CT DRS CT-1120DA 2015 free printable template

Show details

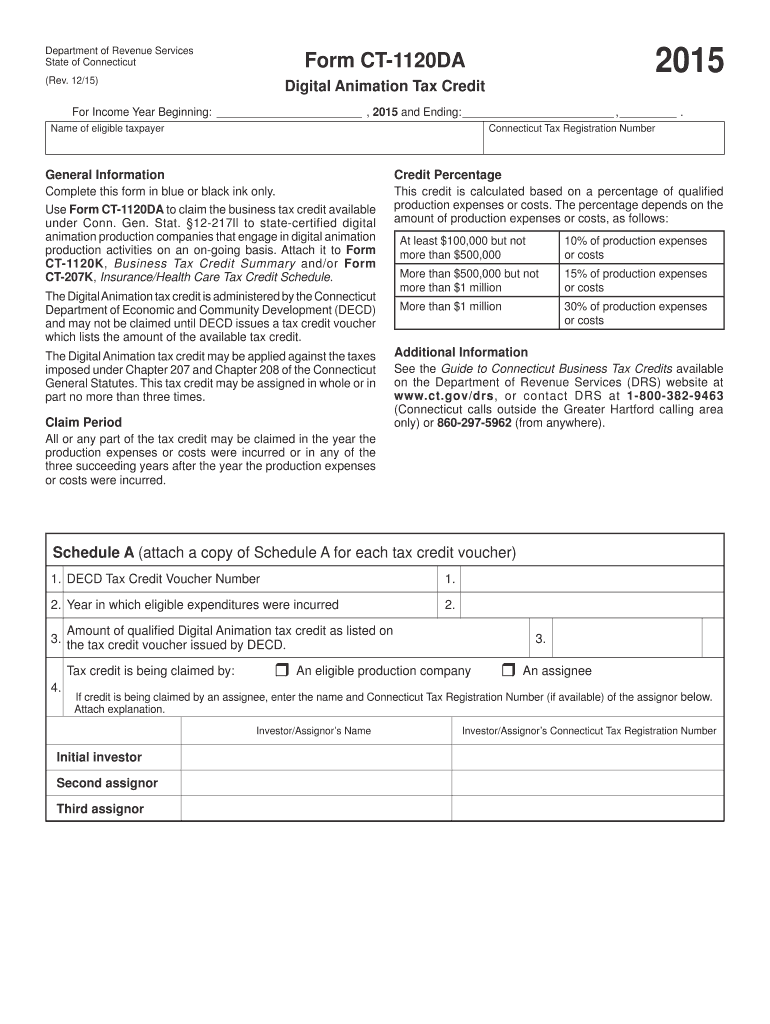

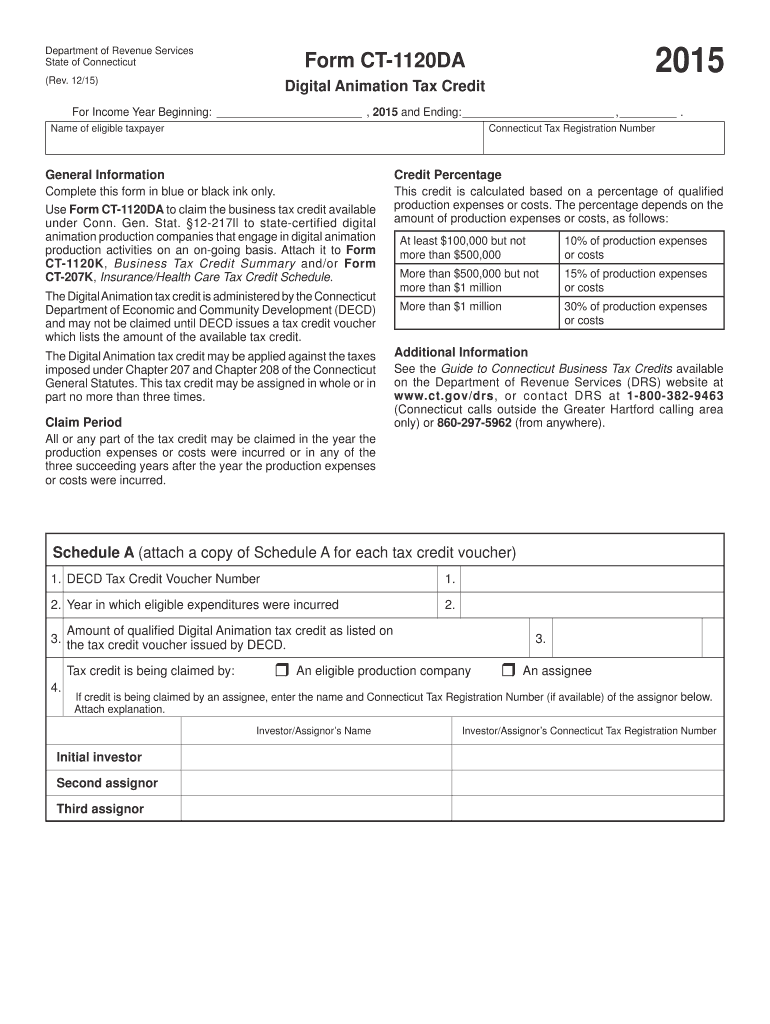

Department of Revenue Services State of Connecticut 2015 Form CT-1120DA (Rev. 12/15) Digital Animation Tax Credit For Income Year Beginning:, 2015 and Ending:, Name of eligible taxpayer Connecticut

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CT DRS CT-1120DA

Edit your CT DRS CT-1120DA form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CT DRS CT-1120DA form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CT DRS CT-1120DA online

Follow the steps below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit CT DRS CT-1120DA. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT DRS CT-1120DA Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CT DRS CT-1120DA

How to fill out CT DRS CT-1120DA

01

Obtain the CT DRS CT-1120DA form from the Connecticut Department of Revenue Services website.

02

Enter your business name and address at the top of the form.

03

Provide your federal employer identification number (FEIN) in the designated section.

04

Fill out the income details, including gross receipts and any adjustments.

05

Complete the tax calculation section, ensuring to input any credits or deductions applicable to your business.

06

Review the instructions on the form to ensure all required information is included.

07

Sign and date the form at the bottom.

Who needs CT DRS CT-1120DA?

01

Businesses operating in Connecticut that need to report income and claim tax credits or deductions for the business taxes.

Fill

form

: Try Risk Free

People Also Ask about

What is the format of tin in Mauritius?

For individuals: The TAN consists of 8 numerals (format: 99999999). The first digit of the TAN is always 1, 5, 7or 8. For entities: The TAN consists of 8 numerals (format 99999999). ). The first digit of the TAN is always 2 or 3.

Who should file tax return in Mauritius?

An individual who is in receipt of emoluments, pension or deriving income from trade, business, profession, agriculture, rents and other sources should fill in a return of income if he: is registered at the MRA ,i.e has been allocated a Tax Account Number. derives a chargeable income whether he is registered or not.

Who is the tax authority in Mauritius?

The MRA is responsible for the assessment of liability, the collection and the accountability for Tax and the management, operation and enforcement of Revenue Laws.Mauritius Revenue Authority. Agency overviewJurisdictionGovernment of MauritiusHeadquartersPort Louis, MauritiusAgency executiveSudhamo Lal, Director General3 more rows

Does Mauritius run a self assessment tax system?

Mauritius runs a self-assessment taxation system. Residents of Mauritius are taxed on worldwide income, except those whose foreign source income is not remitted to Mauritius.

Does Mauritius tax foreign income?

Foreign income means income derived from outside Mauritius. It shall include emoluments, directors' fees, annuity, and pension in respect of past services, business income, rental income, investment income and interest income. The foreign income is taxable in the hand of the resident.

How do I file taxes in Mauritius?

MRA e-Services is a secured online platform offering taxpayers the facility to file tax returns electronically. The taxpayer may effect electronic payment through Direct Debit or online credit card. You are required to use your User ID and password to file your return. User ID is either your TAN or NID/NCID.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute CT DRS CT-1120DA online?

pdfFiller has made filling out and eSigning CT DRS CT-1120DA easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an electronic signature for the CT DRS CT-1120DA in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your CT DRS CT-1120DA in seconds.

How do I fill out CT DRS CT-1120DA using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign CT DRS CT-1120DA and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is CT DRS CT-1120DA?

CT DRS CT-1120DA is a form used for reporting the Corporation Business Tax in the state of Connecticut. It is specifically designed for companies that qualify for the business tax exemption and allows them to report their income and pay taxes accordingly.

Who is required to file CT DRS CT-1120DA?

Corporations that have gross income that does not exceed a certain threshold or those that qualify for specific exemptions are required to file CT DRS CT-1120DA.

How to fill out CT DRS CT-1120DA?

To fill out CT DRS CT-1120DA, taxpayers need to provide basic information about their corporation, report their income and deductions, and calculate any credits or exemptions they are eligible for. It's important to follow the instructions provided with the form carefully.

What is the purpose of CT DRS CT-1120DA?

The purpose of CT DRS CT-1120DA is to facilitate the reporting and payment of the Corporation Business Tax for qualifying entities and to determine their eligibility for any tax exemptions.

What information must be reported on CT DRS CT-1120DA?

CT DRS CT-1120DA requires the reporting of basic corporate information, total revenues, allowable deductions, any applicable tax credits, and details regarding the corporation's tax exemption status.

Fill out your CT DRS CT-1120DA online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CT DRS CT-1120da is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.