ME MRS 1120ME 2014 free printable template

Show details

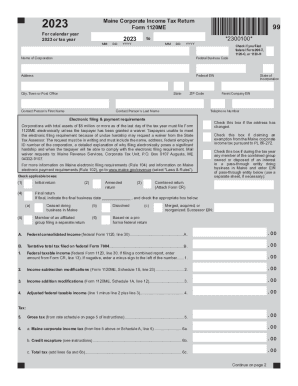

Please submit forms in the following order 1. Pages 1 through 5 of Form 1120ME as required. 2. Form CR if required including af liation schedule. 2g. SUBTRACTIONS FROM FEDERAL TAXABLE INCOME FORM 1120ME - Page 2 Federal EIN SUBTRACTIONS cont h. STATE INCOME TAX REFUNDS included in line 1 above. MAINE CORPORATE INCOME TAX RETURN FORM 1120ME For calendar year 2014 or tax year MM DD to YYYY 1400100 Check if you led federal Form 990-T Name of Corpora...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ME MRS 1120ME

Edit your ME MRS 1120ME form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ME MRS 1120ME form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ME MRS 1120ME online

To use the professional PDF editor, follow these steps below:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ME MRS 1120ME. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ME MRS 1120ME Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ME MRS 1120ME

How to fill out ME MRS 1120ME

01

Gather necessary documents such as previous tax returns, W-2s, and 1099s.

02

Start with personal information including your name, address, and Social Security number.

03

Fill out your income information in the appropriate section, including all sources of income.

04

Deduct any eligible expenses to calculate your taxable income.

05

Review tax credits and deductions applicable to you.

06

Calculate your total tax liability based on your taxable income.

07

If applicable, include any payments made throughout the year.

08

Review your completed form for accuracy.

09

Submit the ME MRS 1120ME form electronically or via mail.

Who needs ME MRS 1120ME?

01

Individuals and businesses operating in Maine that need to report their state income.

02

Tax professionals assisting clients with their state tax obligations in Maine.

Instructions and Help about ME MRS 1120ME

Fill

form

: Try Risk Free

People Also Ask about

Is there a corporate minimum tax?

For companies that report over $1 billion in profits to shareholders, the Inflation Reduction Act of 2022 (the Act) includes a 15% corporate alternative minimum tax (CAMT) based on book income.

What is federal corporate tax rate 2022?

Corporations in the United States pay federal corporate income taxes levied at a 21 percent rate.

What is federal corporate income tax?

What Is a Corporate Income Tax? A corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax.

When did EFTPS become mandatory?

Beginning January 1, 2011, you must deposit all depository taxes (such as employment tax, excise tax, and corporate income tax) electronically using the Electronic Federal Tax Payment System (EFTPS).

What is a form 1120 corporation?

Purpose of Form Use Form 1120, U.S. Corporation Income Tax Return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation.

Is corporation tax 19% or 20%?

The Corporation Tax main rate will, therefore, remain at 19% from 1 April 2023.

Which states have no corporate income tax?

South Dakota and Wyoming are the only states that levy neither a corporate income nor gross receipts tax.

Is an LLC a 1120 or 1120S?

If the LLC is a corporation, normal corporate tax rules will apply to the LLC and it should file a Form 1120, U.S. Corporation Income Tax Return. The 1120 is the C corporation income tax return, and there are no flow-through items to a 1040 or 1040-SR from a C corporation return.

What is tax form 1120 used for?

Use Form 1120-S to report the income, gains, losses, deductions, credits, etc., of a domestic corporation or other entity for any tax year covered by an election to be an S corporation.

Does Maine have a minimum corporate tax?

A corporation that has nexus with Maine is required to file Form 1120ME if it has Maine income and is subject to federal corporate income tax.1. What is Maine's Corporate Income Tax Rate? Greater thanBut not overThe gross tax is:$0$25,0003.5% of adjusted federal taxable income*3 more rows

What is Maine corporate income tax?

Maine Tax Rates, Collections, and Burdens Maine has a graduated individual income tax, with rates ranging from 5.80 percent to 7.15 percent. Maine also has a corporate income tax that ranges from 3.50 percent to 8.93 percent. Maine has a 5.50 percent state sales tax rate and does not levy any local sales taxes.

How do I pay my corporate tax without EFTPS?

If a corporation does not want to use EFTPS, it can arrange for its tax professional, financial institution, payroll service, or other trusted third party to make deposits on its behalf. Also, it may arrange for its financial institution to submit a same-day payment on its behalf (see Instructions for Form 1120).

Is form 1120 for C Corp or S Corp?

C corporations use Form 1120 to calculate their taxes due. S corporations use Form 1120S as an information return. S corporations must also prepare a form 10 K-1 for each shareholder to include with their individual returns.

Is Eftps required for corporations?

Is EFTPS mandatory? Using the EFTPS is not required, although corporations must pay their federal taxes electronically.

What are the tax rates for 2022?

For the 2022 tax year, there are seven federal tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Your tax bracket is determined by your filing status and taxable income.

Are corporations required to use EFTPS?

Corporations must use electronic funds transfer to make all federal tax deposits (such as deposits of employment, excise, and corporate income tax). This includes installment payments of estimated tax. Generally, electronic funds transfer is made using the Electronic Federal Tax Payment System (EFTPS).

Who is required to use EFTPS?

of all federal taxes (including employment taxes, income taxes, Railroad Retirement taxes, Social Security taxes, and various other types of non-payroll withholding taxes) during a calendar year exceed $200,000, you are required to use EFTPS beginning in the second succeeding calendar year.

What is corporate Form 1120?

Domestic corporations use this form to: Report their income, gains, losses, deductions, credits. Figure their income tax liability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get ME MRS 1120ME?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific ME MRS 1120ME and other forms. Find the template you need and change it using powerful tools.

How do I edit ME MRS 1120ME online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your ME MRS 1120ME to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I edit ME MRS 1120ME on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as ME MRS 1120ME. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is ME MRS 1120ME?

ME MRS 1120ME is the Maine Corporate Income Tax Return form used by corporations operating in the state of Maine to report their income, deductions, and tax liability.

Who is required to file ME MRS 1120ME?

Corporations conducting business in Maine or having a tax obligation in the state are required to file the ME MRS 1120ME.

How to fill out ME MRS 1120ME?

To fill out ME MRS 1120ME, corporations must provide their federal identification number, indicate their taxable income, deductions, credits, and calculate the amount of tax owed. The form must be completed accurately and filed by the appropriate deadline.

What is the purpose of ME MRS 1120ME?

The purpose of ME MRS 1120ME is to ensure that corporations report their financial activity accurately to the state of Maine for the assessment of corporate income tax.

What information must be reported on ME MRS 1120ME?

Information that must be reported on ME MRS 1120ME includes federal taxable income, exemptions, deductions, credits, and total tax due.

Fill out your ME MRS 1120ME online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ME MRS 1120me is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.