IRS 940 - Schedule A 2015 free printable template

Show details

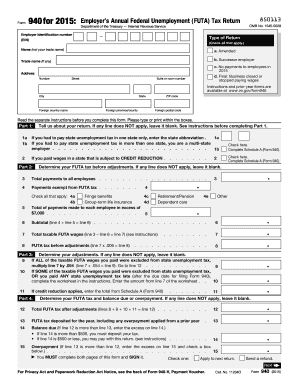

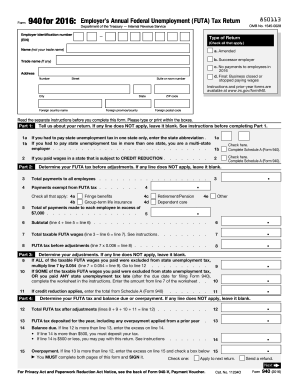

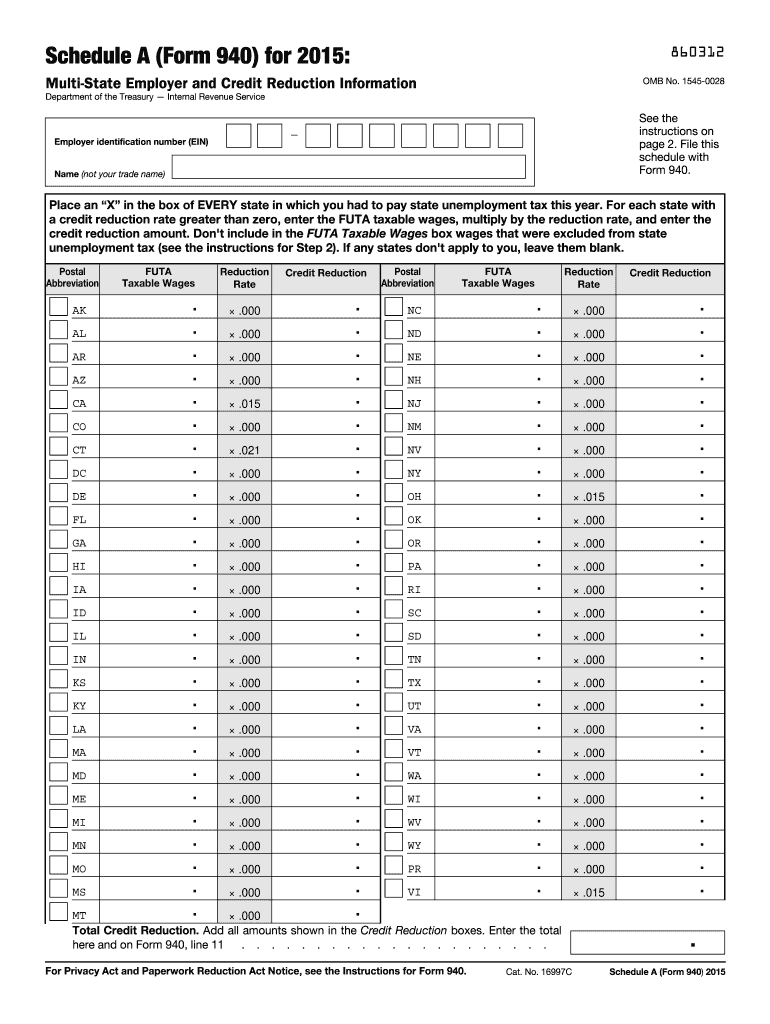

Schedule A Form 940 for 2015 860312 Multi-State Employer and Credit Reduction Information OMB No. 1545-0028 Department of the Treasury Internal Revenue Service See the instructions on page 2. File this schedule with Form 940. Employer identification number EIN Name not your trade name Place an X in the box of EVERY state in which you had to pay state unemployment tax this year. For each state with a credit reduction rate greater than zero enter the FUTA taxable wages multiply by the reduction...rate and enter the unemployment tax see the instructions for Step 2. If any states don t apply to you leave them blank. Postal Abbreviation AK AL AR AZ CA CO CT DC DE FL GA HI IA ID IL IN KS KY LA MA MD ME MI MN MO MS FUTA Taxable Wages. Reduction Rate Credit Reduction NC ND NE NH NJ NM NV NY OH OK OR PA RI SC SD TN TX UT VA VT WA WI WV WY PR VI MT Total Credit Reduction* Add all amounts shown in the Credit Reduction boxes. Enter the total here and on Form 940 line 11. For Privacy Act and...Paperwork Reduction Act Notice see the Instructions for Form 940. Cat* No* 16997C Specific Instructions Completing Schedule A Step 1. Place an X in the box of every state including the District of Columbia Puerto Rico and the U*S* Virgin Islands in which you had to pay state unemployment taxes this year even if the state s credit reduction rate is zero. Note Don t enter your state unemployment wages in the FUTA Note Make sure that you have applied for a state reporting number for your business....If you do not have an unemployment account in a state in which you paid wages contact the state website at www. workforcesecurity. doleta*gov/unemploy/ agencies. asp* Enter your total in the Credit Reduction box at the end of the line. The table below provides the two-letter postal abbreviations used on Schedule A. State Alabama Alaska Arizona Arkansas California Colorado Connecticut Delaware Montana Nebraska Nevada New Hampshire New Jersey New Mexico New York North Carolina North Dakota Florida...Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Ohio Oklahoma Oregon Pennsylvania Rhode Island Tennessee Texas Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming Puerto Rico U*S* Virgin Islands Step 2. You are subject to credit reduction if you paid FUTA taxable wages that were also subject to state reduction rate greater than zero. If you paid FUTA taxable wages that were also subject to...state reduction find the line for each state. In the FUTA Taxable Wages box enter the total FUTA taxable wages that you paid in that state. The FUTA wage base for all states is 7 000. However don t include in the FUTA Taxable Wages box wages that were excluded from state unemployment tax. For example if you paid 5 000 in FUTA taxable wages in a from state unemployment tax report 4 000 in the FUTA Page Then multiply the total FUTA taxable wages by the reduction rate. Step 3. Total credit...reduction To calculate the total credit reduction add up all of the Credit Reduction boxes and enter the amount in the Total Credit Then enter the total credit reduction on Form 940 line 11.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 940 - Schedule A

How to edit IRS 940 - Schedule A

How to fill out IRS 940 - Schedule A

Instructions and Help about IRS 940 - Schedule A

How to edit IRS 940 - Schedule A

To edit the IRS 940 - Schedule A tax form, access a fillable PDF version. Use the pdfFiller platform to make your edits conveniently. Once you're in the pdfFiller interface, select the form and utilize the editing tools to enter or modify information as needed. Ensure all entries are accurate to avoid complications during submission.

How to fill out IRS 940 - Schedule A

To fill out the IRS 940 - Schedule A, first download the form from the IRS website or access it through pdfFiller. Gather all necessary documentation, including prior wage information and employee details. Complete the form by inputting information in the designated fields. Utilize the following steps to ensure a correct submission:

01

Review the instructions provided for IRS 940 - Schedule A.

02

Enter your employer identification number (EIN) at the top of the form.

03

Document all relevant payments and wages paid to employees.

04

Calculate relevant tax liabilities based on the information provided.

05

Sign and date the completed form before submission.

About IRS 940 - Schedule A 2015 previous version

What is IRS 940 - Schedule A?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 940 - Schedule A 2015 previous version

What is IRS 940 - Schedule A?

IRS 940 - Schedule A is a supplemental form used by employers to report annual federal unemployment tax (FUTA) obligations. This form is critical for compiling information regarding employee wages and the taxes associated with them. Completing IRS 940 - Schedule A accurately enables employers to comply with federal employment tax regulations.

What is the purpose of this form?

The purpose of IRS 940 - Schedule A is to help employers report and reconcile their federal unemployment tax liabilities. This form allows employers to document their taxable wages and calculate any adjustments to their unemployment tax based on their experience ratings. Proper completion supports accurate tax filings and prevents penalties.

Who needs the form?

Employers required to file Form 940 must also submit IRS 940 - Schedule A if they qualify for a credit reduction. Generally, businesses with employees covered by unemployment insurance are obligated to complete this form. This typically includes corporations, partnerships, and self-employed individuals with taxable employees.

When am I exempt from filling out this form?

Employers may be exempt from filling out IRS 940 - Schedule A if they have no taxable wages for the year or if they meet specific criteria set by the IRS for exempt organizations. Nonprofits with certain tax-exempt status and state governance may also differ in their filing requirements. To confirm eligibility for exemption, check the IRS guidelines for the applicable tax year.

Components of the form

IRS 940 - Schedule A contains several key components including information fields for employer identification, wage and tax amounts, as well as sections for calculating any adjustments. You'll find sections designated for reporting the total tax liability, any adjustments for state unemployment tax contributions, and the resulting net FUTA tax.

What are the penalties for not issuing the form?

Failure to file IRS 940 - Schedule A accurately and on time can result in significant penalties. Employers may face a penalty of 5% of the tax due for each month the form is late, up to a maximum of 25%. Additional penalties may apply for inaccuracies, and consistent failure to comply could lead to further scrutiny or audits by the IRS.

What information do you need when you file the form?

When filing IRS 940 - Schedule A, gather the following information: your employer identification number (EIN), total amount of taxable wages paid, any adjustments for state unemployment contributions, and records of any prior tax payments. Having this information ready ensures a smoother filing process and reduces the risk of errors.

Is the form accompanied by other forms?

IRS 940 - Schedule A may be submitted along with Form 940. Depending on your business structure and payment history, you may also need to attach Forms 941 or 944. Always consult IRS guidance to ensure you are including all necessary documents pertaining to your specific filing requirements.

Where do I send the form?

The submission location for IRS 940 - Schedule A varies based on your business location. Generally, the form can be sent to the address listed in the instructions for Form 940. If you are mailing the form, make sure to use an express mail service for timely delivery, especially as the due date approaches.

See what our users say