IRS Instruction 1040 Line 20a & 20b 2014-2025 free printable template

Show details

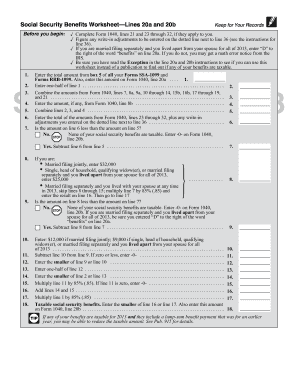

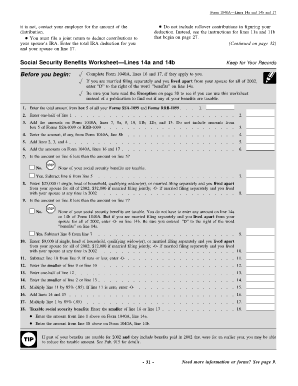

2014 Form 1040 Lines 20a and 20b Social Security Benefits Worksheet Lines 20a and 20b Before you begin: 1. 2. 3. 4. 5. 6. 7. Keep for Your Records Complete Form 1040, lines 21 and 23 through 32, if

pdfFiller is not affiliated with IRS

Instructions and Help about IRS Instruction 1040 Line 20a 20b

How to edit IRS Instruction 1040 Line 20a 20b

How to fill out IRS Instruction 1040 Line 20a 20b

Instructions and Help about IRS Instruction 1040 Line 20a 20b

How to edit IRS Instruction 1040 Line 20a 20b

To edit IRS Instruction 1040 Line 20a 20b, you can use pdfFiller’s editing tools. Start by uploading your document to pdfFiller, where you can make changes as needed. Utilize features like text editing to correct or add information, and save your updates to keep your files organized.

How to fill out IRS Instruction 1040 Line 20a 20b

Follow these steps to fill out IRS Instruction 1040 Line 20a and 20b effectively:

01

Download the IRS 1040 form from the IRS website or access it through pdfFiller.

02

Locate Lines 20a and 20b on the form.

03

Enter the appropriate amounts for each line as guided by your financial records.

04

Double-check your entries for accuracy before submitting.

Latest updates to IRS Instruction 1040 Line 20a 20b

Latest updates to IRS Instruction 1040 Line 20a 20b

The IRS updates tax forms annually, incorporating changes and clarifying instructions. It's important to review the latest version of IRS Instruction 1040 Line 20a 20b to ensure compliance. For the most recent updates, refer to the IRS website or tax guides published by reputable financial institutions.

All You Need to Know About IRS Instruction 1040 Line 20a 20b

What is IRS Instruction 1040 Line 20a 20b?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About IRS Instruction 1040 Line 20a 20b

What is IRS Instruction 1040 Line 20a 20b?

IRS Instruction 1040 Line 20a and 20b refer to sections of the individual income tax return form. These lines are designated for reporting specific income types, such as tax-exempt interest and qualified dividends. Accurate reporting on these lines is critical for determining tax liabilities and compliance with federal regulations.

What is the purpose of this form?

The purpose of IRS Instruction 1040 Line 20a and 20b is to facilitate the reporting of certain income types on your annual tax return. This is crucial for ensuring that taxpayers account for all sources of income, which can affect overall tax obligations. Certain exemptions and credits may apply based on the information provided in these lines.

Who needs the form?

Any U.S. taxpayer who is required to file a federal income tax return using Form 1040 must utilize IRS Instruction 1040 Line 20a and 20b if they have received tax-exempt interest or qualified dividends during the tax year. This applies to individuals, married couples, and families who earn qualifying amounts.

When am I exempt from filling out this form?

You may be exempt from filling out IRS Instruction 1040 Line 20a and 20b if you did not receive any tax-exempt interest or qualified dividends during the tax year. Additionally, if your total income is below the required threshold for filing a tax return, you may not need to fill out these lines.

Components of the form

IRS Instruction 1040 Line 20a consists of reporting tax-exempt interest, while Line 20b deals with qualified dividends. Each line requires specific information, such as the total amount received and the sources of these amounts. Correctly categorizing this information is crucial for tax calculations.

What are the penalties for not issuing the form?

Failure to accurately report income on IRS Instruction 1040 Line 20a and 20b can lead to penalties. The IRS may impose fines and interest on any unpaid taxes resulting from underreported income. Additionally, taxpayers may face audits or increased scrutiny in future filings if discrepancies are noted.

What information do you need when you file the form?

When filing IRS Instruction 1040 Line 20a and 20b, you will need documentation that reflects your tax-exempt interest and qualified dividends. This typically includes forms like 1099-INT for interest income and 1099-DIV for dividends. Keeping these records organized simplifies the reporting process.

Is the form accompanied by other forms?

IRS Instruction 1040 Line 20a and 20b is included as part of Form 1040. Depending on your financial situation, you may also need to accompany Form 1040 with additional schedules or forms, such as Schedule B, which reports interest and ordinary dividends, if necessary.

Where do I send the form?

Once completed, IRS Form 1040, including Instruction 1040 Line 20a and 20b, should be sent to the appropriate IRS office. The mailing address depends on your state and whether you are including a payment. Refer to the IRS instructions for specific mailing addresses based on your circumstances.

See what our users say