TTB 5100.51 2009 free printable template

Show details

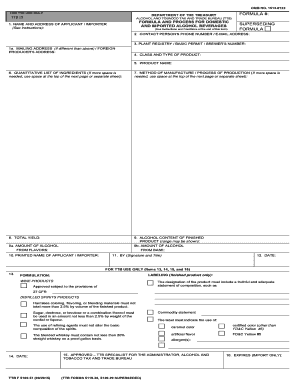

OMB NO. 1513-0122 (05/31/2009) FOR TT USE ONLY DEPARTMENT OF THE TREASURY TT BID ALCOHOL AND TOBACCO TAX AND TRADE BUREAU (TT) FORMULA AND PROCESS FOR DOMESTIC AND IMPORTED ALCOHOL BEVERAGES 1. NAME

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TTB 510051

Edit your TTB 510051 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TTB 510051 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TTB 510051 online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit TTB 510051. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TTB 5100.51 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TTB 510051

How to fill out TTB 5100.51

01

Obtain a copy of TTB Form 5100.51 from the Alcohol and Tobacco Tax and Trade Bureau (TTB) website or local TTB office.

02

Read the instructions provided with the form to understand the requirements and necessary information.

03

Fill out the identifying information at the top of the form including the name, address, and contact details of the applicant.

04

Complete the section detailing the type of application, indicating whether it is for a new bond or a continuation of an existing bond.

05

Provide descriptions of the distilling operation, including production capacity and types of products manufactured.

06

Fill in the financial information requested, including any required background on ownership and financial standing.

07

Review the legal requirements and certifications needed, ensuring all relevant signatures and dates are included.

08

Double-check all sections for accuracy and completeness before submitting.

09

Submit the completed form to the appropriate TTB office as specified in the form instructions.

Who needs TTB 5100.51?

01

Individuals or businesses that wish to operate a distillery or engage in the production of alcoholic beverages.

02

Those who are seeking to establish a new distilled spirits plant or want to modify an existing bonding agreement.

03

Beverage alcohol producers looking to comply with federal regulations as enforced by the TTB.

Fill

form

: Try Risk Free

People Also Ask about

What is TTB F 5100.16 transfer in bond form?

TTB F 5100.16, Transfer in Bond form, is required before making transfers to another distilled spirits plant or alcohol fuel plant, and a new transfer in bond form is required if the bond is changed, updated, or terminated. If you have any questions regarding these forms, contact: National Revenue Center.

What does transfer in bond mean?

A Transfer in Bond means that alcoholic beverage product is being transferred between two manufacturing-tier TTB bonded facilities (regardless of whether either facility is exempt pursuant to the PATH Act of 2015), generally in bulk form, and without payment of tax.

What is a TTB form?

Application for Permit to Manufacture Tobacco Products or Processed Tobacco or to Operate an Export Warehouse. TTB F 5200.7. Schedule of Tobacco Products, Cigarette Papers or Tubes Withdrawn from the Market.

Where do I send TTB forms?

Submitting a Form Most forms must be submitted to the National Revenue Center, 550 Main Street, Suite 8002, Cincinnati, Ohio 45202, complete with signature and date. Puerto Rico Operations forms must be submitted to TTB Puerto Rico Operations, Ste. 310, Torre Chardon, 350 Carlos Chardon Ave., San Juan, PR 00918.

Is TTB part of the Treasury Department?

The Alcohol and Tobacco Tax and Trade Bureau (TTB) is a bureau under the Department of the Treasury. We employ staff across the country, including our Headquarters Offices in Washington, D.C., and the National Revenue Center in Cincinnati, Ohio.

What is a TTB permit?

Federal Alcohol and Tobacco Tax and Trade Bureau (TTB) regulations permit a winegrower to use the facilities and equipment of another winegrower to produce wine. This is commonly referred to as an “alternating proprietorship.”

How do I pay my TTB excise tax?

File and Pay Online Filing electronically is the fastest and most accurate way to file operational reports and excise tax returns with TTB and also provides a secure way to make excise tax payments.

What is the file size of TTB label?

►Note: You can attach up to 10 files per application, each up to 750KB in size.

Is there a fee to file for a new label with the TTB?

No. All labeling, formulation and advertising services provided to you by TTB are free of charge.

What does TTB stand for?

The Alcohol and Tobacco Tax and Trade Bureau (TTB) is a bureau under the Department of the Treasury. We employ staff across the country, including our Headquarters Offices in Washington, D.C., and the National Revenue Center in Cincinnati, Ohio.

What is the file size for TTB?

You can attach up to 10 files, but each file must not exceed 750KB. C26: Will TTB electronically notify the States and U.S. Customs & Border Protection (USCBP) of approved COLAs?

How long does TTB formula approval take?

Our customer service standard is 15 days to complete review of your formula application. For formulas that require sample analysis, our standard allows for an additional 15 days. Learn more about reading the chart.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute TTB 510051 online?

With pdfFiller, you may easily complete and sign TTB 510051 online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I create an electronic signature for signing my TTB 510051 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your TTB 510051 and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I complete TTB 510051 on an Android device?

On an Android device, use the pdfFiller mobile app to finish your TTB 510051. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is TTB 5100.51?

TTB 5100.51 is a form used by the Alcohol and Tobacco Tax and Trade Bureau (TTB) to report various operations and transactions related to alcohol beverages.

Who is required to file TTB 5100.51?

Producers, importers, and wholesalers of alcohol beverages are required to file TTB 5100.51 in accordance with federal regulations.

How to fill out TTB 5100.51?

To fill out TTB 5100.51, individuals must provide specific information about their alcohol operations, following the detailed instructions provided by the TTB.

What is the purpose of TTB 5100.51?

The purpose of TTB 5100.51 is to ensure compliance with federal laws regarding the production, distribution, and taxation of alcohol beverages.

What information must be reported on TTB 5100.51?

Information reported on TTB 5100.51 includes details such as the type of alcohol produced or imported, quantities, and any relevant financial data.

Fill out your TTB 510051 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TTB 510051 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.