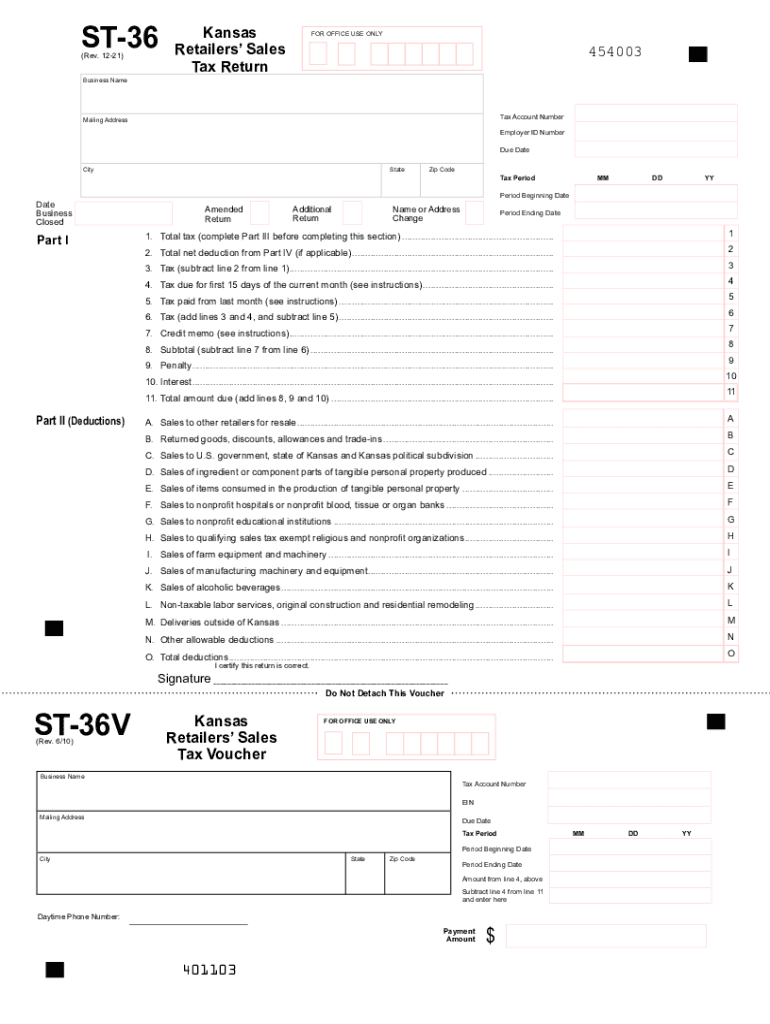

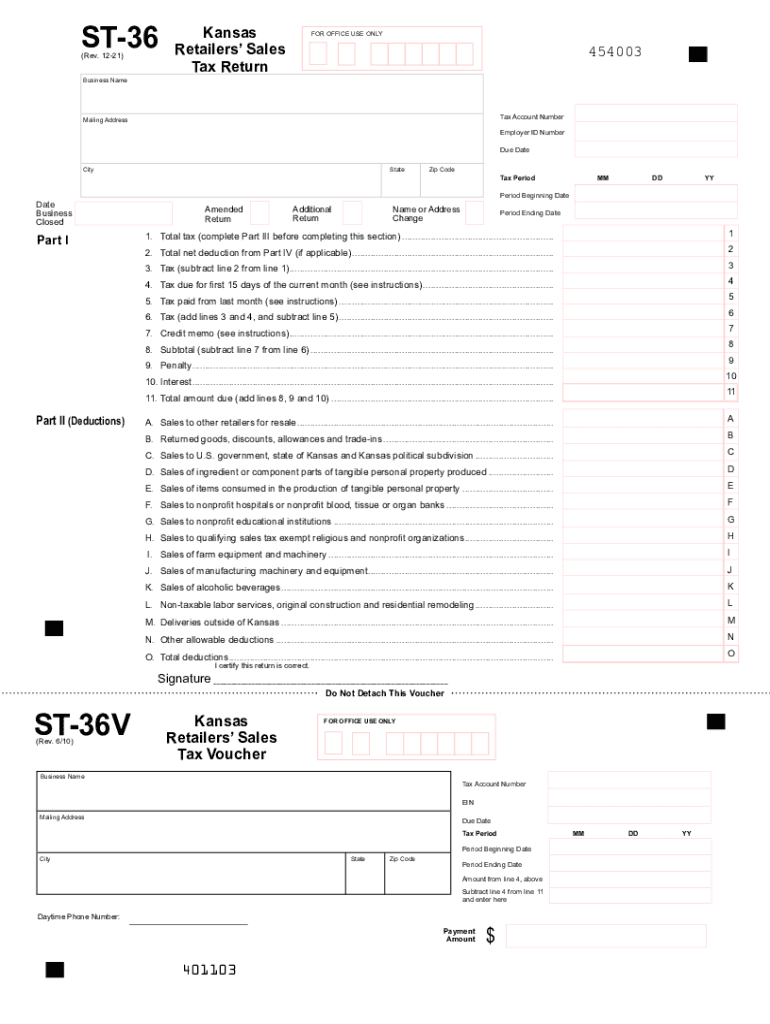

KS DoR ST-36 2021 free printable template

Get, Create, Make and Sign KS DoR ST-36

Editing KS DoR ST-36 online

Uncompromising security for your PDF editing and eSignature needs

KS DoR ST-36 Form Versions

How to fill out KS DoR ST-36

How to fill out KS DoR ST-36

Who needs KS DoR ST-36?

Instructions and Help about KS DoR ST-36

210 North James Hayesville Kansas new new new better than brand-new quality of workmanship shows in this beautifully remodeled home features include four bedrooms on the main floor two and a half baths with an attached two-car garage and a detached 24 × 40 out building / workshop fully finished basements with two more additional finished rooms in a family room with a fireplace in a gaming area interior updates include new interior paint throughout newer lighting throughout newer plumbing fixtures throughout newer flooring throughout newer 36 inches taller than standard vanities with soft-close drawers in the bathrooms kitchen and all vanities new toilets throughout new bath new bathtub insert new double shower and master bath new dual sinks with specialty glass backsplash corner jacuzzi tub with custom tile and master bath walk-in closet and master suite with built-in shelving Angela's new two panel plank Cheyenne interior doors throughout with new hardware new three and one-fourth inch base boards throughout new knock down ceiling throughout new kitchen cabinetry with soft closed doors and cabinets new appliances new double slate sink specially tile with upgraded countertops new hearth custom tile around the fireplace new hot water tank new sump pump new smoke detectors even a new doorbell exterior features include a new exterior paint on the home and shop newer heritage roof on the house and the shop new double pane with low e glass J welding windows throughout new exterior doors with detached shop that majors 24 × 40 and has an air compressor lines ran throughout separate to 200 amp electrical service 220 outlets and tons of cabinets and lighting this even has its own paint booth guys home is all electric homes eat is a show close to areas neighborhoods and shopping call Brian her Denise at nine thirty to twenty-five hundred to view a private showing or view more information at our way

People Also Ask about

What are the filing requirements for Kansas?

How to file Kansas sales tax return?

What is Kansas retailers sales tax?

What is considered Kansas source income?

How does Kansas sales tax work?

How much money do you need to make to file taxes in Kansas?

Which people are legally required to file a tax return?

Is sales tax deductible in Kansas?

What is Kansas sales tax 2022?

Does Kansas have a high sales tax?

How does sales tax work in Kansas?

What items qualify for sales tax deduction?

How do you figure out Kansas sales tax?

Can you deduct sales tax as an expense?

Does Kansas require you to file a tax return?

Who must file a Kansas return?

What is Kansas sales tax right now?

Do I need to file a KS tax return?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify KS DoR ST-36 without leaving Google Drive?

How do I fill out the KS DoR ST-36 form on my smartphone?

How do I fill out KS DoR ST-36 on an Android device?

What is KS DoR ST-36?

Who is required to file KS DoR ST-36?

How to fill out KS DoR ST-36?

What is the purpose of KS DoR ST-36?

What information must be reported on KS DoR ST-36?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.