MO DoR 943 2015 free printable template

Show details

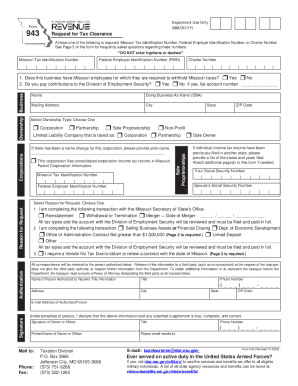

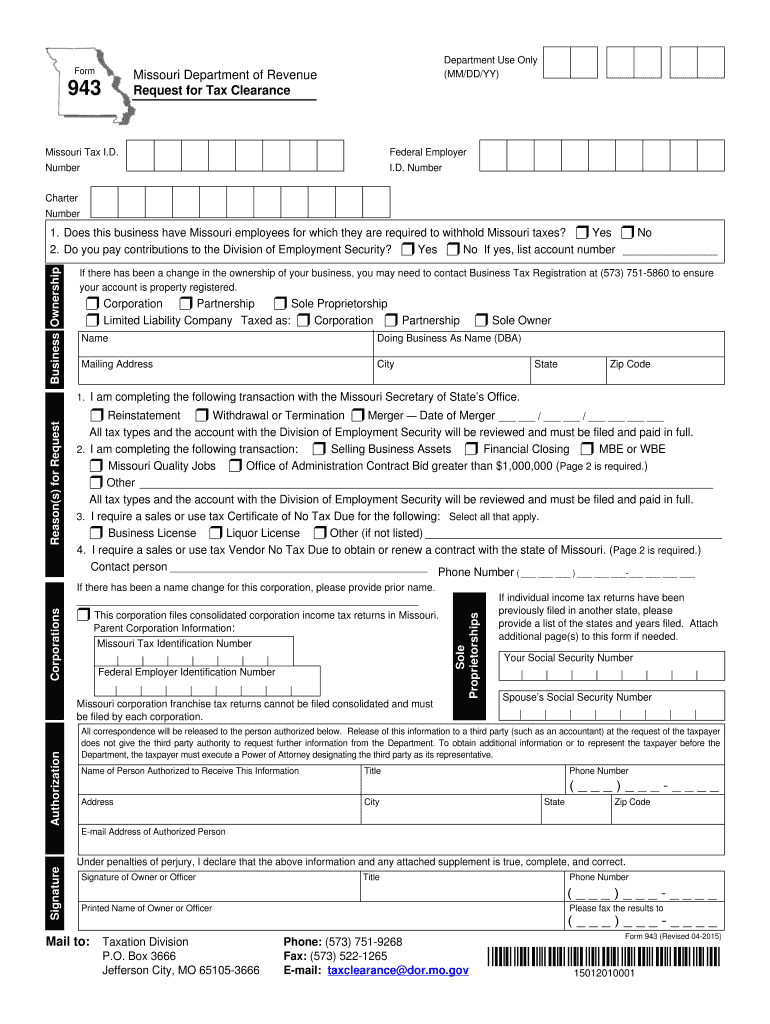

Mo. gov Form 943 Revised 04-2015 15012010001 Complete this page and attach to form if Reason for Request on page 1 is 2 Office of Administration Contract Bid greater than 1 000 000 or 4. Reset Form Form Department Use Only MM/DD/YY Missouri Department of Revenue Request for Tax Clearance Print Form Missouri Tax I. D. Federal Employer Number I. D. Number Charter 1. Does this business have Missouri employees for which they are required to withhold Missouri taxes r Yes r No Business Ownership 2....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign missouri form 943

Edit your missouri form 943 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your missouri form 943 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit missouri form 943 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit missouri form 943. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO DoR 943 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out missouri form 943

How to fill out MO DoR 943

01

Obtain the MO DoR 943 form from the Missouri Department of Revenue website or your local tax office.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Provide details about your income, including W-2 forms and other earnings statements.

04

Complete any sections related to specific deductions or credits applicable to your situation.

05

Double-check all entries for accuracy and completeness.

06

Sign and date the form where indicated.

07

Submit the form to the appropriate tax authority by the specified deadline, either electronically or by mail.

Who needs MO DoR 943?

01

Individuals who are residents of Missouri and need to report their annual income for state tax purposes.

02

Taxpayers looking to claim refunds for overpaid state taxes or apply for specific tax credits.

03

Employers or individuals who have earned income in Missouri but reside in another state.

Fill

form

: Try Risk Free

People Also Ask about

How long does it take to get tax clearance certificate?

SARS has always stated that TCCs take up to 21 working days to process.

How do I get a certificate of tax clearance in Missouri?

Complete Form 943PDF Document a Request For Tax Clearance and submit it to the Department of Revenue's Tax Clearance Unit. Once the form is completed and signed by a corporate officer it can be mailed or faxed to the tax clearance unit.

How much is tax clearance certificate?

within 1-week @ Only R890.

How long does a tax clearance cert last?

Your application for a Tax Clearance Certificate will expire after one year in the case of a grant application and within four years for all other applications.

How do I get a tax clearance for my company?

How to request your Tax Compliance Status via eFiling Selecting the Tax Compliance Status Request option and the type of TCS for which you would like to apply. You will have the following options: Good standing. Tender. Complete the Tax Compliance Status Request and submit it to SARS.

What documents are needed for tax clearance certificate?

The following documents is required when applying for a Tax Clearance Certificate for your company an income tax reference number for the company, the director or also known as the public officer of the company must have a certified copy of his/her ID or a valid passport if the applicant is a foreign, a signed SARS

What is a tax clearance certificate?

The definition of a Tax Clearance Certificate A Tax Clearance Certificate is essentially a piece of official documentation that your business can get from SARS as proof that you have no outstanding Tax at SARS.

What is a tax clearance used for?

A Tax Clearance Certificate is confirmation from Revenue that an applicant's tax affairs are in order. Revenue may issue a Tax Clearance Certificate to a customer who has tax arrears where the arrears are covered by an instalment arrangement.

How do I get a tax clearance certificate?

How to request your Tax Compliance Status via eFiling Selecting the Tax Compliance Status Request option and the type of TCS for which you would like to apply. You will have the following options: Good standing. Tender. Complete the Tax Compliance Status Request and submit it to SARS.

What documents do I need for a tax clearance?

See our Tax Clearance Services: Tax Clearance Pin Certificate. Main Requirements: (1) Company Registration documents; (2) ID Number / Passport; (3) Tax Registration Number; (4) All Tax returns up to date; (5) SARS Registered Representative updated at SARS (we can assist) Timeframe: 1-Week.

How do I get a tax clearance in Missouri?

How do I apply for a tax clearance? Complete Form 943PDF Document a Request For Tax Clearance and submit it to the Department of Revenue's Tax Clearance Unit. Once the form is completed and signed by a corporate officer it can be mailed or faxed to the tax clearance unit.

How do I get my SARS tax clearance certificate online?

How to access your “MY COMPLIANCE PROFILE” (MCP) via SARS eFiling Step 1: Logon to eFiling. Logon to eFiling by using your login name and password. Step 2: Activate the Tax Compliance Status service. Step 3: View your “My Compliance Profile”

How long does it take to get tax clearance?

You can get a SARS-issued Tax Clearance Pin Certificate within 24 hours by using our Tax Clearance Pin Certificate service. Our service includes the support of our Tax Practitioners, who collectively have more than 30 years of experience in SARS administration. That's why we can support you in 24 hours.

How do I obtain a tax clearance certificate?

How to request your Tax Compliance Status via eFiling Selecting the Tax Compliance Status Request option and the type of TCS for which you would like to apply. You will have the following options: Good standing. Tender. Complete the Tax Compliance Status Request and submit it to SARS.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get missouri form 943?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the missouri form 943 in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit missouri form 943 online?

The editing procedure is simple with pdfFiller. Open your missouri form 943 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How can I edit missouri form 943 on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing missouri form 943 right away.

What is MO DoR 943?

MO DoR 943 is a tax form used in the state of Missouri for reporting certain types of income, typically related to businesses and self-employment.

Who is required to file MO DoR 943?

Individuals and businesses in Missouri that earn income from self-employment or other sources that require reporting to the Department of Revenue must file MO DoR 943.

How to fill out MO DoR 943?

To fill out MO DoR 943, you need to provide your personal information, income details, deductions, and any applicable credits on the form, following the instructions provided by the Missouri Department of Revenue.

What is the purpose of MO DoR 943?

The purpose of MO DoR 943 is to ensure that the state of Missouri receives accurate information about income earned and taxes owed to maintain compliance with state tax laws.

What information must be reported on MO DoR 943?

MO DoR 943 requires reporting information such as the taxpayer's identification, total income earned, business expenses, and any deductions or credits applicable.

Fill out your missouri form 943 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Missouri Form 943 is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.