CA FTB Pub 1067 2015 free printable template

Show details

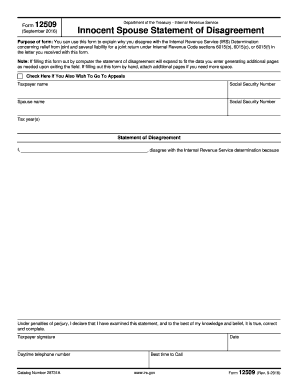

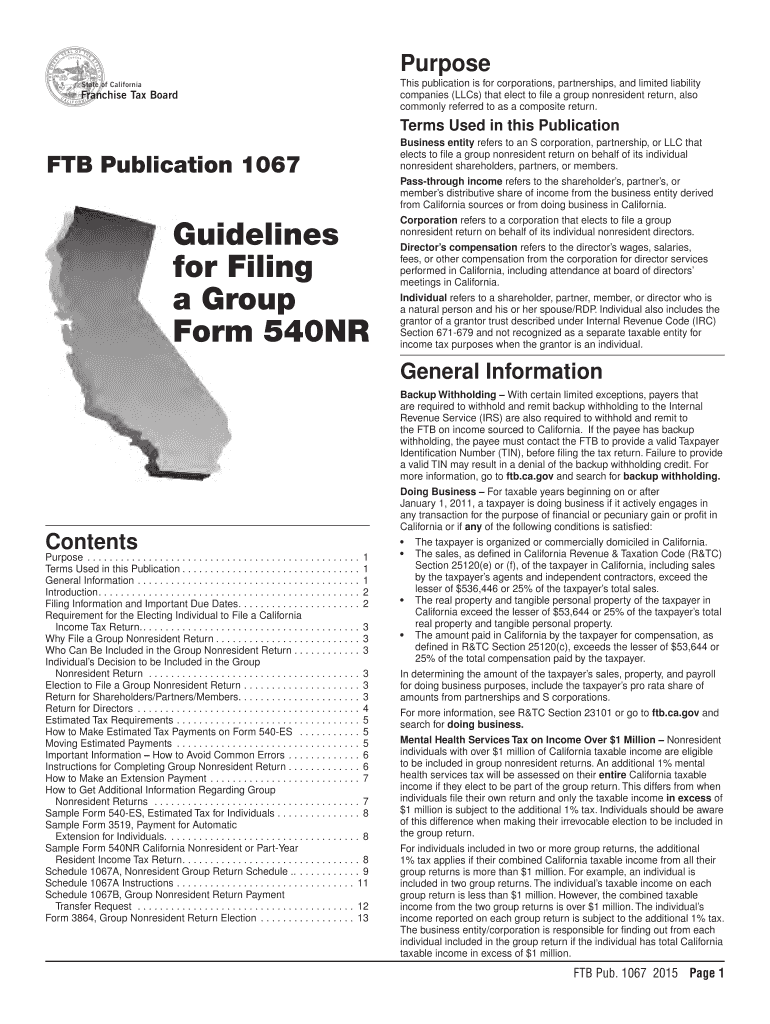

Column d Amount of deferred compensation deduction. See FTB Pub. 1067 Section H for more information. Column g Tax credit allowable. No deduction to a qualified deferred compensation plan is allowed if the See FTB Pub. 1067 for more information. FTB 3864 C2 2015 Side 1 activity. See FTB Pub. 1067 Section H for more information. Column h See Schedule 1067A Instructions Part I for more information. DBA S Corporation/Partnership/Limited Liability Company name Attach this schedule to your...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ftb pub 1067 2015

Edit your ftb pub 1067 2015 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ftb pub 1067 2015 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ftb pub 1067 2015 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ftb pub 1067 2015. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA FTB Pub 1067 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ftb pub 1067 2015

How to fill out CA FTB Pub 1067

01

Obtain a copy of CA FTB Pub 1067 from the California Franchise Tax Board website or local office.

02

Read the instructions carefully to understand the purpose of the form and the information required.

03

Gather necessary documents, such as your tax return, W-2 forms, and other relevant financial statements.

04

Begin filling out the form with your personal information, including your name, address, and Social Security number.

05

Fill out the sections regarding income, deductions, and credits as applicable to your tax situation.

06

Double-check all entries for accuracy and completeness before signing and dating the form.

07

Submit the completed form by the specified deadline, either electronically or by mail, as instructed.

Who needs CA FTB Pub 1067?

01

Individuals who need to report specific information regarding their California state taxes.

02

Taxpayers who received a notice from the California Franchise Tax Board requiring additional information.

03

People who are seeking to claim tax credits or refunds and need to provide supporting documentation.

Fill

form

: Try Risk Free

People Also Ask about

What is the 540NR middle class tax refund?

Middle Class Tax Refund – The California Middle Class Tax Refund is a one-time payment issued to provide relief to qualified recipients. California excludes this payment from gross income. For more information, see Schedule CA (540NR) specific line instructions in Part II, Section B, line 8z.

Do I need to file Schedule CA 540?

If there are no differences between your federal and California income or deductions, do not file a Schedule CA (540), California Adjustments - Residents. If there are differences between your federal and California income or deductions, complete Schedule CA (540).

Who must file form 540?

If you have a tax liability for 2022 or owe any of the following taxes for 2022, you must file Form 540. Tax on a lump-sum distribution. Tax on a qualified retirement plan including an Individual Retirement Arrangement (IRA) or an Archer Medical Savings Account (MSA).

Does California have a composite tax return?

California uses Form 540NR to prepare a composite return for non-resident shareholders. This form can be produced in two ways. Go to the Shareholders > Shareholder Information worksheet.

What is tax form 540 used for?

Use Form 540-ES, Estimated Tax for Individuals, and the 2022 California Estimated Tax Worksheet, to determine if you owe estimated tax for 2022 and to figure the required amounts. Estimated tax is the tax you expect to owe in 2022 after subtracting the credits you plan to take and tax you expect to have withheld.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send ftb pub 1067 2015 to be eSigned by others?

Once your ftb pub 1067 2015 is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I edit ftb pub 1067 2015 online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your ftb pub 1067 2015 and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I fill out the ftb pub 1067 2015 form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign ftb pub 1067 2015 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is CA FTB Pub 1067?

CA FTB Pub 1067 is a publication provided by the California Franchise Tax Board that offers guidelines and information about the tax filing process, specifically regarding the California income tax.

Who is required to file CA FTB Pub 1067?

Individuals who are residents of California and have tax obligations, as well as certain non-residents earning income in California, are required to file CA FTB Pub 1067.

How to fill out CA FTB Pub 1067?

To fill out CA FTB Pub 1067, individuals should follow the instructions provided within the publication, which include gathering necessary financial documents, accurately reporting income and deductions, and ensuring that all information is complete and correct before submission.

What is the purpose of CA FTB Pub 1067?

The purpose of CA FTB Pub 1067 is to educate taxpayers about their filing responsibilities, provide clarity on tax laws, and offer assistance in accurately completing tax forms for California income tax.

What information must be reported on CA FTB Pub 1067?

Information that must be reported on CA FTB Pub 1067 typically includes personal identification details, income sources, deductions, credits, and any relevant financial information that pertains to California tax obligations.

Fill out your ftb pub 1067 2015 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ftb Pub 1067 2015 is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.