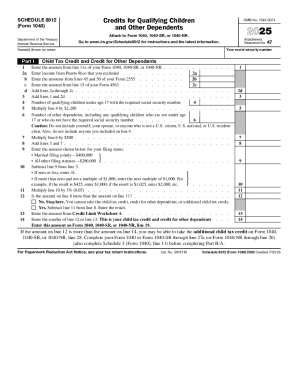

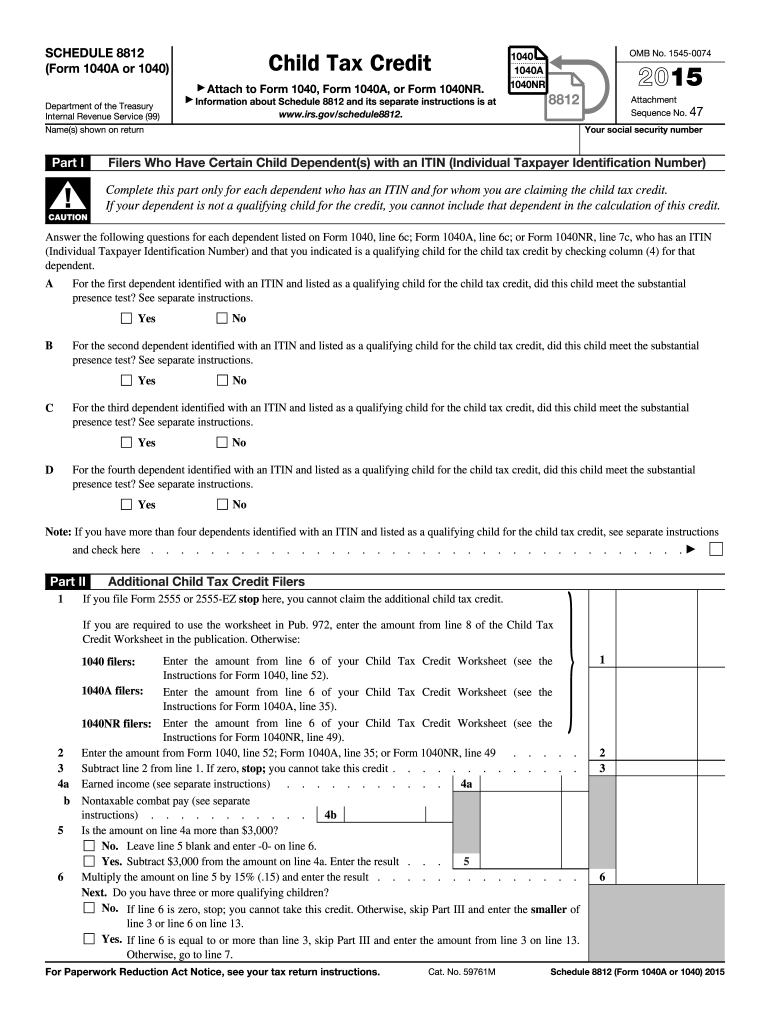

IRS 1040 - Schedule 8812 2015 free printable template

Instructions and Help about IRS 1040 - Schedule 8812

How to edit IRS 1040 - Schedule 8812

How to fill out IRS 1040 - Schedule 8812

About IRS 1040 - Schedule 8 previous version

What is IRS 1040 - Schedule 8812?

Who needs the form?

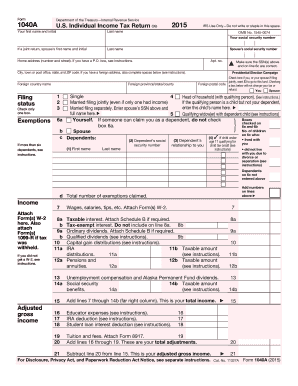

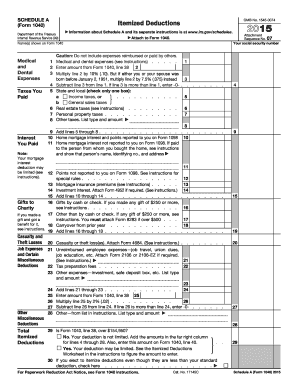

Components of the form

Is the form accompanied by other forms?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

What information do you need when you file the form?

FAQ about IRS 1040 - Schedule 8812

What should I do if I made a mistake on my submitted 2015 8812 form?

If you made an error on your 2015 8812 form, you can submit a corrected version. It's essential to file an amended return using the appropriate process outlined by the IRS. Make sure to explain the changes you are making and provide any necessary documentation to support your correction.

How can I verify if my 2015 8812 form has been received and processed?

To check the status of your submitted 2015 8812 form, you can use the IRS online tool that allows you to verify if your documents have been received. Additionally, you might encounter common e-file rejection codes that will guide you in troubleshooting any issues with your submission.

What should I do if I receive a notice regarding my 2015 8812 form?

In the event you receive a notice or letter related to your 2015 8812 form, it's vital to read it carefully and respond promptly. Gather any required documentation that supports your case and follow the instructions provided. Ensure you communicate timely with the IRS to resolve any issues.

Are there any common errors to avoid when filing the 2015 8812 form?

Yes, common pitfalls when filing the 2015 8812 form can include incorrect taxpayer identification numbers and failing to provide necessary income details. Double-check all entries before submission, and consider using tax preparation software that can help minimize errors and highlight potential issues.

What are the data security measures for submitting the e-filed 2015 8812 form?

When e-filing the 2015 8812 form, it’s crucial to ensure that you are using reputable software that complies with IRS security standards. Look for platforms that encrypt your data and have robust privacy policies to protect your personal information throughout the filing process.

See what our users say