PA DCED CLGS-32-2 2012 free printable template

Show details

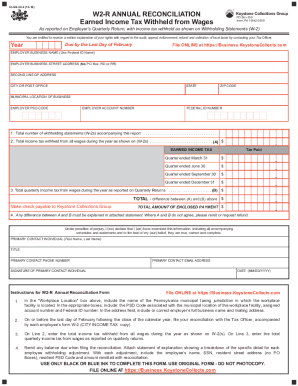

PRIMARY CONTACT INDIVIDUAL First Name Last Name TITLE SIGNATURE OF PRIMARY CONTACT INDIVIDUAL DATE MM/DD/YYYY Instructions for W2-R Annual Reconciliation Form Include municipal location of business in PA assigned account number and Federal ID number. CLGS-32-2 11-12 W2-R ANNUAL RECONCILIATION Earned Income Tax Withheld from Wages As reported on Employer s Quarterly Return Form E-1 with income tax withheld as shown on Withholding Statements W-2 You are entitled to receive a written explanation...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA DCED CLGS-32-2

Edit your PA DCED CLGS-32-2 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA DCED CLGS-32-2 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing PA DCED CLGS-32-2 online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit PA DCED CLGS-32-2. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA DCED CLGS-32-2 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA DCED CLGS-32-2

How to fill out PA DCED CLGS-32-2

01

Start by downloading the PA DCED CLGS-32-2 form from the official Department of Community and Economic Development (DCED) website.

02

Fill in the header section with your organization’s name, address, and contact information.

03

Provide details about the project you are applying for, including the project title and description.

04

Specify the funding amount you are requesting and justify the need for this funding.

05

Complete the budget section by itemizing costs associated with the project.

06

Include any required documentation, such as proof of project eligibility and financial statements.

07

Review the application thoroughly for accuracy and completeness.

08

Submit the form along with any attachments by the specified deadline, either electronically or via mail.

Who needs PA DCED CLGS-32-2?

01

Organizations and entities seeking funding for local government projects in Pennsylvania.

02

Community organizations interested in community revitalization and development.

03

Municipalities planning to undertake economic development initiatives.

Fill

form

: Try Risk Free

People Also Ask about

What is annual reconciliation statement?

The annual reconciliation gives employers the opportunity to review their tax paid for the financial year, make any necessary adjustments to correct overpayments or underpayments made during the year and confirm a registered employer's status.

Is there an annual reconciliation for Form 941?

Annual amounts from payroll records should match the total amounts reported on all Forms 941 for the year. Total amounts reported on all Forms 941 for the year should match the sum of the same data fields shown in W-2/W-3 totals. If these amounts do not match, recheck records and identify necessary adjustments.

What is Form DE 7?

Annual Reconciliation Statement (DE 7)

What is a de7 form?

Annual Reconciliation Statement (DE 7)

How do I get an employer identification number in California?

Log in to e-Services for Business. Select New Employer, then select Next. Select Register for Employer Payroll Tax Account Number. Complete the online registration application. Select Submit.

What is a rev 1667 form?

The Annual Withholding Reconciliation Statement (REV-1667) along with an individual Wage and Tax Statement/Information Statement (W-2/1099) for each employee/distribution recipient must be submitted annually on or before Jan. 31 following the year in which wages were paid or distributions occurred.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out PA DCED CLGS-32-2 using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign PA DCED CLGS-32-2. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I edit PA DCED CLGS-32-2 on an iOS device?

You certainly can. You can quickly edit, distribute, and sign PA DCED CLGS-32-2 on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I edit PA DCED CLGS-32-2 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute PA DCED CLGS-32-2 from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is PA DCED CLGS-32-2?

PA DCED CLGS-32-2 is a form used in Pennsylvania for reporting local wage tax information.

Who is required to file PA DCED CLGS-32-2?

Employers based in Pennsylvania who withhold local wage taxes from their employees are required to file PA DCED CLGS-32-2.

How to fill out PA DCED CLGS-32-2?

To fill out PA DCED CLGS-32-2, provide information about the business, employee wage details, local tax withheld, and any other required information as specified in the form.

What is the purpose of PA DCED CLGS-32-2?

The purpose of PA DCED CLGS-32-2 is to report the local wage taxes withheld from employees' pay for local government tax collections.

What information must be reported on PA DCED CLGS-32-2?

The form requires reporting of the employer's details, total wages paid, local taxes withheld, and information about the employees for whom the taxes were withheld.

Fill out your PA DCED CLGS-32-2 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA DCED CLGS-32-2 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.