IRS 990 - Schedule O 2015 free printable template

Show details

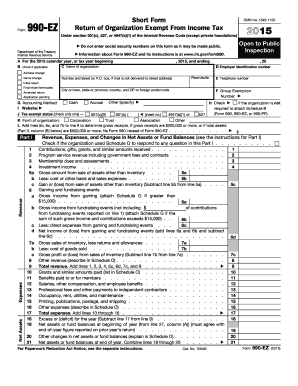

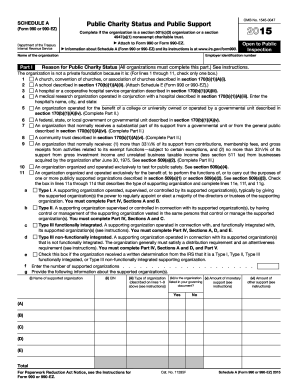

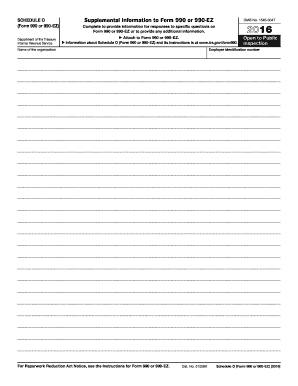

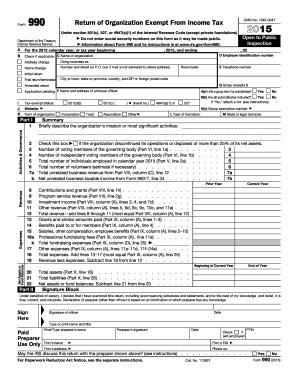

Cat. No. 51056K Schedule O Form 990 or 990-EZ 2015 Page General Instructions Section references are to the Internal Revenue Code unless otherwise noted. Future developments. Supplemental Information to Form 990 or 990-EZ SCHEDULE O Form 990 or 990-EZ Department of the Treasury Internal Revenue Service OMB No* 1545-0047 Complete to provide information for responses to specific questions on Attach to Form 990 or 990-EZ. Information about Schedule O Form 990 or 990-EZ and its instructions is at...www*irs*gov/form990. Open to Public Inspection Employer identification number Name of the organization For Paperwork Reduction Act Notice see the Instructions for Form 990 or 990-EZ. For the latest legislation enacted after the schedule and its instructions were published go to www*irs*gov/form990. Purpose of Schedule An organization should use Schedule O attachments to provide the IRS with narrative information required for responses to specific questions on Form 990 or 990-EZ and to explain...the various questions. It allows organizations to supplement information reported on Do not use Schedule O to supplement responses to questions in other schedules of the Form 990 or 990-EZ. Each of the other schedules includes a separate part for supplemental information* Who Must File certain organizations that file Form 990-EZ must file Schedule O Form 990 or 990-EZ. At a minimum the schedule must be used to answer Form 990 Part VI lines 11b and 19. If an organization is not required to file...it must file a complete return and provide all of the information requested including the required schedules. Specific Instructions attachment to list the name address and EIN of each affiliated organization included in the group return* Do not use this schedule. See the Instructions for Form 990 I. Group Return* for services including the type and amount of each expense included in line 11g if the amount in Part IX line 11g exceeds 10 of the amount in Part IX line 25 total functional expenses....Form 990 Parts III V VI VII IX XI and XII. Use Schedule O Form 990 or 990-EZ to provide any narrative information required for the following questions in the Form 990. 6. Explanation for Part IX Statement of Functional Expenses line 24e all other expenses including the type and amount of each expense included in line 24e if the amount on line 24e exceeds 10 of the amount in Part IX line 25 total functional expenses. 1. Part III Statement of Program Service Accomplishments. a* Yes response to...line 2. c* Other program services on line 4d. 2. Part V Statements Regarding Other IRS Filings and Tax Compliance. a* No response to line 3b. b. Yes or No response to line 13a* 3. Part VI Governance Management and Disclosure. b. Change in committee oversight review from prior year on line 2c* 1. Part I Revenue Expenses and Changes in Net Assets or Fund Balances. 7b. a* Description of other revenue in response to line 8. d. No responses to lines 8a 8b and 10b. b. List of grants and similar...amounts paid in response to line 10.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 990 - Schedule O

How to edit IRS 990 - Schedule O

How to fill out IRS 990 - Schedule O

Instructions and Help about IRS 990 - Schedule O

How to edit IRS 990 - Schedule O

Editing the IRS 990 - Schedule O can be effectively accomplished using forms editing tools like pdfFiller. Follow these steps to edit:

01

Open the IRS 990 - Schedule O document in pdfFiller.

02

Select the text or fields you wish to edit.

03

Make necessary changes directly in the document.

04

Save your changes to ensure all edits are retained.

How to fill out IRS 990 - Schedule O

Filling out the IRS 990 - Schedule O requires careful attention to detail. Start by gathering relevant organizational information, including mission statements and achievements. Follow these steps to complete the form:

01

Enter the organization's legal name and address.

02

Describe the organization’s exempt purpose and mission.

03

Provide details on how the organization achieved its goals during the reporting period.

04

Review for completeness and accuracy before finalizing.

About IRS 990 - Schedule O 2015 previous version

What is IRS 990 - Schedule O?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 990 - Schedule O 2015 previous version

What is IRS 990 - Schedule O?

IRS 990 - Schedule O is an accompanying document required for certain tax-exempt organizations. This form allows organizations to provide narrative explanations to supplement their main Form 990, detailing their mission and activities. It is crucial for demonstrating transparency and accountability to the IRS and the public.

What is the purpose of this form?

The primary purpose of IRS 990 - Schedule O is to provide context to the quantitative data reported in the main Form 990. Organizations use this form to elaborate on the services they provide, highlight accomplishments, and clarify financial statements. This ensures that stakeholders understand the broader impact of the organization’s work.

Who needs the form?

Organizations that are tax-exempt and required to file Form 990 or 990-EZ must also complete IRS 990 - Schedule O. This includes public charities, private foundations, and other nonprofit organizations looking to maintain their tax-exempt status.

When am I exempt from filling out this form?

Organizations are exempt from filling out IRS 990 - Schedule O if they do not meet the income thresholds requiring Form 990 filing, such as small organizations with gross receipts normally below $50,000. Additionally, religious organizations might have different filing requirements.

Components of the form

The IRS 990 - Schedule O consists of various sections that capture qualitative information about the organization. Components typically include the organization’s mission statement, significant activities over the past year, and any changes in management or structure. This supplementary information is critical for clarity and transparency.

What are the penalties for not issuing the form?

Failure to submit IRS 990 - Schedule O when required can lead to penalties, including fines from the IRS. Specifically, organizations may face a daily penalty for each day the form is late, potentially impacting their tax-exempt status if continued non-compliance occurs.

What information do you need when you file the form?

To file IRS 990 - Schedule O, organizations should gather detailed financial statements, narratives about their mission and effectiveness, and records of significant activities. Having accurate and up-to-date records will enable organizations to provide a comprehensive view of their operations and impact.

Is the form accompanied by other forms?

IRS 990 - Schedule O generally accompanies the main Form 990 or Form 990-EZ. Depending on the organization’s specific activities and structure, additional schedules may also be required, such as Schedule A for public charities or Schedule B for significant contributors.

Where do I send the form?

The completed IRS 990 - Schedule O should be submitted to the IRS along with the primary Form 990 or Form 990-EZ. Organizations must follow the IRS guidelines for submission methods, which could include electronic filing or mailing a paper form to the appropriate address based on the organization’s location.

See what our users say