FL CLK/CT.965 2015-2026 free printable template

Show details

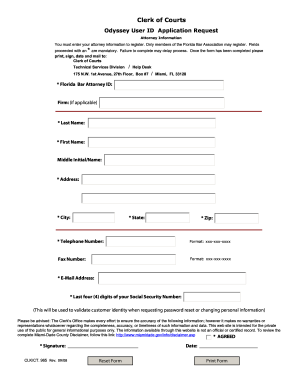

Miami-Dade County Clerk of Courts Public Access User ID Application Request Attorney and Public Access Members of the Florida Bar Association may register providing their Florida Bar# for access to

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign FL CLKCT965

Edit your FL CLKCT965 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your FL CLKCT965 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing FL CLKCT965 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit FL CLKCT965. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FL CLK/CT.965 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out FL CLKCT965

How to fill out FL CLK/CT.965

01

Obtain the FL CLK/CT.965 form from the official website or the relevant court office.

02

Fill in the case number at the top of the form if applicable.

03

Provide your full name and contact information in the designated fields.

04

Specify the purpose of the form clearly in the appropriate section.

05

Include any necessary supporting documents as indicated in the form instructions.

06

Review the form for accuracy and completeness before submission.

07

Sign and date the form at the bottom where required.

08

Submit the completed form to the designated court or agency either in person or by mail.

Who needs FL CLK/CT.965?

01

Individuals involved in legal proceedings who need to officially communicate or submit information to the court.

02

Lawyers representing clients in a court case.

03

Parties seeking to file motions, petitions, or responses in family court matters.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a fee waiver for replacement naturalization certificate?

In some cases, you may be able to request a Form N-565 fee waiver if you are unable to pay the fees due to financial hardship. To request a fee waiver, you will need to submit Form I-912, Request for Fee Waiver, along with your application.

Can you fill out immigration forms online?

Submitting your application online provides you with several benefits. Get helpful instructions and tips from USCIS as you complete your form using our secure online filing system, avoid common mistakes, and pay your fees online. These are just a few of the many benefits that filing online offers.

What is the reason for applying for i765?

What Is the Purpose of Form I-765? Certain foreign nationals who are in the United States may file Form I-765, Application for Employment Authorization, to request employment authorization and an Employment Authorization Document (EAD).

What is the processing time for I-956?

While every application will be reviewed on a case-by-case basis, IPO aims for its processing times on Form I-956 applications to meet or exceed the statutory goal of 180 days.”] I very much hope that the first applicants to receive RFEs will be public-spirited and share the RFEs with the rest of the community.

What is the purpose of form I-956?

Use Form I-956 to request U.S. Citizenship and Immigration Services (USCIS) designation as a regional center under Immigration and Nationality Act (INA) section 203(b)(5)(E), or to request an amendment to an approved regional center designated under INA 203(b)(5)(E).

When did Section 965 apply?

Amendment: Act section 422(a) of the American Jobs Creation Act of 2004 (P. L. 108-357) added Code section 965. Effective for tax years ending on or after October 22, 2004.

What is the 965 toll charge?

965, which imposes a one-time transition tax (toll charge) on the undistributed, nonpreviously taxed post-1986 foreign earnings and profits of certain U.S.-owned foreign corporations as part of the transition to a new territorial tax regime.

What is a 965 installment payment?

Your successive section 965(h) net tax liability installment payments should be made separately from your income tax payments for successive tax years. The successive installment(s) relate to an income tax liability assessed in a prior year and need to be credited to that prior year.

What is Form 965-A used for?

Form 965-A is used by individual taxpayers and entities taxed like individuals to report a taxpayer's net 965 liability, for each tax year in which a taxpayer must account for section 965 amounts.

What is a Form 965 from the IRS?

Form 965-A is used by individual taxpayers and entities taxed like individuals to report a taxpayer's net 965 liability, for each tax year in which a taxpayer must account for section 965 amounts.

Does section 965 apply to individuals?

An individual with a net tax liability under section 965 is required to report the liability on his or her tax return for the year in which or with which the inclusion year of the deferred foreign income corporation ends and pay the full amount of that liability on the unextended due date of that return, unless the

Where do I report Section 965-a inclusion?

Include a net section 965 amount (section 965(a) amount less section 965(c) deduction) on Page 1, Line 21, Other Income. Write SEC 965 on the dotted line to the left of Line 21. See 965(a) amount column. Report the relevant section 965(a) amount and the relevant section 965(c) deduction on Form 1116.

Who needs to file Form 965?

Section 965 requires United States shareholders (as defined under section 951(b)) to pay a transition tax on the untaxed foreign earnings of certain specified foreign corporations as if those earnings had been repatriated to the United States.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my FL CLKCT965 in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign FL CLKCT965 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I send FL CLKCT965 to be eSigned by others?

Once you are ready to share your FL CLKCT965, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit FL CLKCT965 on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share FL CLKCT965 from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is FL CLK/CT.965?

FL CLK/CT.965 is a form used by certain entities in Florida to report their revenue and expenses for state tax purposes.

Who is required to file FL CLK/CT.965?

Entities that engage in specific business activities in Florida or that meet certain financial thresholds are required to file FL CLK/CT.965.

How to fill out FL CLK/CT.965?

To fill out FL CLK/CT.965, taxpayers must provide their basic business information, detail their revenue and expenses, and include any supporting documentation as required.

What is the purpose of FL CLK/CT.965?

The purpose of FL CLK/CT.965 is to collect information necessary for the state to assess taxes and ensure compliance with Florida tax laws.

What information must be reported on FL CLK/CT.965?

FL CLK/CT.965 requires reporting of total revenue, expenses, applicable deductions, and any other pertinent financial data related to the entity's operations.

Fill out your FL CLKCT965 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

FL clkct965 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.