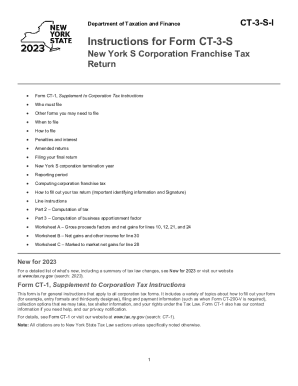

................ 1 New York State Department of Taxation and Finance Instructions for Forms CT-3-S and CT-3-S-ATT CT-3-S-I New York S Corporation Franchise Tax Return and Attachment Table of contents Page S Corporation Franchise Tax Return for an S Corporation: Form CT-1, Form CT-1A, Form CT-1B, Form CT-1C, Form CT-1D, Form CT-1E, Form CT-1F and Form CT-1G, Application for Taxpayer Certificate of Entitlement................................................ 9 S Corporation Franchise Tax Return for a Partnership: Form CT-1, Form CT-1A, Form CT-1B, Form CT-1C, Form CT-1D, Form CT-1E, Form CT-1F and Form CT-1G, Application for Taxpayer Certificate of Entitlement................................................ 9 P Corporation Franchise Tax Return for an S corporation or partnership.... 11 Attachment 1A, Application for Taxpayer Certificate of Entitlement from a Partnership............... 13 Attachment 1B, Application for Taxpayer Certificate of Entitlement from an S Corporation............................................ 14 Attachment 1C, Application for Taxpayer Certificate of Entitlement from a Nonresident S Corporation............ 15 Attachment 1D, Application for Taxpayer Certificate of Entitlement from an LLC................. 16 Attachment 1E, Application for Taxpayer Certificate of Entitlement from a Nonresident S Corp.................. 17 Attachment 1F, Application For Certificate of Entitlement from an S Corporation......................... 18 Attachment 1G, Application for Certificate of Entitlement from a Partnership............................ 19 Attachment 1H, Certificate of Entitlement from an S Corp........................... 20 Attachment 1J, Certificate of Entitlement from a Nonresident LLC................................... 22 Attachment 1K, Certificate of Entitlement from a Nonresident S Corp............... 23 Attachment 1L, Certificate of Entitlement from an LLC (Limited Liability Company (LLC) or Partnership)........................... 24 Forms for the Payment of Taxes............................ 26 New York State Department of Taxation and Finance Instructions for Forms CT-3-S, CT-3-S-ATT CT-3-S-I New York S Corporation Franchise Tax Return............ 32 Attachment 1, Application for Taxpayer Certificate of Entitlement from an LLC............................

NY DTF CT-3-S-I 2012 free printable template

Show details

New York State Department of Taxation and Finance Instructions for Forms CT-3-S and CT-3-S-ATT CT-3-S-I New York S Corporation Franchise Tax Return and Attachment Table of contents Page Form CT-1 Supplement to Corporation Tax Instructions. 1 Who must file. 1 Other forms you may need to file. 3 When to file. 3 Penalties and interest. 4 Is this an amended return. If all of your capital is employed within New York State enter 100. If less than 100 of your capital is employed in New York State...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your ct 3 s 2012 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ct 3 s 2012 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ct 3 s 2012 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ct 3 s 2012. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

NY DTF CT-3-S-I Form Versions

Version

Form Popularity

Fillable & printabley

Instructions and Help about ct 3 s 2012

Fill form : Try Risk Free

People Also Ask about ct 3 s 2012

What is NY Form CT-3-S?

How do I file for an S Corp in NY?

What is CT-3-s?

What is Form CT 3 A BC I?

Can I file NYS CT 3 online?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ct 3 s form?

CT-3S form is a New York State tax form used by S Corporations to report their income, deductions, and credits.

Who is required to file ct 3 s form?

All S Corporations that have a New York State filing requirement need to file CT-3S form.

How to fill out ct 3 s form?

To fill out CT-3S form, you need to provide information about the corporation's income, deductions, credits, and other relevant details. The form can be filled out manually or electronically.

What is the purpose of ct 3 s form?

The purpose of CT-3S form is to report the income, deductions, and credits of S Corporations for New York State tax purposes.

What information must be reported on ct 3 s form?

CT-3S form requires information about the corporation's income, deductions, credits, and any other information required for New York State tax purposes.

When is the deadline to file ct 3 s form in 2023?

The deadline to file CT-3S form in 2023 is March 15th.

What is the penalty for the late filing of ct 3 s form?

The penalty for the late filing of CT-3S form may vary depending on the circumstances and can include monetary fines or interest charges. It is recommended to file the form on time to avoid penalties.

How can I manage my ct 3 s 2012 directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your ct 3 s 2012 along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

Can I sign the ct 3 s 2012 electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your ct 3 s 2012 in seconds.

How do I edit ct 3 s 2012 on an Android device?

You can make any changes to PDF files, such as ct 3 s 2012, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

Fill out your ct 3 s 2012 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.