TTB 5100.51 2012 free printable template

Show details

OMB NO. 1513-0122 (08/31/2015)

FOR TTB USE ONLY

FORMULA #:

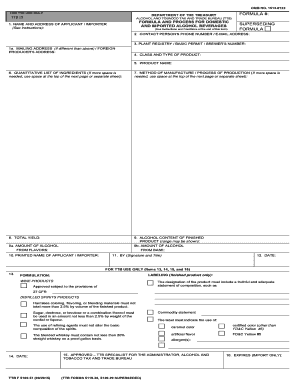

DEPARTMENT OF THE TREASURY

TTB ID

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU (TTB)

FORMULA AND PROCESS FOR DOMESTIC

AND IMPORTED ALCOHOL

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TTB 510051

Edit your TTB 510051 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TTB 510051 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TTB 5100.51 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TTB 510051

How to fill out TTB 5100.51

01

Obtain the TTB Form 5100.51 from the TTB website or your local TTB office.

02

Fill out the applicant's name and address in the designated fields.

03

Provide your federal Employer Identification Number (EIN).

04

Specify the type of application you are submitting (e.g., new, renewal, etc.).

05

Include detailed information about the premises where the alcohol will be produced or distributed.

06

Describe the type of alcohol beverage and the method of production if applicable.

07

State the intended use of the alcohol product.

08

Answer any additional questions presented in the form, such as previous violations or regulatory compliance.

09

Sign and date the application to validate it.

10

Submit the completed form to the TTB either electronically or via mail, along with any necessary attachments or fees.

Who needs TTB 5100.51?

01

Businesses or individuals seeking to produce or distribute alcoholic beverages in the United States must file TTB Form 5100.51.

02

Importers and wholesalers of alcoholic beverages also need this form to comply with federal regulations.

03

New alcohol beverage manufacturers seeking federal permits are required to complete this form.

Fill

form

: Try Risk Free

People Also Ask about

What is TTB F 5100.16 transfer in bond form?

TTB F 5100.16, Transfer in Bond form, is required before making transfers to another distilled spirits plant or alcohol fuel plant, and a new transfer in bond form is required if the bond is changed, updated, or terminated. If you have any questions regarding these forms, contact: National Revenue Center.

What does transfer in bond mean?

A Transfer in Bond means that alcoholic beverage product is being transferred between two manufacturing-tier TTB bonded facilities (regardless of whether either facility is exempt pursuant to the PATH Act of 2015), generally in bulk form, and without payment of tax.

What is a TTB form?

Application for Permit to Manufacture Tobacco Products or Processed Tobacco or to Operate an Export Warehouse. TTB F 5200.7. Schedule of Tobacco Products, Cigarette Papers or Tubes Withdrawn from the Market.

Where do I send TTB forms?

Submitting a Form Most forms must be submitted to the National Revenue Center, 550 Main Street, Suite 8002, Cincinnati, Ohio 45202, complete with signature and date. Puerto Rico Operations forms must be submitted to TTB Puerto Rico Operations, Ste. 310, Torre Chardon, 350 Carlos Chardon Ave., San Juan, PR 00918.

Is TTB part of the Treasury Department?

The Alcohol and Tobacco Tax and Trade Bureau (TTB) is a bureau under the Department of the Treasury. We employ staff across the country, including our Headquarters Offices in Washington, D.C., and the National Revenue Center in Cincinnati, Ohio.

What is a TTB permit?

Federal Alcohol and Tobacco Tax and Trade Bureau (TTB) regulations permit a winegrower to use the facilities and equipment of another winegrower to produce wine. This is commonly referred to as an “alternating proprietorship.”

How do I pay my TTB excise tax?

File and Pay Online Filing electronically is the fastest and most accurate way to file operational reports and excise tax returns with TTB and also provides a secure way to make excise tax payments.

What is the file size of TTB label?

►Note: You can attach up to 10 files per application, each up to 750KB in size.

Is there a fee to file for a new label with the TTB?

No. All labeling, formulation and advertising services provided to you by TTB are free of charge.

What does TTB stand for?

The Alcohol and Tobacco Tax and Trade Bureau (TTB) is a bureau under the Department of the Treasury. We employ staff across the country, including our Headquarters Offices in Washington, D.C., and the National Revenue Center in Cincinnati, Ohio.

What is the file size for TTB?

You can attach up to 10 files, but each file must not exceed 750KB. C26: Will TTB electronically notify the States and U.S. Customs & Border Protection (USCBP) of approved COLAs?

How long does TTB formula approval take?

Our customer service standard is 15 days to complete review of your formula application. For formulas that require sample analysis, our standard allows for an additional 15 days. Learn more about reading the chart.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is TTB 5100.51?

TTB 5100.51 is a form used by the Alcohol and Tobacco Tax and Trade Bureau (TTB) for reporting information related to alcohol beverages.

Who is required to file TTB 5100.51?

Producers, manufacturers, or importers of alcohol beverages who meet certain thresholds or requirements are required to file TTB 5100.51.

How to fill out TTB 5100.51?

To fill out TTB 5100.51, individuals must provide their business information, details regarding alcohol production or importation, and other required disclosures as specified on the form.

What is the purpose of TTB 5100.51?

The purpose of TTB 5100.51 is to ensure compliance with federal regulations regarding the production and distribution of alcohol, and to collect necessary data for tax and regulatory purposes.

What information must be reported on TTB 5100.51?

Information that must be reported on TTB 5100.51 includes the type of alcohol produced or imported, quantities, relevant dates, and details about the business and responsible parties.

Fill out your TTB 510051 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TTB 510051 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.