KS DoR ST-36 2008 free printable template

Show details

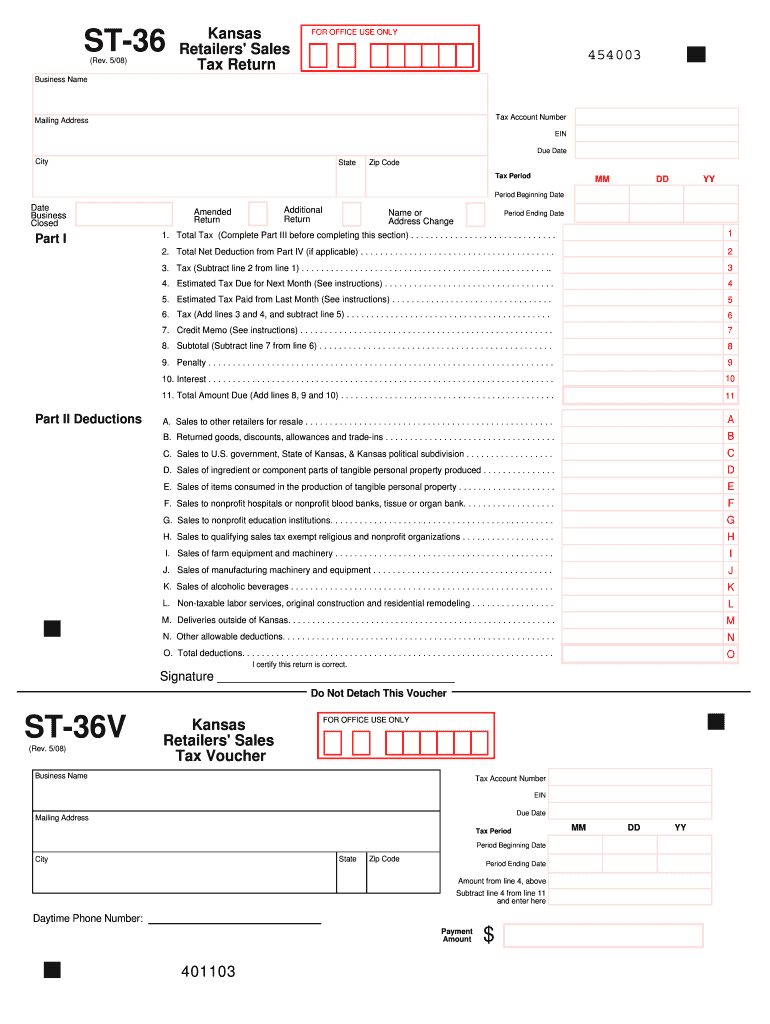

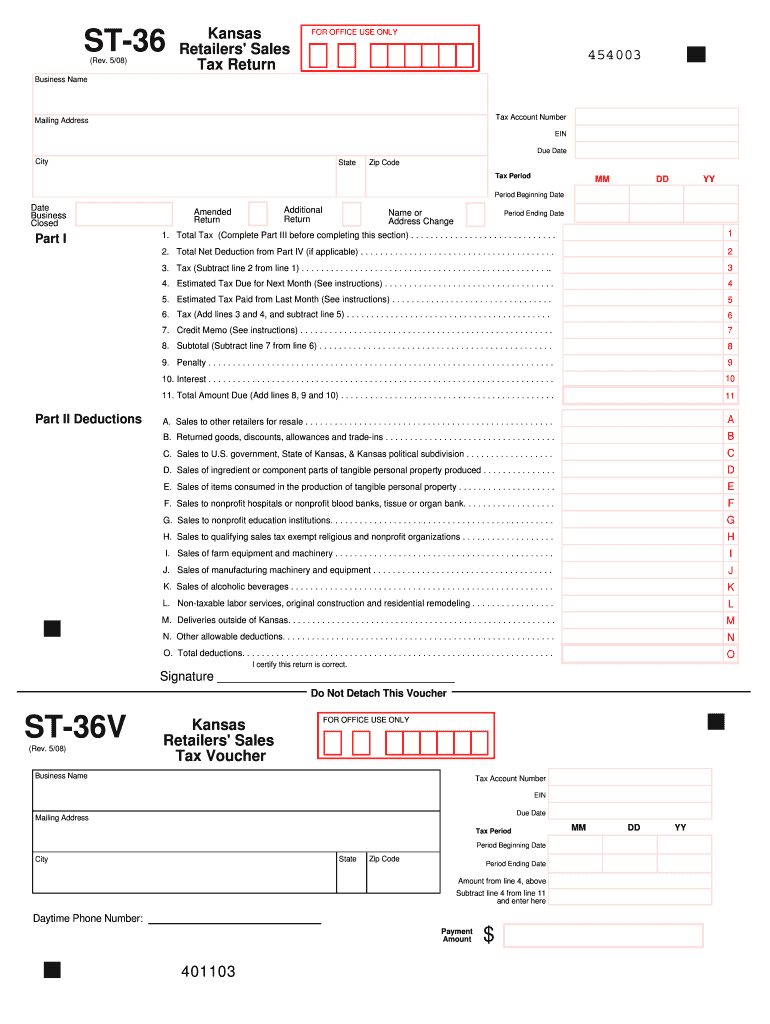

KANSAS Retailers’

Sales Tax Return

Form ST-36

Tired of paper

and postage?

Use KS WebTax, a quick, easy, smart way to get your

Business Taxes where you want them to be - DONE!

Visit www.webtax.org

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KS DoR ST-36

Edit your KS DoR ST-36 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KS DoR ST-36 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing KS DoR ST-36 online

Follow the steps below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit KS DoR ST-36. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KS DoR ST-36 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KS DoR ST-36

How to fill out KS DoR ST-36

01

Gather all required personal identification information including Social Security Number and address.

02

Obtain the necessary financial details such as income, deductions, and credits.

03

Complete the form by filling in each section accurately, starting with your personal information.

04

Provide details regarding your income and any applicable deductions.

05

Double-check all numbers and information for accuracy.

06

Sign and date the form before submission.

07

Submit the form by the designated deadline via mail or electronically.

Who needs KS DoR ST-36?

01

Individuals who are required to report state income tax in Kansas.

02

Residents of Kansas who have earned income during the tax year.

03

Businesses operating in Kansas that need to file for state tax.

Fill

form

: Try Risk Free

People Also Ask about

What are the filing requirements for Kansas?

Kansas Form K-40 Instructions A Kansas resident must file if he or she is:And gross income is at least:SINGLEUnder 65$ 5,25065 or older or blind$ 6,10065 or older and blind$ 6,950MARRIED FILING JOINTUnder 65 (both spouses)$12,00011 more rows

How to file Kansas sales tax return?

Retailers' Sales and Compensating Use Tax Go to the Kansas Department of Revenue Customer Service Center and create your account. Contact Electronic Services for your Access Code assignment. Connect your tax account to your login and begin filing.

What is Kansas retailers sales tax?

Sales tax is a tax paid to a governing body (state or local) on the sale of certain goods and services. Kansas first adopted a general state sales tax in 1937, and since that time, the rate has risen to 6.5 percent.

What is considered Kansas source income?

Kansas source income includes all income earned while a Kansas resident; income from services performed in Kansas Kansas lottery, pari-mutuel, and gambling winnings; income from real or tangible personal property located in Kansas; income from a business, trade, profession or occupation operating in Kansas,

How does Kansas sales tax work?

Sales tax 101 Kansas first adopted a general state sales tax in 1937, and since that time, the rate has risen to 6.5 percent. On top of the state sales tax, there may be one or more local sales taxes, as well as one or more special district taxes, each of which can range between 0 percent and 4.1 percent.

How much money do you need to make to file taxes in Kansas?

Kansas Form K-40 Instructions A Kansas resident must file if he or she is:And gross income is at least:SINGLEUnder 65$ 5,25065 or older or blind$ 6,10065 or older and blind$ 6,950MARRIED FILING JOINTUnder 65 (both spouses)$12,00011 more rows

Which people are legally required to file a tax return?

Most U.S. citizens – and permanent residents who work in the United States – need to file a tax return if they make more than a certain amount for the year. You may want to file even if you make less than that amount, because you may get money back if you file.

Is sales tax deductible in Kansas?

If you elect, on your federal return, to deduct state and local general sales and use taxes instead of state and local income taxes then your Kansas itemized deductions are the same as your federal itemized deductions.

What is Kansas sales tax 2022?

The Kansas sales tax rate is currently 6.5%.

Does Kansas have a high sales tax?

Kansas has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 4%. There are a total of 530 local tax jurisdictions across the state, collecting an average local tax of 1.99%. Click here for a larger sales tax map, or here for a sales tax table.

How does sales tax work in Kansas?

What is the sales tax rate in Kansas? The state rate is 6.50%. However, various cities and counties in Kansas have an additional local sales tax. You can see the entire listing of local sales tax rates in the Local Sales Tax Rates by Jurisdiction (KS-1700).

What items qualify for sales tax deduction?

The IRS allows you to deduct the actual sales taxes you paid, as long as the tax rate was no different than the general sales tax rate in your area. Exceptions are made for food, clothing and medical supplies.

How do you figure out Kansas sales tax?

Collecting Sales Tax The state sales tax rate in Kansas is 6.5%. In Wichita, the local sales tax rate is 1% (for Sedgwick County); the total sales tax rate is 7.5%. Sellers based out-of-state also charge sales tax based on the destination of the buyer.

Can you deduct sales tax as an expense?

You can elect to deduct state and local general sales taxes instead of state and local income taxes, but you can't deduct both. If you elect to deduct state and local general sales taxes, you can use either your actual expenses or the optional sales tax tables.

Does Kansas require you to file a tax return?

As a resident, you must file a Kansas income tax return if you file a Federal income tax return or if your income is greater than the combined total of your Kansas standard deduction and your personal exemption amount.

Who must file a Kansas return?

Kansas residents and nonresidents of Kansas earning income from Kansas sources are required to annually file an income tax return, K-40. Kansas income tax conforms to many provisions of the Internal Revenue Service.

What is Kansas sales tax right now?

What is the sales tax rate in Kansas? The state rate is 6.50%. However, various cities and counties in Kansas have an additional local sales tax.

Do I need to file a KS tax return?

Kansas residents and nonresidents of Kansas earning income from Kansas sources are required to annually file an income tax return, K-40. Kansas income tax conforms to many provisions of the Internal Revenue Service.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my KS DoR ST-36 in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your KS DoR ST-36 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I make changes in KS DoR ST-36?

The editing procedure is simple with pdfFiller. Open your KS DoR ST-36 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an electronic signature for signing my KS DoR ST-36 in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your KS DoR ST-36 and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

What is KS DoR ST-36?

KS DoR ST-36 is a tax form used in the state of Kansas for reporting specific income, deductions, and credits related to business and individual tax obligations.

Who is required to file KS DoR ST-36?

Individuals and businesses in Kansas that need to report income, deductions, or credits as part of their tax obligations are required to file the KS DoR ST-36 form.

How to fill out KS DoR ST-36?

To fill out KS DoR ST-36, start by providing your personal and business information, then enter the income, deductions, and credits according to the instructions provided with the form.

What is the purpose of KS DoR ST-36?

The purpose of KS DoR ST-36 is to ensure accurate reporting of tax obligations for individuals and businesses in Kansas, facilitating proper tax assessments and compliance.

What information must be reported on KS DoR ST-36?

KS DoR ST-36 requires reporting of personal and business identification details, total income, itemized deductions, and applicable tax credits.

Fill out your KS DoR ST-36 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KS DoR ST-36 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.