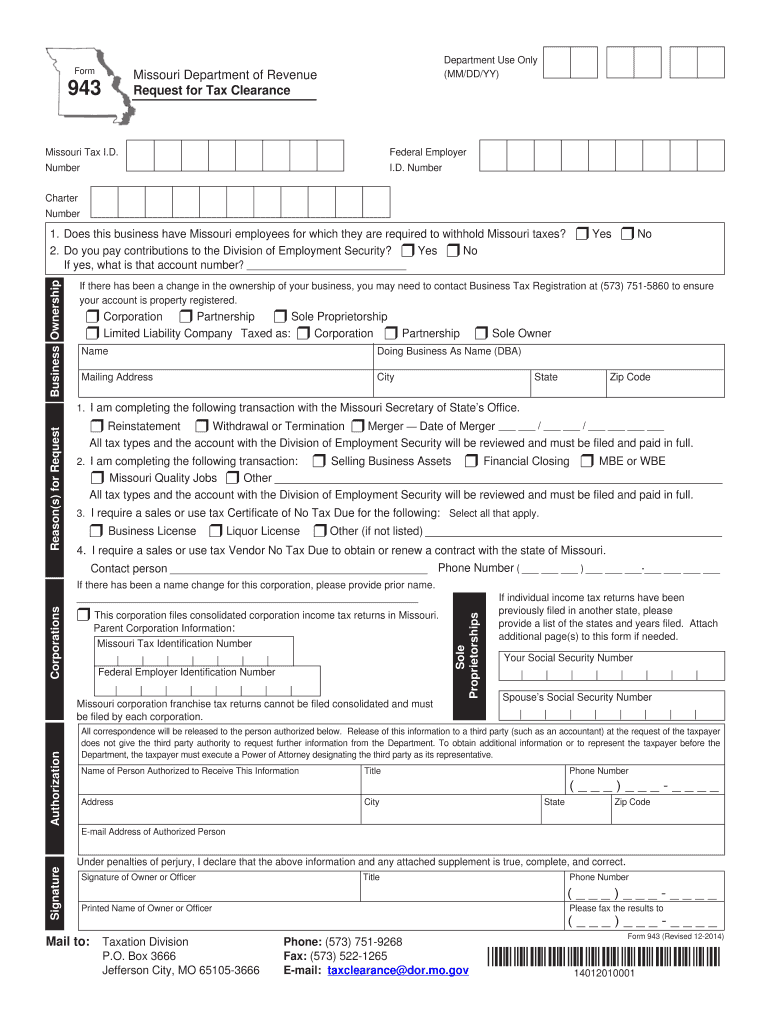

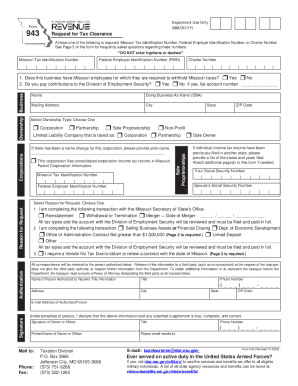

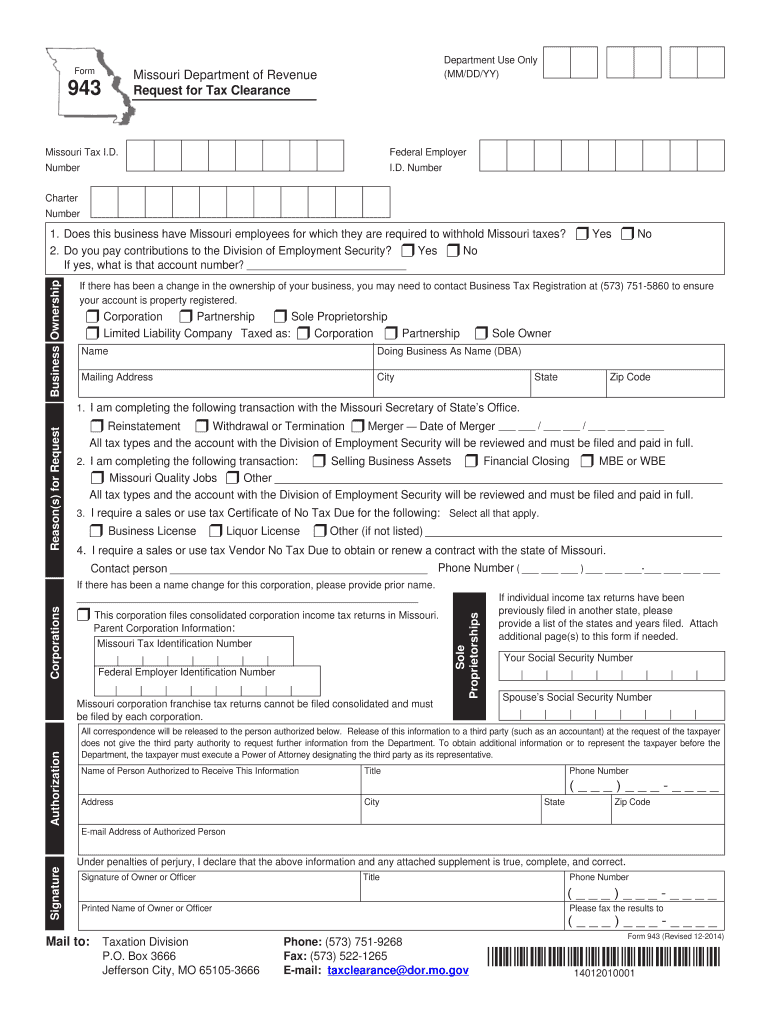

MO DoR 943 2014 free printable template

Get, Create, Make and Sign MO DoR 943

Editing MO DoR 943 online

Uncompromising security for your PDF editing and eSignature needs

MO DoR 943 Form Versions

How to fill out MO DoR 943

How to fill out MO DoR 943

Who needs MO DoR 943?

Instructions and Help about MO DoR 943

All right guys I remember hating this back when I did second year in organic chemistry at the University of Waterloo, but I realized they still teach it, so we still got to teach it to you, you need the mo diagram for n2 plus now they could have asked you for the mo diagram for any of these atoms here or rather diatoms Li to be e2 f2 and e2 these are just the way that they teach you mo diagrams alright now here's the first thing you got to remember when you're asked for the mo diagram of a diatom like that there are two different mo diagrams you basically have to memorize for atoms from lithium to nitrogen it looks like this where you have your two s orbitals coming together to form a sigma 2 s and a sigma 2 s anti-bonding I shouldn't have drawn that there that's a mistake Sigma 2 s and Sigma 2 s antibonding your 2p orbitals come together to form these and yes you're just going to have to memorize these and the order you have a Sigma 2p and a Sigma 2p antibonding, and you also have a PI 2p and a PI 2p anti-bonding now there are two of those notice 6 orbitals became 6 orbitals at different energies this is just how mo diagrams work, and honestly I've never figured any reason for other than that's just the way it is, and we accept it so if you're asked for the mo diagram for n2 plus you're basically going to regurgitate this diagram let's see if we can do that well the two 2's orbitals come together to form a sigma 2 s and a sigma 2 s anti-bonding check my two peas come together to form a PI 2p and a Sigma 2p, and we need corresponding PI 2p anti-bonding and oops Sigma 2p anti-bonding it's ideal to draw in those funky lines if they always seem to show tu-tu-tu-tu-tu-tu q, and then you've got to fill it with electrons n2 + brings each n brings 5 electrons with it, so that makes 10, but we have a plus charge, so we're taking away one we need to fill this with 9 electrons now what I haven't shown you are that there's a 1s orbital that's already filled here but nonetheless in my valence shell I need nine electrons 1 2 3 4 5 6 notice that I'm spreading out the electrons, so there's one in each equivalent energy orbital before I start doubling up 7 8 9 now that's the mo diagram for n 2 plus you may be asked for something called the bond order which is the number of electrons in bonding orbitals minus the number of electrons and anti-bonding orbitals divided by 2 in the bonding orbitals I've got 1 2 3 4 5 6 electrons in anti-bonding orbitals I've got oops one thought back to bonding I didn't realize that was bonding one two three four five six seven I've got seven bonding electrons how many antibonding electrons one two and that's it when I do that my calculator I got a bond order of 2.5 a bond order with a point five in it isn't super stable and so n/2 plus probably isn't super stable FYI I told you this was the mo diagram you had to memorize for lithium to nitrogen the one for oxygen to neon is pretty much the same the only difference is that oxygen to...

People Also Ask about

Is w2 same as 1040?

Can I fill out a 1040 form myself?

What is IRS 1040 form?

Where can I print a 1040 tax form?

What are the different ways to file tax return?

Can I file tax return by myself?

How can tax returns be filed?

When can I file my taxes for 2023?

When should tax returns be filled out?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the MO DoR 943 form on my smartphone?

How do I complete MO DoR 943 on an iOS device?

How do I complete MO DoR 943 on an Android device?

What is MO DoR 943?

Who is required to file MO DoR 943?

How to fill out MO DoR 943?

What is the purpose of MO DoR 943?

What information must be reported on MO DoR 943?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.