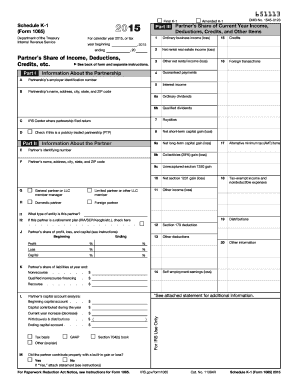

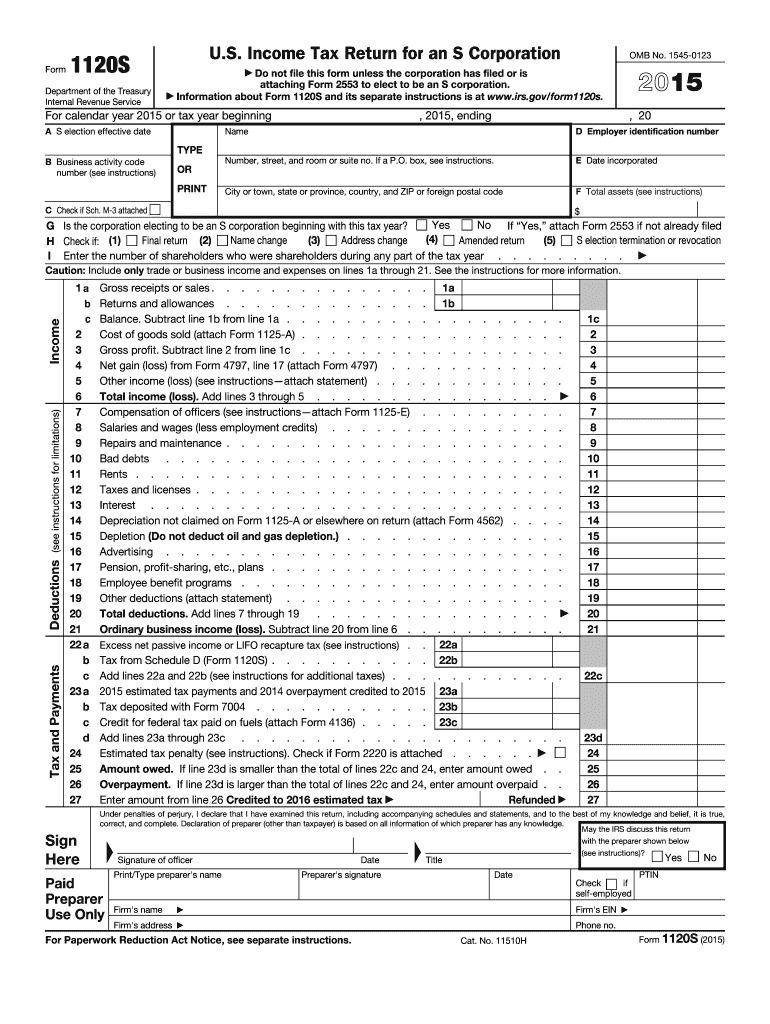

IRS 1120S 2015 free printable template

Instructions and Help about IRS 1120S

How to edit IRS 1120S

How to fill out IRS 1120S

About IRS 1120S 2015 previous version

What is IRS 1120S?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1120S

What should I do if I need to correct a mistake on my IRS 1120S after filing?

If you need to correct a mistake on your IRS 1120S, you should file Form 1120S-X, the amended return. This form enables you to address specific errors made in the original filing, ensuring that the IRS has accurate records. It's important to clearly indicate the changes made and attach any necessary supporting documents.

How can I verify the receipt of my submitted IRS 1120S?

To verify the receipt of your submitted IRS 1120S, you can contact the IRS directly or use the IRS e-file tracking tool if you filed electronically. This tracking mechanism allows you to check the status of your return and confirm whether it has been processed. Keep an eye out for any notices that may indicate issues with your submission.

What are common e-file rejection codes for IRS 1120S and how should I respond?

Common e-file rejection codes for IRS 1120S can include issues like mismatched information or incorrect formats. Upon receiving a rejection code, carefully review the error details provided, correct the discrepancies, and resubmit the form. It's crucial to address the exact issues noted to avoid further rejections.

What should I maintain in terms of record retention after filing IRS 1120S?

After filing your IRS 1120S, it is essential to maintain records for at least three years from the date of filing. This retention period allows you to provide documentation in case of an audit or if the IRS requests further information. Keeping thorough and organized records will also assist in the event of filing amended returns.

What should I do if I receive an audit notice related to my IRS 1120S?

If you receive an audit notice regarding your IRS 1120S, you should review the notice carefully and gather all requested documentation. Respond promptly to the IRS with the necessary records and explanations. It's advisable to consult a tax professional who can help guide you through the audit process and ensure that you are adequately prepared.

See what our users say