ME MRS 1120ME 2023-2026 free printable template

Show details

ClearPrint2023For calendar year

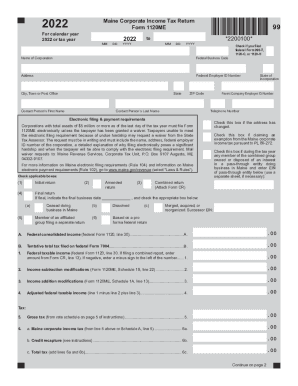

2023 or tax yearMaine Corporate Income Tax Return

Form 1120ME

mmdd2023yyyytommdd99

*2300100*yyyyName of CorporationFederal Business CodeCheck if you filed

federal Form

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign maine form 1120me

Edit your 1120me form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your maine return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ME MRS 1120ME online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ME MRS 1120ME. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ME MRS 1120ME Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ME MRS 1120ME

How to fill out ME MRS 1120ME

01

Gather all necessary personal and business information.

02

Download or access the ME MRS 1120ME form from the official website.

03

Fill out the identification section with your name, address, and Tax Identification Number (TIN).

04

Provide details about your business, including the type of entity and its activities.

05

Complete the income section, including all revenue sources.

06

Report any allowable deductions based on business expenses.

07

Calculate your taxable income and ensure all figures are correct.

08

Sign and date the form to confirm the accuracy of the information provided.

09

Submit the form by the deadline through the method specified by the tax authority.

Who needs ME MRS 1120ME?

01

Businesses operating in Maine that need to report income for tax purposes.

02

Sole proprietors, partnerships, corporations, and other business entities within Maine.

03

Tax professionals who assist clients with their tax filings in Maine.

Fill

form

: Try Risk Free

People Also Ask about

Is there a corporate minimum tax?

For companies that report over $1 billion in profits to shareholders, the Inflation Reduction Act of 2022 (the Act) includes a 15% corporate alternative minimum tax (CAMT) based on book income.

What is federal corporate tax rate 2022?

Corporations in the United States pay federal corporate income taxes levied at a 21 percent rate.

What is federal corporate income tax?

What Is a Corporate Income Tax? A corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax.

When did EFTPS become mandatory?

Beginning January 1, 2011, you must deposit all depository taxes (such as employment tax, excise tax, and corporate income tax) electronically using the Electronic Federal Tax Payment System (EFTPS).

What is a form 1120 corporation?

Purpose of Form Use Form 1120, U.S. Corporation Income Tax Return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation.

Is corporation tax 19% or 20%?

The Corporation Tax main rate will, therefore, remain at 19% from 1 April 2023.

Which states have no corporate income tax?

South Dakota and Wyoming are the only states that levy neither a corporate income nor gross receipts tax.

Is an LLC a 1120 or 1120S?

If the LLC is a corporation, normal corporate tax rules will apply to the LLC and it should file a Form 1120, U.S. Corporation Income Tax Return. The 1120 is the C corporation income tax return, and there are no flow-through items to a 1040 or 1040-SR from a C corporation return.

What is tax form 1120 used for?

Use Form 1120-S to report the income, gains, losses, deductions, credits, etc., of a domestic corporation or other entity for any tax year covered by an election to be an S corporation.

Does Maine have a minimum corporate tax?

A corporation that has nexus with Maine is required to file Form 1120ME if it has Maine income and is subject to federal corporate income tax.1. What is Maine's Corporate Income Tax Rate? Greater thanBut not overThe gross tax is:$0$25,0003.5% of adjusted federal taxable income*3 more rows

What is Maine corporate income tax?

Maine Tax Rates, Collections, and Burdens Maine has a graduated individual income tax, with rates ranging from 5.80 percent to 7.15 percent. Maine also has a corporate income tax that ranges from 3.50 percent to 8.93 percent. Maine has a 5.50 percent state sales tax rate and does not levy any local sales taxes.

How do I pay my corporate tax without EFTPS?

If a corporation does not want to use EFTPS, it can arrange for its tax professional, financial institution, payroll service, or other trusted third party to make deposits on its behalf. Also, it may arrange for its financial institution to submit a same-day payment on its behalf (see Instructions for Form 1120).

Is form 1120 for C Corp or S Corp?

C corporations use Form 1120 to calculate their taxes due. S corporations use Form 1120S as an information return. S corporations must also prepare a form 10 K-1 for each shareholder to include with their individual returns.

Is Eftps required for corporations?

Is EFTPS mandatory? Using the EFTPS is not required, although corporations must pay their federal taxes electronically.

What are the tax rates for 2022?

For the 2022 tax year, there are seven federal tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Your tax bracket is determined by your filing status and taxable income.

Are corporations required to use EFTPS?

Corporations must use electronic funds transfer to make all federal tax deposits (such as deposits of employment, excise, and corporate income tax). This includes installment payments of estimated tax. Generally, electronic funds transfer is made using the Electronic Federal Tax Payment System (EFTPS).

Who is required to use EFTPS?

of all federal taxes (including employment taxes, income taxes, Railroad Retirement taxes, Social Security taxes, and various other types of non-payroll withholding taxes) during a calendar year exceed $200,000, you are required to use EFTPS beginning in the second succeeding calendar year.

What is corporate Form 1120?

Domestic corporations use this form to: Report their income, gains, losses, deductions, credits. Figure their income tax liability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute ME MRS 1120ME online?

With pdfFiller, you may easily complete and sign ME MRS 1120ME online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I make edits in ME MRS 1120ME without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your ME MRS 1120ME, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I create an electronic signature for the ME MRS 1120ME in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your ME MRS 1120ME in seconds.

What is ME MRS 1120ME?

ME MRS 1120ME is a tax form used by corporations operating in Maine to report their income and calculate their state income tax obligations.

Who is required to file ME MRS 1120ME?

Corporations doing business in Maine, including both domestic and foreign corporations that have income sourced from Maine, are required to file the ME MRS 1120ME.

How to fill out ME MRS 1120ME?

To fill out ME MRS 1120ME, you need to provide basic information about the corporation, report total income, deductions, and calculate the tax owed based on Maine tax laws. Detailed instructions are available from the Maine Revenue Services.

What is the purpose of ME MRS 1120ME?

The purpose of ME MRS 1120ME is to enable the state of Maine to collect income tax from corporations that operate within its jurisdiction.

What information must be reported on ME MRS 1120ME?

Information that must be reported on ME MRS 1120ME includes the corporation's name, address, federal employer identification number (EIN), total income, deductions, and the resulting tax liability.

Fill out your ME MRS 1120ME online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ME MRS 1120me is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.