VA DoT 760 2014 free printable template

Show details

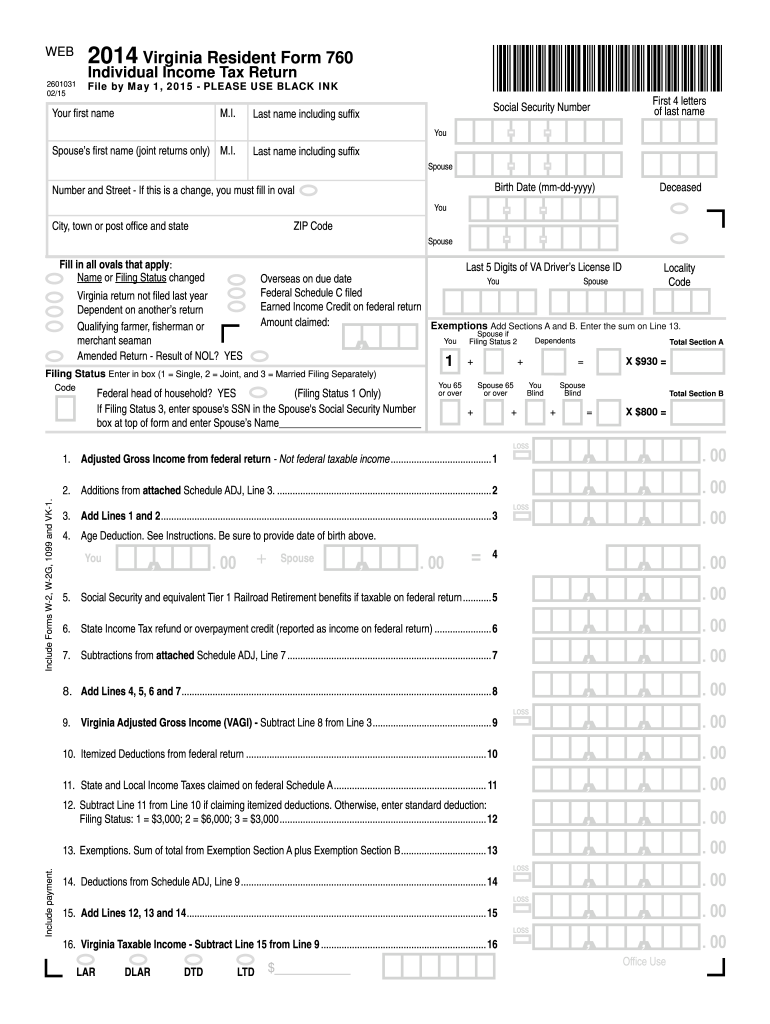

WEB 2014 Virginia Resident Form 760 Individual Income Tax Return 2601031 02/15 File by May 1 2015 - PLEASE USE BLACK INK Your first name M. Deductions from Schedule ADJ Line 9. 14 15. Add Lines 12 13 and 14. 15 16. Virginia Taxable Income - Subtract Line 15 from Line 9. 16 LAR DTD LTD Office Use Page 2 2014 Form 760 Your SSN 17. Amount of Tax from Tax Table or Tax Rate Schedule round to whole dollars. 16 LAR DTD LTD Office Use Page 2 2014 Form 760 Your SSN 17. Amount of Tax from Tax Table...or Tax Rate Schedule round to whole dollars. 17 18. Spouse Tax Adjustment STA. Filing Status 2 only. Enter Spouse s VAGI in box here. 00 18 and STA amount on Line 18. 19. Net Amount of Tax - Subtract Line 18 from Line 17. 19 20b. Spouse s Virginia withholding Filing Status 2 only. I. Last name including suffix Spouse s first name joint returns only M. I. You - Spouse Birth Date mm-dd-yyyy Number and Street - If this is a change you must fill in oval City town or post office and state ZIP Code...Fill in all ovals that apply Name or Filing Status changed Virginia return not filed last year Dependent on another s return Qualifying farmer fisherman or merchant seaman Amended Return - Result of NOL YES First 4 letters of last name Social Security Number Deceased Last 5 Digits of VA Driver s License ID Locality Overseas on due date Code Federal Schedule C filed Earned Income Credit on federal return Amount claimed Exemptions Add Sections A and B. Enter the sum on Line 13. Filing Status 2...Dependents Total Section A X 930 Federal head of household YES box at top of form and enter Spouse s Name You 65 or over LOSS 1. Adjusted Gross Income from federal return - Not federal taxable income. 1 Include Forms W-2 W-2G 1099 and VK-1. 2. Additions from attached Schedule ADJ Line 3. 2 3. Add Lines 1 and 2. 3 X 800 4. Age Deduction* See Instructions. Be sure to provide date of birth above. 6. State Income Tax refund or overpayment credit reported as income on federal return. 6 7....Subtractions from attached Schedule ADJ Line 7. 7 8. Add Lines 4 5 6 and 7. 8 10. Itemized Deductions from federal return. 10 11. State and Local Income Taxes claimed on federal Schedule A. 11 12. Subtract Line 11 from Line 10 if claiming itemized deductions. Otherwise enter standard deduction 13. Exemptions. Sum of total from Exemption Section A plus Exemption Section B. 13 9. Virginia Adjusted Gross Income VAGI - Subtract Line 8 from Line 3. 9 Include payment. Blind 14. Deductions from...Schedule ADJ Line 9. 14 15. Add Lines 12 13 and 14. 15 16. Virginia Taxable Income - Subtract Line 15 from Line 9. 16 LAR DTD LTD Office Use Page 2 2014 Form 760 Your SSN 17. Amount of Tax from Tax Table or Tax Rate Schedule round to whole dollars. 17 18. Spouse Tax Adjustment STA. Filing Status 2 only. Enter Spouse s VAGI in box here. 00 18 and STA amount on Line 18. 19. Net Amount of Tax - Subtract Line 18 from Line 17. 19 20b. Spouse s Virginia withholding Filing Status 2 only. 20b 21....Estimated tax payments for taxable year 2014 from Form 760ES. 21 22. Amount of 2013 overpayment applied toward 2014 estimated tax.

pdfFiller is not affiliated with any government organization

Instructions and Help about VA DoT 760

How to edit VA DoT 760

How to fill out VA DoT 760

Instructions and Help about VA DoT 760

How to edit VA DoT 760

To edit the VA DoT 760 Tax Form, you can use pdfFiller, which provides tools for modifying existing PDF documents. Simply upload your file to pdfFiller, select the areas you want to change, and make the necessary adjustments. This option is particularly useful for correcting or updating information before submission.

How to fill out VA DoT 760

Filling out the VA DoT 760 Tax Form requires you to gather essential information in advance. Start by obtaining your tax identification number and details about income, deductions, and any credits you may be eligible for. You can systematically approach the form by following these steps:

01

Gather personal identification information.

02

List all applicable income sources.

03

Detail deductions and credits relevant to your tax situation.

04

Review the completed form for accuracy.

About VA DoT previous version

What is VA DoT 760?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About VA DoT previous version

What is VA DoT 760?

The VA DoT 760 is a tax form used primarily in the state of Virginia for individual income tax reporting and collection. This form is utilized by residents to report their income and calculate any taxes owed to the state. It may also be used for determining eligibility for various credits and deductions under Virginia tax law.

What is the purpose of this form?

The main purpose of the VA DoT 760 form is to collect income and tax information for individuals residing in Virginia. This form aids the Virginia Department of Taxation in assessing the tax liability for residents, ensuring compliance with state tax laws. It serves as a primary document for reporting income, claiming deductions, and calculating taxes owed.

Who needs the form?

Individuals who reside in Virginia and earn taxable income need to complete the VA DoT 760. This includes full-time residents, part-year residents, and individuals who have Virginia-sourced income. Specific scenarios, such as those claiming tax credits or exemptions, also necessitate the completion of this form.

When am I exempt from filling out this form?

There are certain conditions that may exempt an individual from filing the VA DoT 760. If your income is below the minimum threshold set by the Virginia Department of Taxation, you may not be required to file. Additionally, individuals who are not residents of Virginia or do not have Virginia-source income may also not need to submit the form.

Components of the form

The VA DoT 760 consists of several key components, including sections for personal information, income reporting, deductions, and tax credits. Additionally, the form requires a verification statement which can be affirmed with a signature. Completing all components accurately is essential for compliance and to avoid potential penalties.

What are the penalties for not issuing the form?

Failure to file the VA DoT 760 can lead to significant penalties, including fines and interest on unpaid taxes. The Virginia Department of Taxation typically imposes penalties for late submissions, which can increase the longer the form remains unfiled. It is crucial to submit the form on time to avoid these repercussions.

What information do you need when you file the form?

When filing the VA DoT 760, you will need various pieces of information, including:

01

Your Social Security number or taxpayer identification number.

02

Details about your income from all sources.

03

Documentation supporting your deductions and credits.

This information is essential for accurately completing the form and ensuring compliance with tax laws.

Is the form accompanied by other forms?

The VA DoT 760 may require accompanying forms or schedules, depending on the complexity of your tax situation. For instance, if you are claiming specific deductions, additional documentation may be necessary to substantiate your claims. Always check the instructions provided with the form to ensure you include any required attachments.

Where do I send the form?

After completing the VA DoT 760, you should mail it to the address specified in the instructions provided with the form. Generally, this address varies based on whether you're receiving a refund or alongside payment. Confirming the correct mailing address is crucial for timely processing of your submission.

See what our users say