Get the free RJK Trust - in

Show details

INDIANA BOARD OF TAX REVIEW Small Claims Final Determination Findings and Conclusions Petition No.: Petitioner: Respondent: Parcel No.: Assessment Year: 46023061500117 RJ Trust Lahore County Assessor

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rjk trust - in

Edit your rjk trust - in form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rjk trust - in form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing rjk trust - in online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit rjk trust - in. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rjk trust - in

01

To fill out the rjk trust - in, you will need the necessary forms and documents. These typically include the trust agreement, identification documents, and any assets or properties that are being transferred into the trust.

02

Start by carefully reviewing the trust agreement. This document outlines the rules and guidelines for the trust and provides instructions for filling out the necessary paperwork.

03

Gather all relevant identification documents for both the settlor (the person creating the trust) and the beneficiaries. This may include passports, driver's licenses, or social security cards.

04

If any assets or properties are being transferred into the trust, gather the necessary documents to prove ownership. This may include property deeds, vehicle titles, or financial statements.

05

Complete the necessary paperwork as outlined in the trust agreement. This typically involves providing personal information, such as names, addresses, and social security numbers, along with details about the assets being transferred.

06

Carefully review the completed paperwork to ensure accuracy and completeness. Mistakes or missing information could lead to complications in the future.

07

Once the paperwork is complete, sign the necessary documents in the presence of a notary public or other authorized witness. This helps to ensure the legality and authenticity of the trust.

08

Keep copies of all completed documents for your records. These may be needed in the future for reference or if any legal issues arise.

Who needs rjk trust - in?

01

Individuals who have significant assets or properties that they wish to protect or pass on to beneficiaries may need a rjk trust - in. By utilizing a trust, individuals can ensure that their assets are managed and distributed according to their specific wishes.

02

Business owners or professionals who face higher liability risks may also benefit from a rjk trust - in. This type of trust can provide added protection for personal assets in the event of legal action or creditor claims.

03

Families who wish to avoid probate or maintain privacy in their estate transfers may find a rjk trust - in beneficial. By placing assets in a trust, individuals can avoid the time-consuming and public process of probate, allowing for a quicker and more private transfer of wealth to their chosen beneficiaries.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit rjk trust - in from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your rjk trust - in into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I make changes in rjk trust - in?

The editing procedure is simple with pdfFiller. Open your rjk trust - in in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I edit rjk trust - in in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing rjk trust - in and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

What is rjk trust - in?

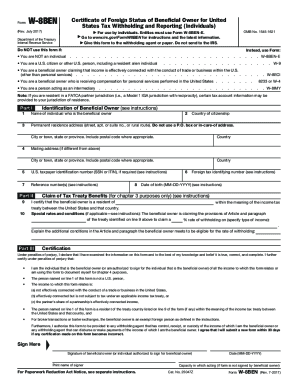

RJK Trust - In is a type of tax form that must be filed by certain individuals or entities.

Who is required to file rjk trust - in?

Certain individuals or entities who have a trust fund are required to file RJK Trust - In.

How to fill out rjk trust - in?

RJK Trust - In can be filled out by providing information about the trust fund, income generated, and other relevant details.

What is the purpose of rjk trust - in?

The purpose of RJK Trust - In is to report income generated from trust funds and ensure compliance with tax regulations.

What information must be reported on rjk trust - in?

Information such as income generated from trust funds, expenses related to the trust, and any capital gains must be reported on RJK Trust - In.

Fill out your rjk trust - in online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rjk Trust - In is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.