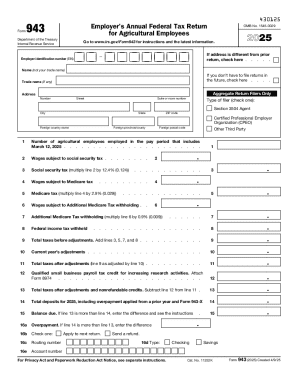

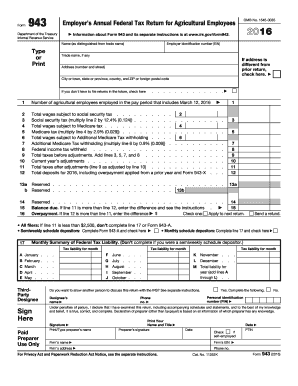

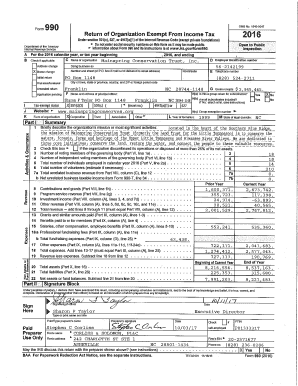

IRS 943 2015 free printable template

Instructions and Help about IRS 943

How to edit IRS 943

How to fill out IRS 943

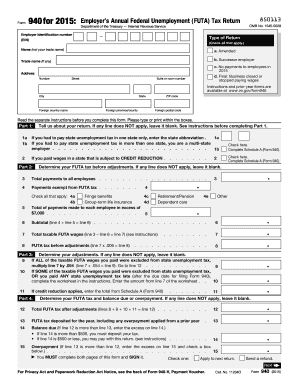

About IRS previous version

What is IRS 943?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

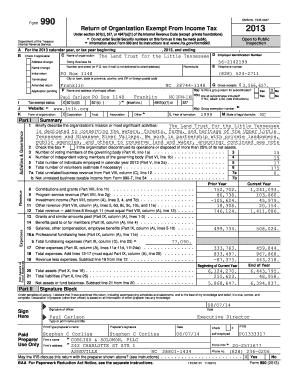

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 943

What should I do if I realize I made a mistake on my submitted 943 form 2015?

If you discover an error after filing your 943 form 2015, you should file an amended form to correct the mistakes. This involves using the appropriate process outlined by the IRS for corrections, which ensures your changes are officially recognized. Be sure to clearly indicate that the form is amended to avoid confusion.

How can I check the status of my submitted 943 form 2015?

To verify the status of your 943 form 2015 submission, you can utilize the IRS's e-file tracking tools or contact their helpline. Common reasons for rejection include discrepancies in data or missing information. Familiarizing yourself with e-file rejection codes can help you quickly resolve issues if your submission is not accepted.

What do I need to know about submitting the 943 form 2015 for nonresident payees?

Filing a 943 form 2015 for nonresident foreign payees requires special consideration regarding tax withholding rates and reporting obligations. You should ensure that proper documentation and tax treaties are taken into account to avoid unnecessary penalties or errors in your filing.

How long do I need to keep records related to the 943 form 2015?

You should retain all records pertaining to the 943 form 2015 for at least four years from the date of filing. This retention period applies to any supporting documents, calculations, or correspondence that relate to your submitted form. Proper record-keeping ensures compliance and aids in responding to any future inquiries or audits from the IRS.

Are there specific fees associated with electronically filing the 943 form 2015?

There may be service fees associated with e-filing your 943 form 2015, depending on the software or tax service you choose to use. It's essential to review these fees beforehand, as they can vary widely. Additionally, if your submission is rejected, you should inquire whether the service offers refunds or credits for the service fees paid.

See what our users say