CA FTB 590-P 2015 free printable template

Show details

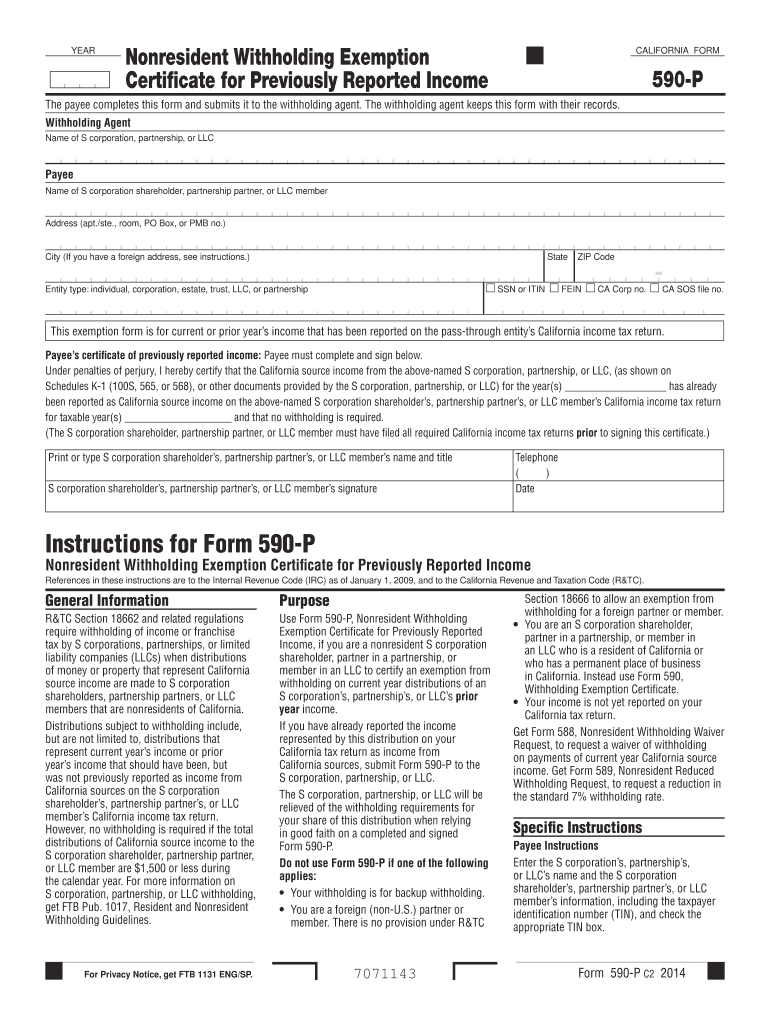

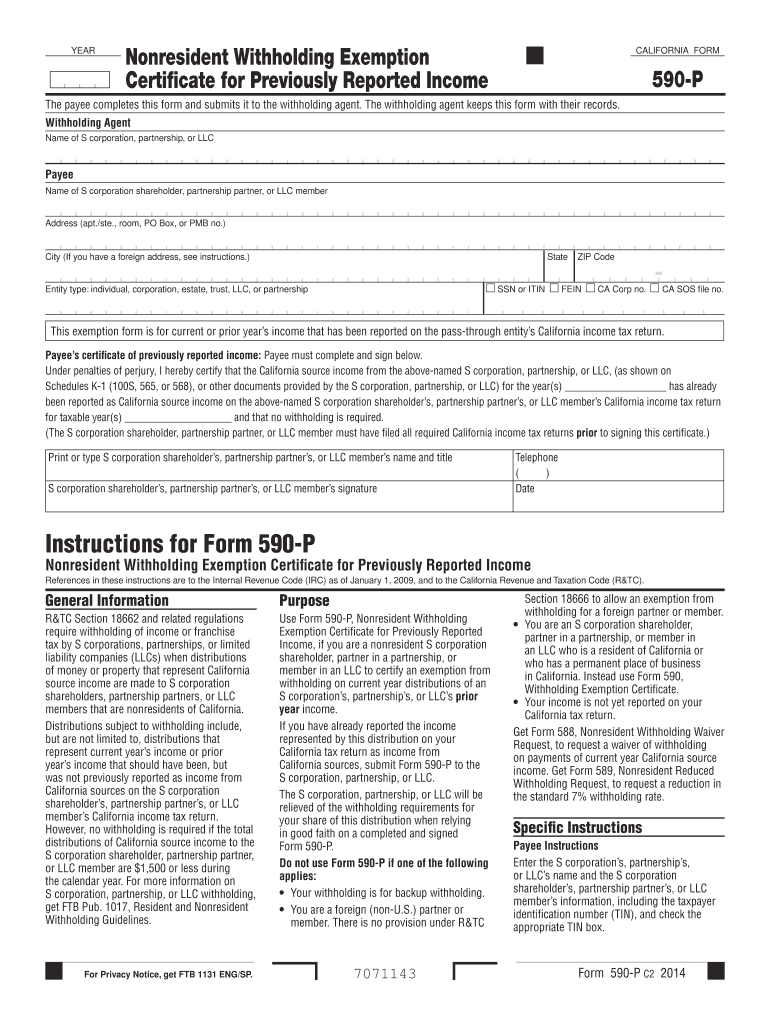

YEAR Nonresident Withholding Exemption Certificate for Previously Reported Income CALIFORNIA FORM 590-P The payee completes this form and submits it to the withholding agent. The withholding agent

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign usda 590 forms 2015

Edit your usda 590 forms 2015 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your usda 590 forms 2015 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing usda 590 forms 2015 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit usda 590 forms 2015. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA FTB 590-P Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out usda 590 forms 2015

How to fill out CA FTB 590-P

01

Obtain the CA FTB 590-P form from the California Franchise Tax Board website or your local tax office.

02

Fill in your personal information at the top of the form, including your name, address, and tax identification number.

03

Indicate the type of income or distribution you are reporting, such as pension or annuity payments.

04

Provide detailed information about the source of the income, including the name and address of the institution making the payment.

05

Enter the appropriate amounts in the designated fields, ensuring accuracy in reporting the distribution amounts.

06

Review the completed form for any errors or omissions.

07

Sign and date the form at the bottom.

08

Submit the form to the California Franchise Tax Board by the required deadline.

Who needs CA FTB 590-P?

01

Individuals receiving California-source income or certain distributions that need to report withholding to the California Franchise Tax Board.

02

Taxpayers who need to claim a withholding for California-related pensions, annuities, or retirement distributions.

Fill

form

: Try Risk Free

People Also Ask about

Is California state tax withholding mandatory?

Purpose of Form: Unless you elect otherwise, state law requires that California Personal Income Tax (PIT) be withheld from payments of pensions and annuities.

What is not subject to withholding?

Taxable income not subject to withholding - Interest income, dividends, capital gains, self employment income, IRA (including certain Roth IRA) distributions. Adjustments to income - IRA deduction, student loan interest deduction, alimony expense.

What is form 592-B used for?

California Form 592-B is used to report to a payee the amount of payment or distribution subject to withholding and tax withheld. Generally a taxpayer receives this form when they have backup withholding on a payment.

What is ca590 form?

2022 Withholding Exemption Certificate. CALIFORNIA FORM. 590. The payee completes this form and submits it to the withholding agent. The withholding agent keeps this form with their records.

What Does not subject to withholding mean?

When you file as exempt from withholding with your employer for federal tax withholding, you don't make any federal income tax payments during the year.

Do I use 592 or 592 PTE?

Use Form 592-PTE to report the total withholding under California Revenue and Taxation Code (R&TC) Sections 18662.

How do I know if Im subject to California withholding?

Your payer must take 7% from your CA income that exceeds $1,500 in a calendar year.You may need to prepay tax if you receive a non-wage payment, such as: Trust distributions. Partnership and LLC distributions. Rents. Royalties. Gambling winnings.

What does it mean to be exempt from California withholding?

You can claim exemption from withholding only if both the following situations apply: For the prior year, you had a right to a refund of all federal income tax withheld because you had no tax liability. For the current year, you expect a refund of all federal income tax withheld because you expect to have no liability.

What wages are subject to California withholding?

Your payer must take 7% from your CA income that exceeds $1,500 in a calendar year.You may need to prepay tax if you receive a non-wage payment, such as: Trust distributions. Partnership and LLC distributions. Rents. Royalties. Gambling winnings.

What is CA 587 or 590?

FTB Form 590, Withholding Exemption Certificate, listing CHCF as the withholding agent and certifying exemption from the withholding requirement. ❑ CA Form 587, Nonresident Income Allocation Worksheet, which allocates the expected income under CHCF's contract for work completed within and outside of California.

What does it mean to be subject to California withholding?

Payments subject to withholding include: Payments to nonresident independent contractors who provide services in California. Other non-wage payments of California source income to nonresidents such as leases, rents, royalties, winnings and payouts.

Who is subject for withholding?

A WITHHOLDING AGENT - is any person or entity who is in control of the payment subject to withholding tax and therefore is required to deduct and remit taxes withheld to the government. Compensation - is the tax withheld from income payments to individuals arising from an employer-employee relationship.

Who is subject to California withholding?

Payments subject to withholding include: Payments to nonresident independent contractors or consultants who provide services in California. Other non-wage payments of California source income to nonresidents such as leases, rents, royalties, winnings and payouts.

Who is exempt from California withholding?

You may not have to withhold if: Total payments or distributions are $1,500 or less. Paying for goods. Paying for services performed outside of California.

What is the difference between 592 Q and 592 V?

FTB Form 592-Q is largely based off of the FTB Form 592-V, with the primary difference being that FTB Form 592-V is used as a voucher for payments with respect to nonresident withholding, whereas FTB Form 592-Q is used as a voucher for domestic PTE withholding.

Who needs to file 592 PTE?

For the purpose of this form, a PTE is an entity that has paid withholding on behalf of a nonresident owner or has had its income withheld upon. Each of these PTEs is a withholding agent and is required to file Form 592-PTE on an annual basis to allocate withholding.

Who is not subject to California withholding?

You may not have to withhold if: Total payments or distributions are $1,500 or less. Paying for goods. Paying for services performed outside of California.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in usda 590 forms 2015?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your usda 590 forms 2015 to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I create an eSignature for the usda 590 forms 2015 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your usda 590 forms 2015 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I complete usda 590 forms 2015 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your usda 590 forms 2015. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is CA FTB 590-P?

CA FTB 590-P is a form used by the California Franchise Tax Board to report California source income paid to nonresidents, as well as the withholding on that income.

Who is required to file CA FTB 590-P?

Payors making payments to nonresidents for California source income are required to file CA FTB 590-P.

How to fill out CA FTB 590-P?

To fill out CA FTB 590-P, payors should provide details including the name and address of the payee, the type of income, the amount of income paid, and the amount of California tax withheld.

What is the purpose of CA FTB 590-P?

The purpose of CA FTB 590-P is to document and report payments made to nonresidents and ensure compliance with California tax withholding requirements.

What information must be reported on CA FTB 590-P?

The information that must be reported on CA FTB 590-P includes the payee's name, address, social security number or taxpayer identification number, the type of income, the total amount paid, and the amount withheld for taxes.

Fill out your usda 590 forms 2015 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Usda 590 Forms 2015 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.