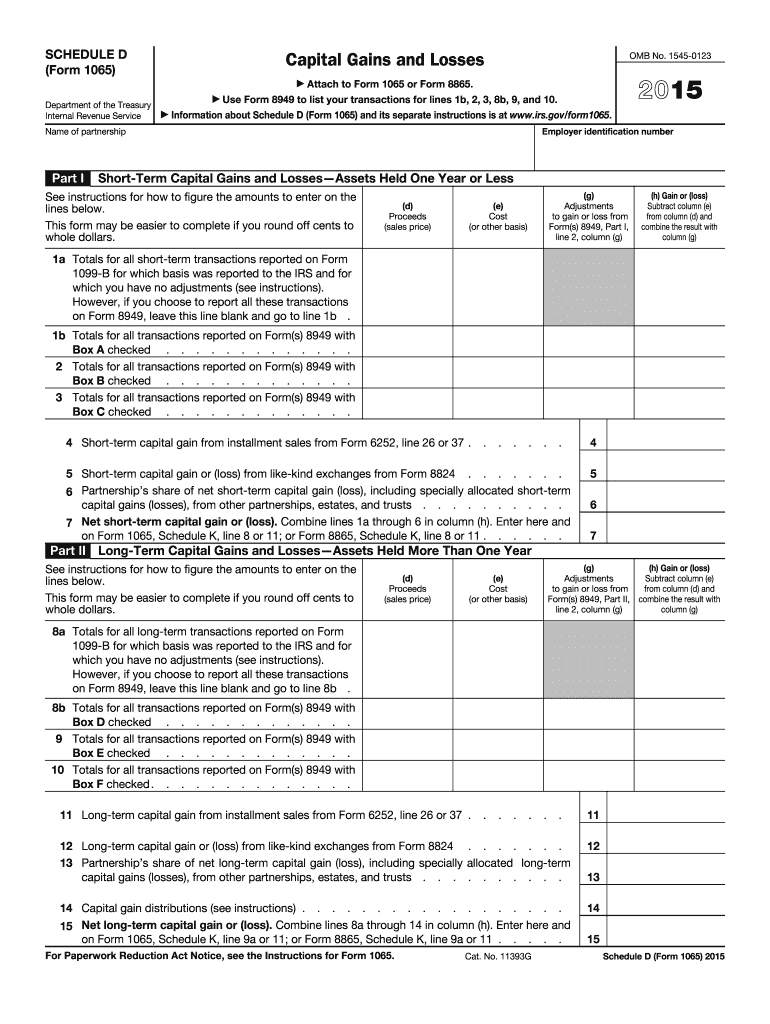

IRS 1065 - Schedule D 2015 free printable template

Show details

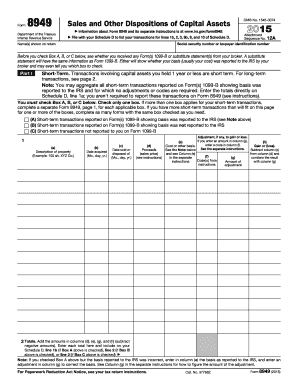

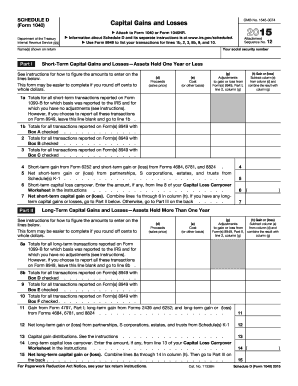

SCHEDULE D (Form 1065) Capital Gains and Losses OMB No. 1545-0123 ? Attach to Form 1065 or Form 8865. Use Form 8949 to list your transactions for lines 1b, 2, 3, 8b, 9, and 10. Department of the Treasury

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1065 - Schedule D

How to edit IRS 1065 - Schedule D

How to fill out IRS 1065 - Schedule D

Instructions and Help about IRS 1065 - Schedule D

How to edit IRS 1065 - Schedule D

To edit the IRS 1065 - Schedule D form, first obtain a copy of the form from the IRS website or through your tax software. If using pdfFiller, upload the form and utilize its editing tools to make necessary changes. After editing, save the updated version securely and be prepared for submission.

How to fill out IRS 1065 - Schedule D

To fill out the IRS 1065 - Schedule D form, gather all required financial documents regarding your partnerships or affiliated entities. Follow these steps:

01

Begin at the top of the form, entering your partnership's name and Employer Identification Number (EIN).

02

Complete sections regarding income, deductions, and other financial activities that apply to your partnership.

03

Review all entries for accuracy before submitting the form.

About IRS 1065 - Schedule D 2015 previous version

What is IRS 1065 - Schedule D?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1065 - Schedule D 2015 previous version

What is IRS 1065 - Schedule D?

The IRS 1065 - Schedule D is a tax form used by partnerships to report capital gains and losses from the sale or exchange of capital assets. It provides the IRS with details on the partnership's investment activities and is essential for calculating the tax implications related to these transactions.

What is the purpose of this form?

The purpose of the IRS 1065 - Schedule D is to document the capital transactions of a partnership. This includes reporting gains or losses from the sale of stocks, bonds, or property. By accurately reporting this information, partnerships can determine their tax liabilities and fulfill their IRS obligations.

Who needs the form?

Partnerships that have realized capital gains or losses on their investments must file the IRS 1065 - Schedule D. Additionally, any entity classified as a partnership for tax purposes, such as multi-member LLCs, must also complete this form, irrespective of their activity level during the tax year.

When am I exempt from filling out this form?

Filing the IRS 1065 - Schedule D is not required if your partnership did not sell or exchange any capital assets during the tax year. Additionally, if all capital transactions have been reported through other tax forms, you may be exempt. It's crucial to evaluate your overall tax situation with a tax professional to ensure compliance.

Components of the form

The IRS 1065 - Schedule D consists of various sections, including those for detailing sales, exchanges, and ordinary gains or losses. Each section requires specific financial data, including the type of asset sold, date of acquisition, date of sale, and the corresponding financial outcome (gain or loss). Clear documentation for each entry is essential for accuracy.

What are the penalties for not issuing the form?

Failure to file the IRS 1065 - Schedule D can result in significant penalties. The IRS may impose a penalty for each month the form remains unfiled, as well as interest for any unpaid taxes due to underreporting. Furthermore, partnerships may be subjected to scrutiny, leading to potential audits or further action from the IRS.

What information do you need when you file the form?

When filing the IRS 1065 - Schedule D, you'll need comprehensive records of all capital transactions, including purchase and sale dates, asset types, purchase price, sale price, and any associated costs (like commissions or fees). Documentation such as bank statements and previous years' tax returns can also provide critical context and support for your entries.

Is the form accompanied by other forms?

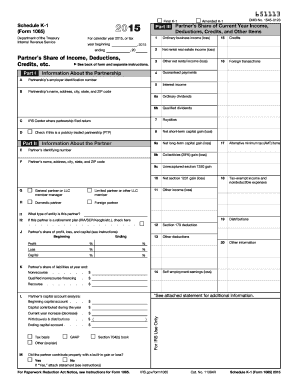

The IRS 1065 - Schedule D is typically filed alongside Form 1065, the U.S. Return of Partnership Income. Additional forms, such as Schedule K-1, may be required to report each partner's share of income, gains, losses, and deductions. Ensure all accompanying forms are complete for accurate reporting.

Where do I send the form?

Send the completed IRS 1065 - Schedule D and its accompanying forms to the address specified in the Form 1065 instructions, which can vary based on your partnership's location. Ensure to check the most recent instructions to confirm the correct mailing address, as it may change periodically.

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.