CT DRS CT-1041 2015 free printable template

Show details

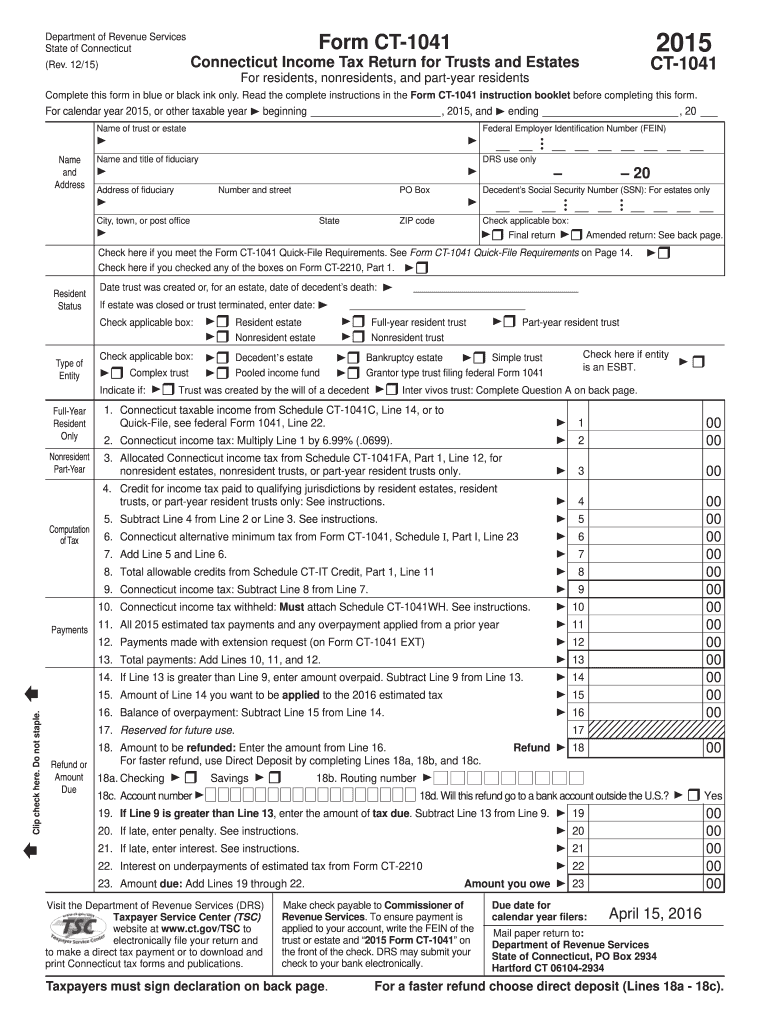

All 2015 estimated tax payments and any overpayment applied from a prior year 12. Payments made with extension request on Form CT-1041 EXT 13. Amount you owe 23 Make check payable to Commissioner of Revenue Services. To ensure payment is applied to your account write the FEIN of the trust or estate and 2015 Form CT-1041 on the front of the check. Read the complete instructions in the Form CT-1041 instruction booklet before completing this form. For calendar year 2015 or other taxable year ...beginning 2015 and ending 20 Name and Address Name of trust or estate Name and title of fiduciary Address of fiduciary Number and street City town or post office PO Box State ZIP code Federal Employer Identification Number FEIN DRS use only Decedent s Social Security Number SSN For estates only Check applicable box Final return Amended return See back page. Department of Revenue Services State of Connecticut Form CT-1041 Connecticut Income Tax Return for Trusts and Estates Rev* 12/15...CT-1041 For residents nonresidents and part-year residents Complete this form in blue or black ink only. Check here if you meet the Form CT-1041 Quick-File Requirements. See Form CT-1041 Quick-File Requirements on Page 14. Resident Status Date trust was created or for an estate date of decedent s death If estate was closed or trust terminated enter date Type of Entity Full-Year Only Nonresident Part-Year Computation of Tax Resident estate Clip check here. Do not staple. 1. Connecticut taxable...income from Schedule CT-1041C Line 14 or to Quick-File see federal Form 1041 Line 22. 2. Connecticut income tax Multiply Line 1 by 6. 99. 0699. 3. Allocated Connecticut income tax from Schedule CT-1041FA Part 1 Line 12 for nonresident estates nonresident trusts or part-year resident trusts only. 4. Credit for income tax paid to qualifying jurisdictions by resident estates resident trusts or part-year resident trusts only See instructions. 5. Subtract Line 4 from Line 2 or Line 3. See...instructions. 7. Add Line 5 and Line 6. 8. Total allowable credits from Schedule CT-IT Credit Part 1 Line 11 Payments 11. Total payments Add Lines 10 11 and 12. 14. If Line 13 is greater than Line 9 enter amount overpaid* Subtract Line 9 from Line 13. 15. Amount of Line 14 you want to be applied to the 2016 estimated tax 16. Balance of overpayment Subtract Line 15 from Line 14. 17. Reserved for future use. Refund or Amount Due Part-year resident trust Full-year resident trust trust Check here...if entity Decedent s estate Bankruptcy estate Simple trust is an ESBT. Complex trust Pooled income fund Grantor type trust filing federal Form 1041 Indicate if Trust was created by the will of a decedent Inter vivos trust Complete Question A on back page. 18. Amount to be refunded Enter the amount from Line 16. For faster refund use Direct Deposit by completing Lines 18a 18b and 18c* 18a* Checking Savings Refund 18 18b. Routing number 18c* Account number 18d. Will this refund go to a...bank account outside the U*S* Yes 19.

pdfFiller is not affiliated with any government organization

Instructions and Help about CT DRS CT-1041

How to edit CT DRS CT-1041

How to fill out CT DRS CT-1041

Instructions and Help about CT DRS CT-1041

How to edit CT DRS CT-1041

To edit the CT DRS CT-1041 form, download it from an authorized source or access it through pdfFiller. Utilize the editing features available in pdfFiller to make necessary changes. Ensure that all information is accurate and reflective of your tax situation before saving the updated form.

How to fill out CT DRS CT-1041

To fill out the CT DRS CT-1041 form, begin at the top by entering your identification details, including your name and tax identification number. Next, proceed to complete the financial sections by providing accurate income and deduction figures. Review your entries to confirm all information is correct and applicable, and then proceed to sign at the designated area.

About CT DRS CT- previous version

What is CT DRS CT-1041?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About CT DRS CT- previous version

What is CT DRS CT-1041?

CT DRS CT-1041 is the Connecticut Department of Revenue Services (DRS) form used for reporting income earned by estates and trusts. This form captures the income, deductions, and taxes owed by the estate or trust for the tax year.

What is the purpose of this form?

The purpose of the CT DRS CT-1041 is to ensure proper tax compliance for estates and trusts in Connecticut. By accurately reporting income and expenses, the fiduciary can determine the tax liability and make appropriate payments to the state.

Who needs the form?

The form is required for any estate or trust that earns income during the fiscal year and is subject to Connecticut income tax. Additionally, trustees or executors responsible for managing the financial affairs of the estate or trust must complete and file this form on behalf of the beneficiaries.

When am I exempt from filling out this form?

You are exempt from filling out the CT DRS CT-1041 form if the estate or trust does not have reportable income. Additionally, if the estate has been settled, or the trust is wholly distributed without generating income, filing the form may not be necessary.

Components of the form

The CT DRS CT-1041 consists of several sections including taxpayer identification information, income types, deductions, and a tax computation section. Each section requires precise details to ensure accurate tax reporting, including the type of income received and any expenses incurred during the year.

Due date

The CT DRS CT-1041 must be filed by the 15th day of the fourth month following the end of the tax year. For estates operating on a calendar year, this means the due date is April 15. Extensions may be granted under certain circumstances, but the tax payment portion must still be timely submitted.

What payments and purchases are reported?

Payments reported on the CT DRS CT-1041 include all avoidable income received by the estate or trust, such as interest, dividends, and rental income. Furthermore, the form details any deductible expenses incurred during the management of the estate or trust.

How many copies of the form should I complete?

Typically, you need to complete one copy of the CT DRS CT-1041 for filing with the Connecticut DRS and retain copies for your records. However, if the estate or trust has multiple beneficiaries, it may be prudent to provide each a copy of their portion for accounting purposes.

What are the penalties for not issuing the form?

Failing to issue the CT DRS CT-1041 can result in significant penalties, including a fine based on the amount of tax owed. Additional interest may accrue over time, complicating the tax situation for the fiduciary responsible for filing.

What information do you need when you file the form?

When filing the CT DRS CT-1041, gather essential information including records of income received during the tax year, detailed accounts of deductions, the estate's or trust's tax identification number, and details concerning the fiduciary managing the estate or trust.

Is the form accompanied by other forms?

The CT DRS CT-1041 may need to be accompanied by various schedules and supporting documents depending on the complexity of the estate or trust. These may include forms detailing specific income types, deductions claimed, and other related tax documentation.

Where do I send the form?

The completed CT DRS CT-1041 should be sent to the Connecticut Department of Revenue Services. Ensure the mailing address is correct and adheres to the most current guidance received from the DRS.

See what our users say