NY DTF CT-3-S-I 2014 free printable template

Show details

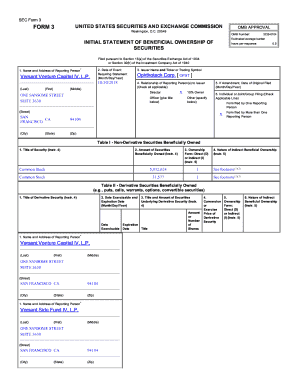

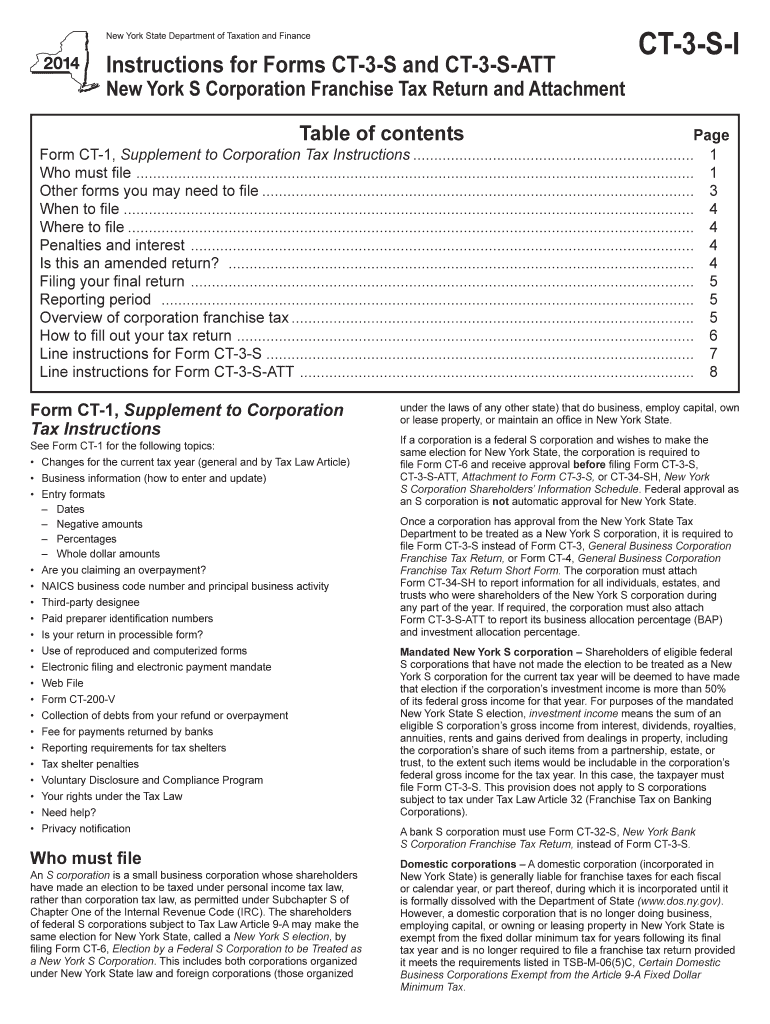

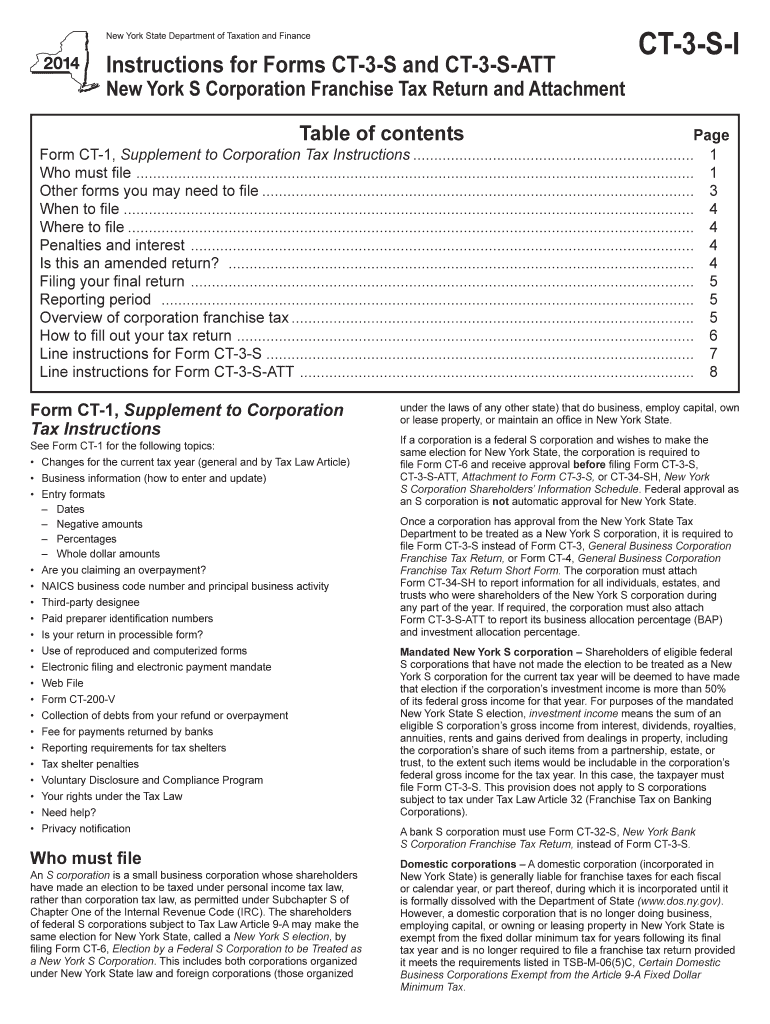

For Form CT-3-S only Use this tax return for calendar year 2014 and fiscal years that begin in 2014 and end in 2015. Form CT-6. 1 Termination of Election to be Treated as CT-3-S-I 2014 Page 3 of 12 excise tax on its gross receipts from the sale of telecommunication services under Article 9 section 186-e. Page 2 of 12 CT-3-S-I 2014 Foreign corporations A foreign corporation incorporated outside in which it is doing business employing capital owning or leasing property or maintaining an...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY DTF CT-3-S-I

Edit your NY DTF CT-3-S-I form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY DTF CT-3-S-I form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY DTF CT-3-S-I online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit NY DTF CT-3-S-I. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF CT-3-S-I Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY DTF CT-3-S-I

How to fill out NY DTF CT-3-S-I

01

Download the NY DTF CT-3-S-I form from the New York State Department of Taxation and Finance website.

02

Begin by providing your business's federal employer identification number (EIN) at the top of the form.

03

Fill out basic information about your business, including the legal name, trade name, address, and type of business.

04

Indicate the tax year for which you are filing the form.

05

Complete Part I by detailing your income sources, deductions, and credits as applicable.

06

Proceed to Part II, where you will provide information regarding any additions and subtractions to income.

07

Review Part III to calculate your tax liability based on the information provided.

08

Finally, sign and date the form before submitting it to the New York State Department of Taxation and Finance.

Who needs NY DTF CT-3-S-I?

01

Businesses that have a New York State location and are required to file corporation tax returns.

02

Corporations that are eligible to claim the small business corporation election.

03

Taxpayers looking to report federal income tax adjustments and modifications.

Instructions and Help about NY DTF CT-3-S-I

Fill

form

: Try Risk Free

People Also Ask about

What is NY Form CT-3-S?

Form CT-3-S is used to pay the entity level franchise tax under Article 9-A. This tax is the fixed dollar minimum tax imposed under § 210.1(d).

How do I file for an S Corp in NY?

There are ten steps you'll complete to start an S Corp in New York. Step 1: Choose a Business Name. Step 2: Obtain EIN. Step 3: Certificate of Incorporation. Step 4: Registered Agent. Step 5: Corporate Bylaws. Step 6: Directors and Meeting Requirements. Step 7: Stock Requirements. Step 8: Biennial Statement.

What is CT-3-s?

Form CT-3-S New York S Corporation Franchise Tax Return Tax Year 2022.

What is Form CT 3 A BC I?

Form CT‑3‑A/BC is an individual certification that must be filed by each member, including non‑taxpayer members, of the New York State combined group except for the taxpayer that is the designated agent of the combined group (the corporation responsible for filing Form CT‑3‑A, General Business Corporation Combined

Can I file NYS CT 3 online?

File using our Online Services or your NYS approved e-file software. To use our Online Services, create an account, log in, and select File a corporation tax online extension. If you are unable to file electronically, call (518) 457-5431 and request a form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send NY DTF CT-3-S-I for eSignature?

Once your NY DTF CT-3-S-I is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I sign the NY DTF CT-3-S-I electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your NY DTF CT-3-S-I in seconds.

How do I complete NY DTF CT-3-S-I on an Android device?

Complete NY DTF CT-3-S-I and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is NY DTF CT-3-S-I?

NY DTF CT-3-S-I is a New York State tax form used by S corporations to report their earnings and calculate their franchise tax.

Who is required to file NY DTF CT-3-S-I?

S corporations doing business in New York State or deriving income from New York State sources are required to file the NY DTF CT-3-S-I.

How to fill out NY DTF CT-3-S-I?

To fill out NY DTF CT-3-S-I, you need to provide information about the corporation's income, deductions, and any applicable credits as per the instructions provided on the form.

What is the purpose of NY DTF CT-3-S-I?

The purpose of NY DTF CT-3-S-I is to calculate the New York State franchise tax for S corporations and ensure compliance with state tax obligations.

What information must be reported on NY DTF CT-3-S-I?

The information that must be reported on NY DTF CT-3-S-I includes total income, allowable deductions, tax credits, and the resultant tax liability for the S corporation.

Fill out your NY DTF CT-3-S-I online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DTF CT-3-S-I is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.