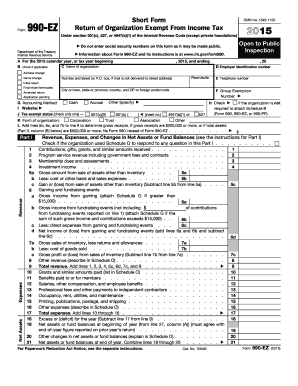

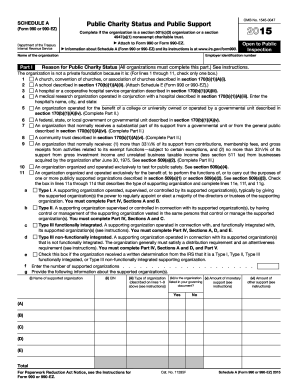

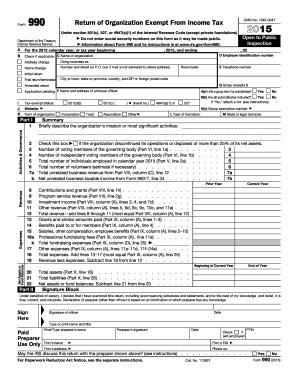

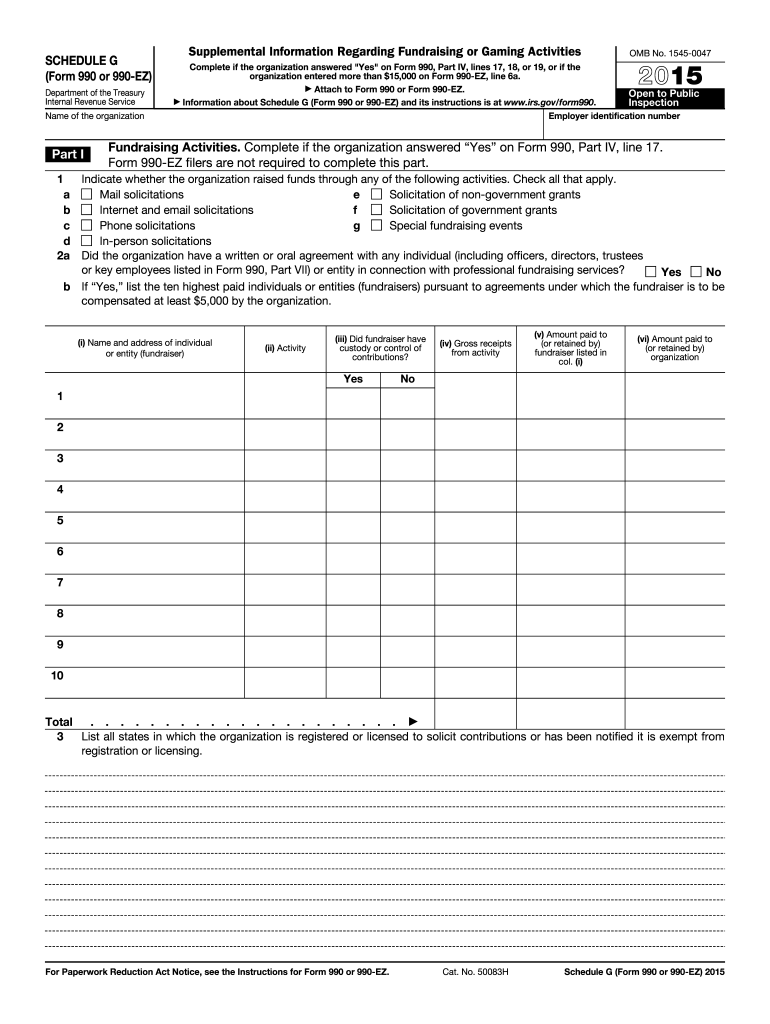

IRS 990 - Schedule G 2015 free printable template

Instructions and Help about IRS 990 - Schedule G

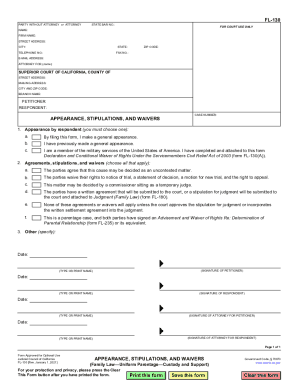

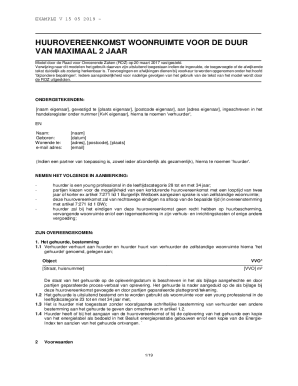

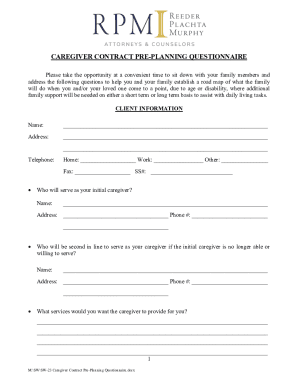

How to edit IRS 990 - Schedule G

How to fill out IRS 990 - Schedule G

About IRS 990 - Schedule G 2015 previous version

What is IRS 990 - Schedule G?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 990 - Schedule G

What should I do if I realize I made a mistake on my 2015 schedule g form after submission?

If you identify a mistake on your submitted 2015 schedule g form, you need to amend it by submitting a corrected form. Ensure that your corrections are clearly indicated and include any additional information required. Follow the procedures outlined by the IRS to ensure your amendment is processed correctly.

How can I check the status of my 2015 schedule g form submission?

To check the status of your 2015 schedule g form submission, you can visit the IRS's online tools or contact their support line for assistance. Keep your submission details on hand to facilitate the process. This can help you verify if your form has been received and is being processed.

What should I consider regarding record retention after filing the 2015 schedule g form?

After submitting the 2015 schedule g form, it is important to retain copies of your filed form and any supporting documentation for a minimum of three years. This period allows for the potential audit or review by the IRS. Ensure that your records are secure and easily accessible.

Are there special considerations for filing the 2015 schedule g form on behalf of someone else?

If you are filing the 2015 schedule g form on behalf of another individual, make sure you have the appropriate authorization, such as power of attorney (POA). This ensures compliance with IRS rules and protects both parties involved. Include the necessary documentation when submitting the form.

What common errors should I be aware of when completing the 2015 schedule g form?

Common errors when filling out the 2015 schedule g form include incorrect identification numbers, misreporting payment amounts, and failing to include all relevant information. To avoid these mistakes, double-check your entries against documentation and ensure you understand the form's requirements before submission.

See what our users say