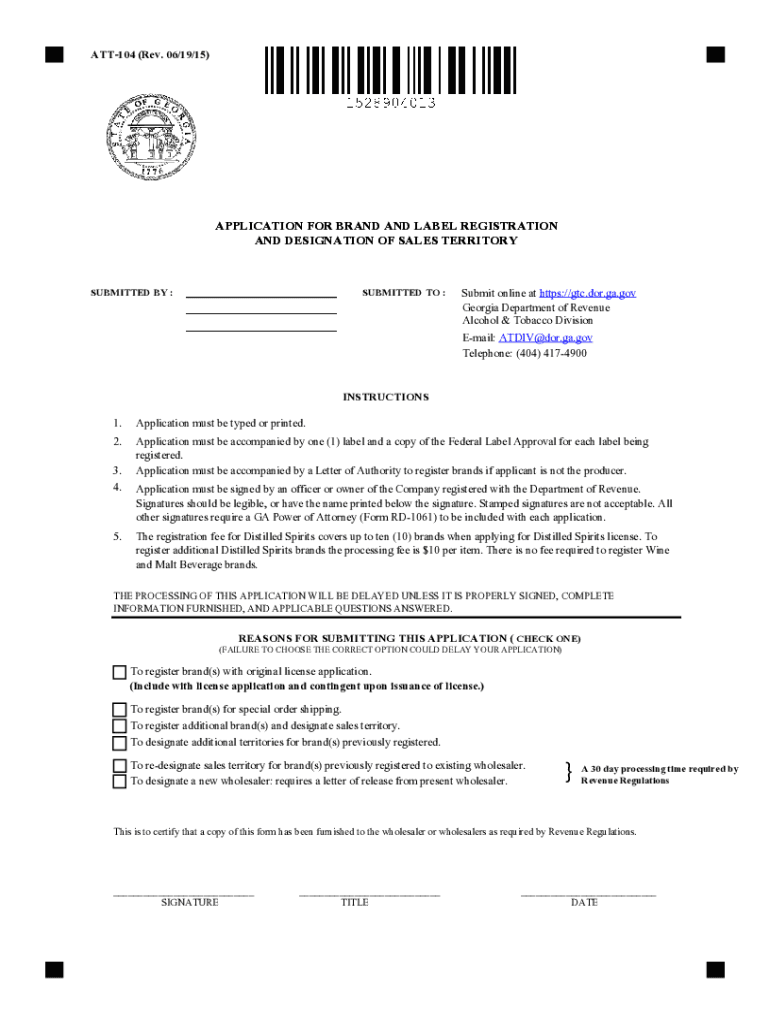

Ga.gov/documents/forms select Alcohol Tobacco. Application for Brand and Label Registration and Designation of Sales Territory - Form ATT-104 Follow the instructions and complete the Application in its entirety. Stamped signatures are not acceptable. All other signatures require a GA Power of Attorney Form RD-1061 to be included with each application. The registration fee for Distilled Spirits covers up to ten 10 brands when applying for Distilled Spirits license. ATT-104 Rev. 06/19/15 Print...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign georgia att 104 form

Edit your att 104 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ga att 104 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing georgia department of revenue letter online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form att 104. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

GA DoR ATT-104 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out the georgia department of revenue form

How to fill out GA DoR ATT-104

01

Obtain the GA DoR ATT-104 form from the official website or office.

02

Fill out your personal information including your name, address, and contact details.

03

Provide specific information regarding the purpose of the form.

04

Review any applicable guidelines or instructions that pertain to your situation.

05

Complete all necessary fields, ensuring accuracy to avoid delays.

06

Sign and date the form where indicated.

07

Submit the completed form either online or via designated mailing address, following the submission instructions.

Who needs GA DoR ATT-104?

01

Individuals applying for tax-related matters in the State of Georgia.

02

Businesses that require documentation for state compliance.

03

Tax professionals assisting clients with Georgia Department of Revenue requirements.

Fill

georgia department of revenue

: Try Risk Free

People Also Ask about

What is the Kentucky Department of Revenue voluntary disclosure Program?

The Kentucky Voluntary Disclosure Program (VDP) is designed to promote compliance and to benefit taxpayers who discover a past filing obligation and liability that has not been discharged. It applies to taxpayers that have failed to file returns and pay any taxes due to the Kentucky Department of Revenue (DOR).

What is the purpose of the voluntary disclosure Program?

The Voluntary Disclosures Program (VDP) grants relief on a case by case basis to taxpayers and registrants who voluntarily come forward to fix errors or omissions in their tax filings before CRA knows or contacts them about it.

What is IRS voluntary disclosure?

What is a Voluntary Disclosure? A voluntary disclosure occurs when a taxpayer provides information that is truthful, timely, and complete. The taxpayer must cooperate with the IRS in determining his or her correct tax liability and make arrangements to pay the IRS in full.

What is the voluntary disclosure program in Louisiana?

What is voluntary disclosure? Voluntary disclosure is the process of reporting undisclosed liabilities for any tax administered by the Department. Taxpayers may anonymously enter into agreements and voluntarily pay their taxes with a reduced or no penalty. In most cases, taxpayers enjoy a limited “look-back” period.

What is the penalty for voluntary disclosure with the IRS?

Offshore Penalties Under the updated IRS Voluntary Disclosure procedures the taxpayer does not have a set penalty. Rather, the IRS agent will follow the rules of the IRM (Internal Revenue Manual). Under the IRM, a person is (generally) subject to a 50% penalty on the highest year's unreported balance.

What is an example of a voluntary disclosure?

Types and examples Voluntary disclosures can include strategic information such as company characteristics and strategy, nonfinancial information such socially responsible practices, and financial information such as stock price information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my GA DoR ATT-104 in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your GA DoR ATT-104 along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I complete GA DoR ATT-104 online?

Easy online GA DoR ATT-104 completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How can I fill out GA DoR ATT-104 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your GA DoR ATT-104. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is GA DoR ATT-104?

GA DoR ATT-104 is a tax form used in the state of Georgia for reporting certain types of income, specifically for the taxation purposes of dealers in tangible personal property.

Who is required to file GA DoR ATT-104?

Businesses or individuals that are dealers in tangible personal property in Georgia are required to file GA DoR ATT-104 as part of their tax reporting obligations.

How to fill out GA DoR ATT-104?

To fill out GA DoR ATT-104, taxpayers must provide their business information, report income details, and submit the form along with any required documentation to the Georgia Department of Revenue according to the guidelines provided.

What is the purpose of GA DoR ATT-104?

The purpose of GA DoR ATT-104 is to ensure proper reporting of income received by dealers in tangible personal property and to facilitate the correct assessment of state taxes.

What information must be reported on GA DoR ATT-104?

The information that must be reported on GA DoR ATT-104 includes the dealer's name, address, total income from sales, specific deductions, and any applicable taxes owed.

Fill out your GA DoR ATT-104 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

GA DoR ATT-104 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.