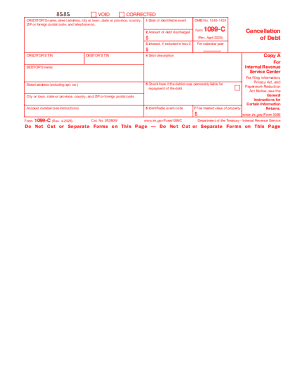

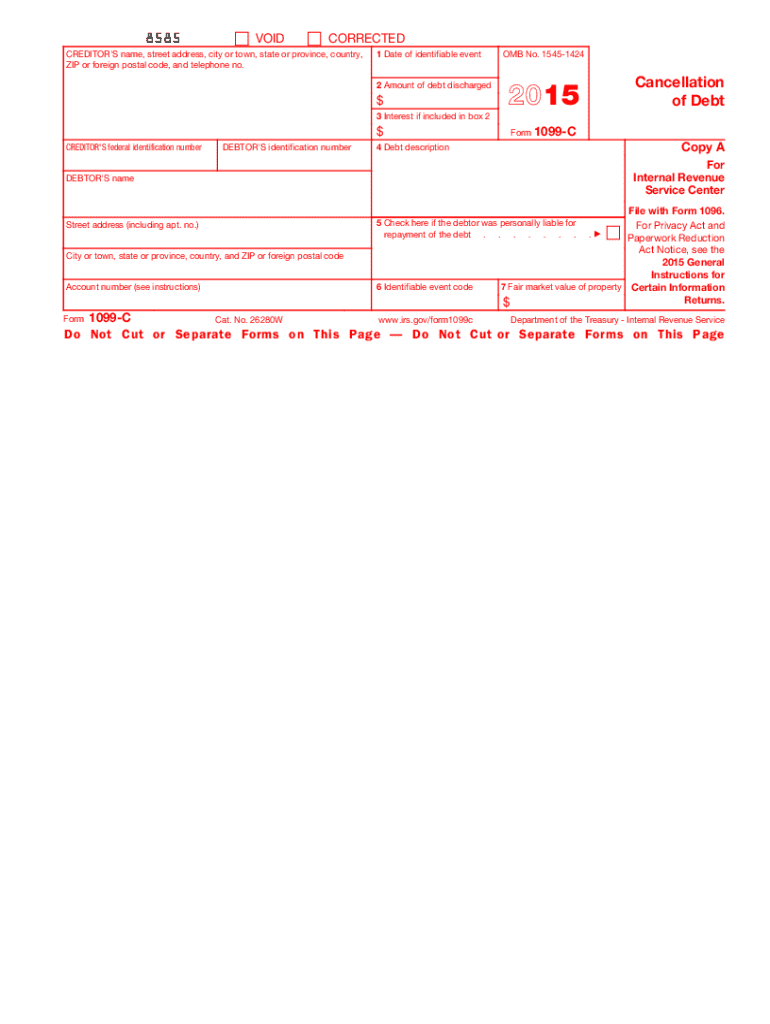

IRS 1099-C 2015 free printable template

Instructions and Help about IRS 1099-C

How to edit IRS 1099-C

How to fill out IRS 1099-C

About IRS 1099-C previous version

What is IRS 1099-C?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1099-C

What should I do if I need to correct an error on my 2015 1099 C form?

If you discover an error on your 2015 1099 C form after submission, it's essential to file a corrected form with the IRS. You should indicate that the form is a correction and provide the correct information. Always keep a copy of both the original and corrected forms for your records, as these may be needed for verification or audits.

How can I verify if my 2015 1099 C form has been received and processed by the IRS?

To check the status of your 2015 1099 C form, you can contact the IRS directly. Have your submission details handy. If you filed electronically, you may also receive confirmation through the e-filing service. Be aware of common rejection codes to troubleshoot potential issues that may arise.

What should I consider regarding privacy and data security when filing my 2015 1099 C form?

When filing your 2015 1099 C form, ensure that you utilize secure methods for submission, especially if filing electronically. It's crucial to safeguard sensitive information, as unauthorized access can lead to identity theft. Retain the form in a secure location for the applicable retention period to further protect your data.

Are there specific considerations for filing a 2015 1099 C form for a foreign payee?

Filing a 2015 1099 C form for a foreign payee may involve additional complexities, such as compliance with IRS regulations on foreign income. Ensure that you have the correct tax identification for the foreign payee and check if any tax treaties might affect their liability. Consulting a tax professional is advisable in these scenarios.

What common errors should I be aware of when submitting my 2015 1099 C form?

Common errors to watch for when submitting the 2015 1099 C form include incorrect taxpayer identification numbers and overstating or understating the amount cancelled. Double-check all data entries for accuracy. Implementing a checklist can help ensure that all information is entered correctly before filing.

See what our users say