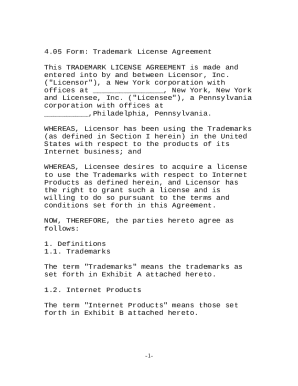

CT DRS CT-1120DA 2022 free printable template

Show details

Department of Revenue Services

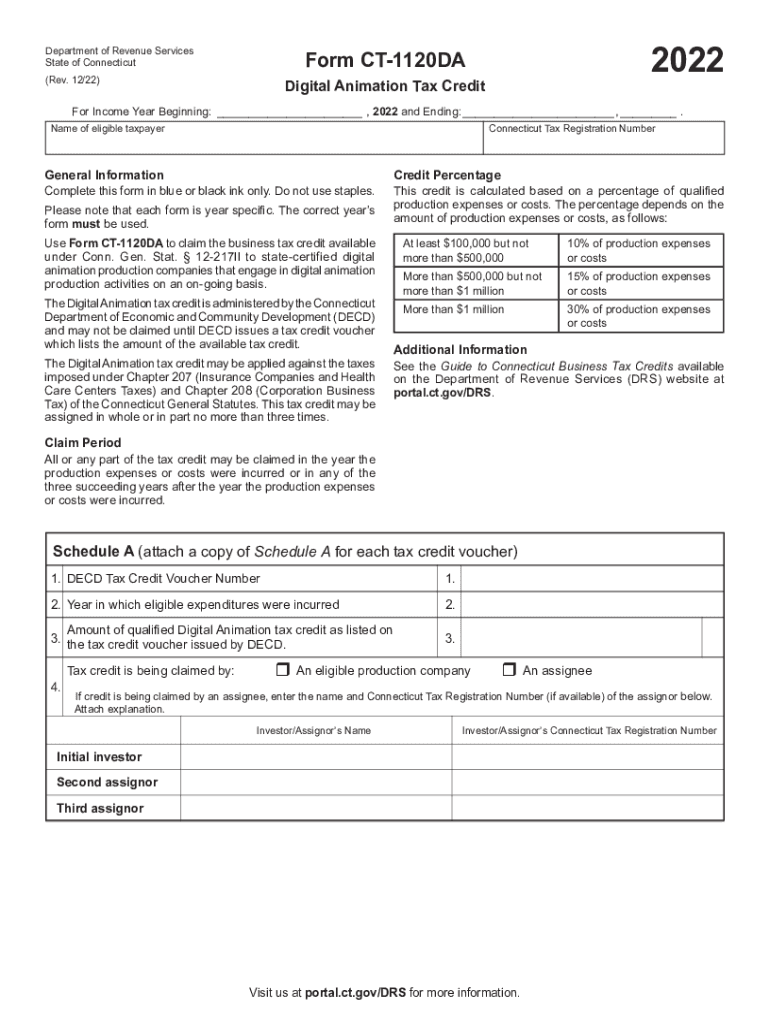

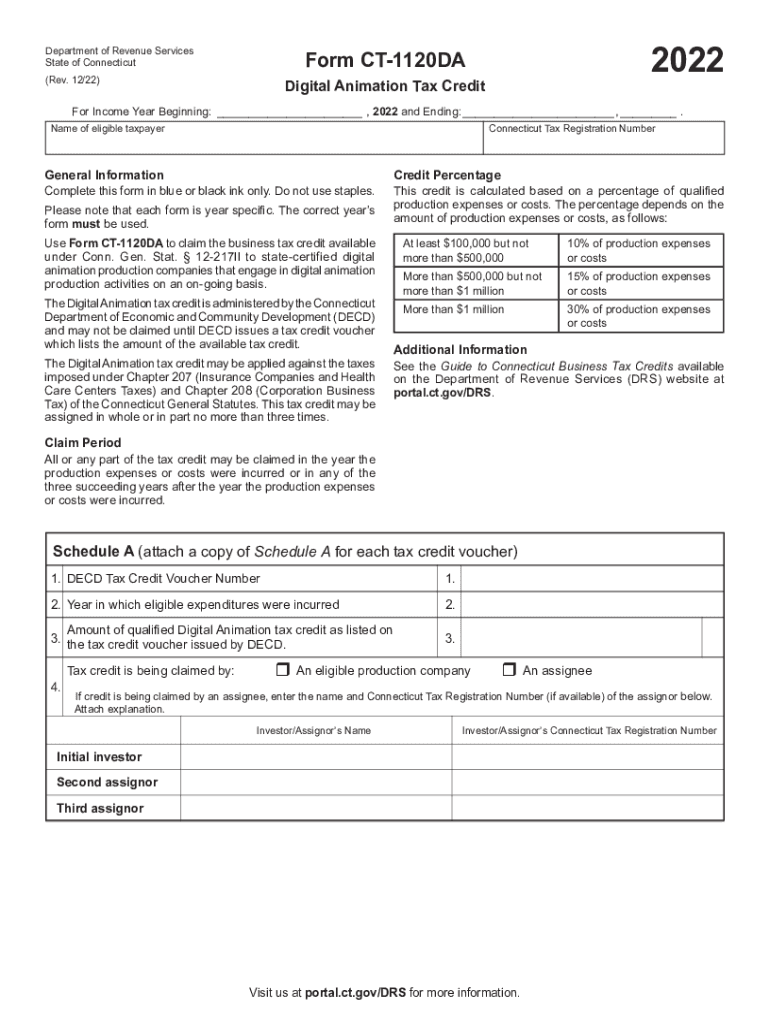

State of Connecticut2022Form CT1120DA(Rev. 12/22)Digital Animation Tax Creditor Income Year Beginning:___, 2022 and Ending:___, ___.

Name of eligible taxpayer Connecticut

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CT DRS CT-1120DA

Edit your CT DRS CT-1120DA form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CT DRS CT-1120DA form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CT DRS CT-1120DA online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit CT DRS CT-1120DA. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT DRS CT-1120DA Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CT DRS CT-1120DA

How to fill out CT DRS CT-1120DA

01

Download the CT DRS CT-1120DA form from the Connecticut Department of Revenue Services website.

02

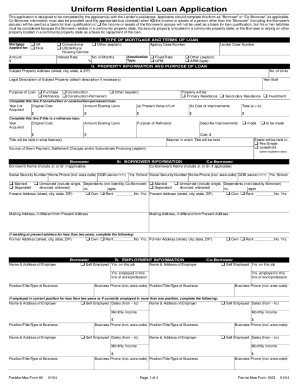

Fill in your business name, address, and federal employer identification number (EIN) at the top of the form.

03

Indicate the taxable year for which you are filing the form.

04

Complete the section detailing your income and deductions as per the instructions provided on the form.

05

Calculate your tax liability based on the provided tax tables.

06

Review the form for accuracy and completeness to ensure all required fields are filled.

07

Sign and date the form where indicated.

08

Submit the form by mail or electronically, as specified in the filing instructions.

Who needs CT DRS CT-1120DA?

01

Businesses operating in Connecticut that are required to report and pay taxes on their business income.

02

Corporations that meet the criteria for filing the CT-1120DA, including those with a business presence in Connecticut.

Fill

form

: Try Risk Free

People Also Ask about

What is the format of tin in Mauritius?

For individuals: The TAN consists of 8 numerals (format: 99999999). The first digit of the TAN is always 1, 5, 7or 8. For entities: The TAN consists of 8 numerals (format 99999999). ). The first digit of the TAN is always 2 or 3.

Who should file tax return in Mauritius?

An individual who is in receipt of emoluments, pension or deriving income from trade, business, profession, agriculture, rents and other sources should fill in a return of income if he: is registered at the MRA ,i.e has been allocated a Tax Account Number. derives a chargeable income whether he is registered or not.

Who is the tax authority in Mauritius?

The MRA is responsible for the assessment of liability, the collection and the accountability for Tax and the management, operation and enforcement of Revenue Laws.Mauritius Revenue Authority. Agency overviewJurisdictionGovernment of MauritiusHeadquartersPort Louis, MauritiusAgency executiveSudhamo Lal, Director General3 more rows

Does Mauritius run a self assessment tax system?

Mauritius runs a self-assessment taxation system. Residents of Mauritius are taxed on worldwide income, except those whose foreign source income is not remitted to Mauritius.

Does Mauritius tax foreign income?

Foreign income means income derived from outside Mauritius. It shall include emoluments, directors' fees, annuity, and pension in respect of past services, business income, rental income, investment income and interest income. The foreign income is taxable in the hand of the resident.

How do I file taxes in Mauritius?

MRA e-Services is a secured online platform offering taxpayers the facility to file tax returns electronically. The taxpayer may effect electronic payment through Direct Debit or online credit card. You are required to use your User ID and password to file your return. User ID is either your TAN or NID/NCID.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit CT DRS CT-1120DA from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your CT DRS CT-1120DA into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I make edits in CT DRS CT-1120DA without leaving Chrome?

CT DRS CT-1120DA can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I complete CT DRS CT-1120DA on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your CT DRS CT-1120DA. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is CT DRS CT-1120DA?

CT DRS CT-1120DA is a form used by corporations in Connecticut to report their income and calculate their tax liability in accordance with state tax laws.

Who is required to file CT DRS CT-1120DA?

Corporations that are doing business in Connecticut or have a tax obligation in the state are required to file CT DRS CT-1120DA.

How to fill out CT DRS CT-1120DA?

To fill out CT DRS CT-1120DA, corporations need to provide their identification information, income details, deductions, and other relevant financial data as outlined in the form instructions.

What is the purpose of CT DRS CT-1120DA?

The purpose of CT DRS CT-1120DA is to report a corporation's income to the Connecticut Department of Revenue Services and to determine the amount of state corporate income tax owed.

What information must be reported on CT DRS CT-1120DA?

The information that must be reported on CT DRS CT-1120DA includes the corporation's gross income, deductions, taxable income, credits claimed, and other relevant financial details.

Fill out your CT DRS CT-1120DA online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CT DRS CT-1120da is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.