CA FTB 590-P 2016 free printable template

Show details

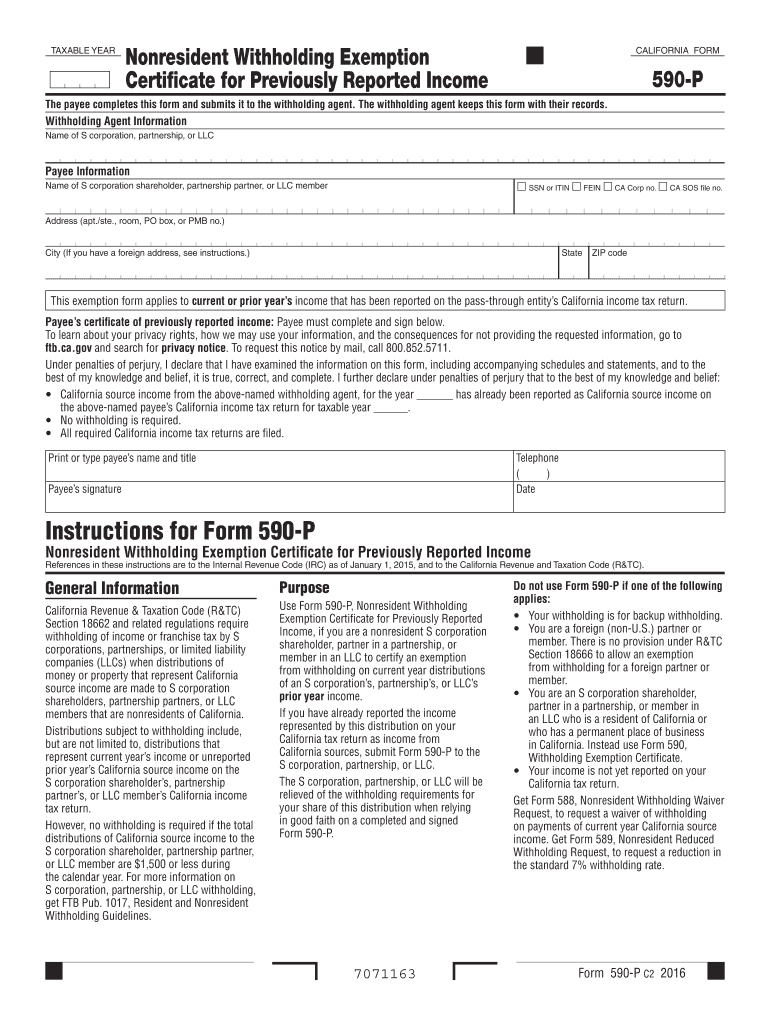

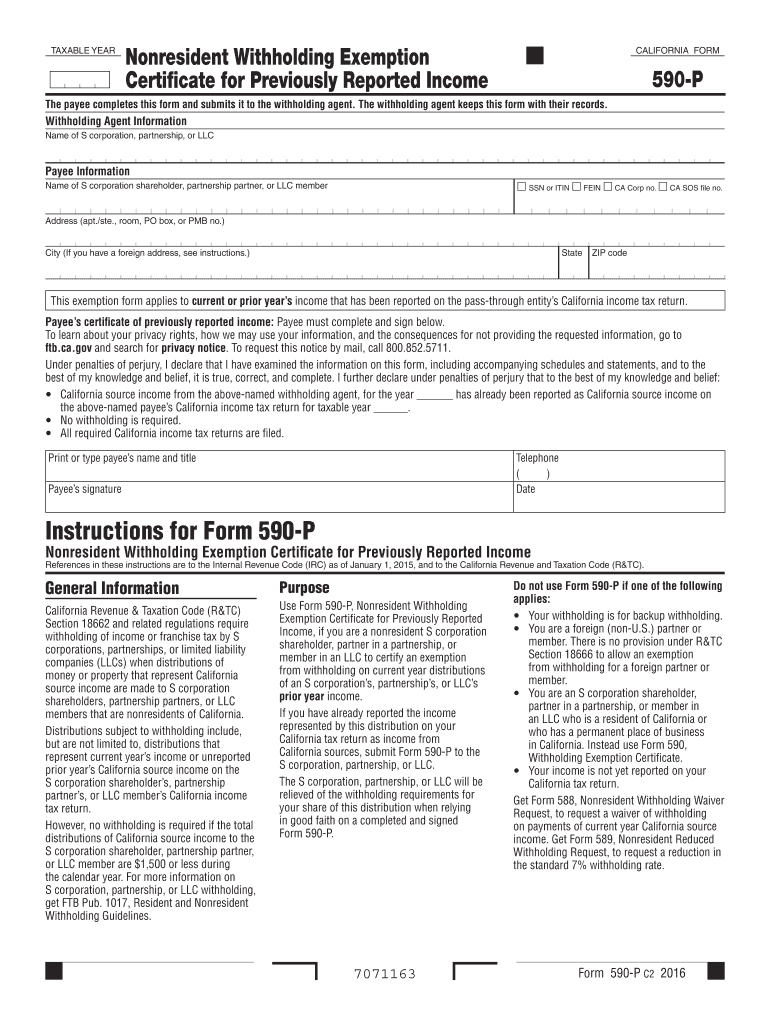

Form 590-P C2 2015 You must provide an acceptable TIN as requested on this form. The following are acceptable TINs social security number SSN individual taxpayer identification number ITIN federal employer identification number FEIN California corporation number CA Corp no. TAXABLE YEAR Nonresident Withholding Exemption Certificate for Previously Reported Income CALIFORNIA FORM 590-P The payee completes this form and submits it to the withholding agent. The withholding agent keeps this form...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ca form 590 p

Edit your ca form 590 p form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ca form 590 p form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ca form 590 p online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ca form 590 p. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA FTB 590-P Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ca form 590 p

How to fill out CA FTB 590-P

01

Gather necessary information such as the Social Security number or Individual Taxpayer Identification Number of the recipient.

02

Fill in the recipient’s name and address in the appropriate sections.

03

Indicate the type of income being reported (e.g., rental income, royalties, etc.).

04

Enter the total amount paid to the recipient in the designated box.

05

Specify any applicable California taxes withheld in the relevant section.

06

Complete the certification section by signing and dating the form.

07

Submit the form to the California Franchise Tax Board as instructed.

Who needs CA FTB 590-P?

01

Any person or entity making payments of California source income to nonresident individuals or entities needs to file CA FTB 590-P.

Fill

form

: Try Risk Free

People Also Ask about

Is California state tax withholding mandatory?

Purpose of Form: Unless you elect otherwise, state law requires that California Personal Income Tax (PIT) be withheld from payments of pensions and annuities.

What is not subject to withholding?

Taxable income not subject to withholding - Interest income, dividends, capital gains, self employment income, IRA (including certain Roth IRA) distributions. Adjustments to income - IRA deduction, student loan interest deduction, alimony expense.

What is form 592-B used for?

California Form 592-B is used to report to a payee the amount of payment or distribution subject to withholding and tax withheld. Generally a taxpayer receives this form when they have backup withholding on a payment.

What is ca590 form?

2022 Withholding Exemption Certificate. CALIFORNIA FORM. 590. The payee completes this form and submits it to the withholding agent. The withholding agent keeps this form with their records.

What Does not subject to withholding mean?

When you file as exempt from withholding with your employer for federal tax withholding, you don't make any federal income tax payments during the year.

Do I use 592 or 592 PTE?

Use Form 592-PTE to report the total withholding under California Revenue and Taxation Code (R&TC) Sections 18662.

How do I know if Im subject to California withholding?

Your payer must take 7% from your CA income that exceeds $1,500 in a calendar year.You may need to prepay tax if you receive a non-wage payment, such as: Trust distributions. Partnership and LLC distributions. Rents. Royalties. Gambling winnings.

What does it mean to be exempt from California withholding?

You can claim exemption from withholding only if both the following situations apply: For the prior year, you had a right to a refund of all federal income tax withheld because you had no tax liability. For the current year, you expect a refund of all federal income tax withheld because you expect to have no liability.

What wages are subject to California withholding?

Your payer must take 7% from your CA income that exceeds $1,500 in a calendar year.You may need to prepay tax if you receive a non-wage payment, such as: Trust distributions. Partnership and LLC distributions. Rents. Royalties. Gambling winnings.

What is CA 587 or 590?

FTB Form 590, Withholding Exemption Certificate, listing CHCF as the withholding agent and certifying exemption from the withholding requirement. ❑ CA Form 587, Nonresident Income Allocation Worksheet, which allocates the expected income under CHCF's contract for work completed within and outside of California.

What does it mean to be subject to California withholding?

Payments subject to withholding include: Payments to nonresident independent contractors who provide services in California. Other non-wage payments of California source income to nonresidents such as leases, rents, royalties, winnings and payouts.

Who is subject for withholding?

A WITHHOLDING AGENT - is any person or entity who is in control of the payment subject to withholding tax and therefore is required to deduct and remit taxes withheld to the government. Compensation - is the tax withheld from income payments to individuals arising from an employer-employee relationship.

Who is subject to California withholding?

Payments subject to withholding include: Payments to nonresident independent contractors or consultants who provide services in California. Other non-wage payments of California source income to nonresidents such as leases, rents, royalties, winnings and payouts.

Who is exempt from California withholding?

You may not have to withhold if: Total payments or distributions are $1,500 or less. Paying for goods. Paying for services performed outside of California.

What is the difference between 592 Q and 592 V?

FTB Form 592-Q is largely based off of the FTB Form 592-V, with the primary difference being that FTB Form 592-V is used as a voucher for payments with respect to nonresident withholding, whereas FTB Form 592-Q is used as a voucher for domestic PTE withholding.

Who needs to file 592 PTE?

For the purpose of this form, a PTE is an entity that has paid withholding on behalf of a nonresident owner or has had its income withheld upon. Each of these PTEs is a withholding agent and is required to file Form 592-PTE on an annual basis to allocate withholding.

Who is not subject to California withholding?

You may not have to withhold if: Total payments or distributions are $1,500 or less. Paying for goods. Paying for services performed outside of California.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit ca form 590 p from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your ca form 590 p into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I complete ca form 590 p online?

Completing and signing ca form 590 p online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I edit ca form 590 p on an iOS device?

Create, edit, and share ca form 590 p from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is CA FTB 590-P?

CA FTB 590-P is a form used by the California Franchise Tax Board to report the amount of California source income paid to a nonresident partner in a partnership.

Who is required to file CA FTB 590-P?

Any partnership that pays California source income to a nonresident partner is required to file CA FTB 590-P.

How to fill out CA FTB 590-P?

To fill out CA FTB 590-P, provide the partnership's information, the nonresident partner's information, and the amount of California source income paid to the partner.

What is the purpose of CA FTB 590-P?

The purpose of CA FTB 590-P is to report the income that nonresident partners have earned from a partnership for California tax purposes.

What information must be reported on CA FTB 590-P?

The information that must be reported on CA FTB 590-P includes the partnership's name, address, taxpayer identification number, the nonresident partner's name, address, identification number, and the total California source income paid to the nonresident partner.

Fill out your ca form 590 p online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ca Form 590 P is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.