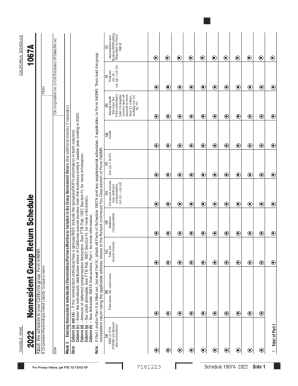

CA FTB Pub 1067 2023-2025 free printable template

Get, Create, Make and Sign ftb publication 1067 form

Editing CA FTB Pub 1067 online

Uncompromising security for your PDF editing and eSignature needs

CA FTB Pub 1067 Form Versions

How to fill out CA FTB Pub 1067

How to fill out CA FTB Pub 1067

Who needs CA FTB Pub 1067?

Video instructions and help with filling out and completing ftb pub

Instructions and Help about CA FTB Pub 1067

All right you guys wanted a video solar#39’s talk it#39’s weird a pop their#39;slow pokes' girl are you mind Bangor camera it#39’s slow folks' girl done#39;worry they can#39’t seat you their#39’s some people that done#39’t want to be in the videotape#39’s dire IN#39’m doing a video for the per year IRC channel that is demanding video that means here lemming king lemon and author of the thermal expansion behave more Valeria and man morph and Leland it#39’s me and yeah look you guys got video it#39’s like a minute long have fun

People Also Ask about

What is the 540NR middle class tax refund?

Do I need to file Schedule CA 540?

Who must file form 540?

Does California have a composite tax return?

What is tax form 540 used for?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my CA FTB Pub 1067 in Gmail?

Where do I find CA FTB Pub 1067?

How do I edit CA FTB Pub 1067 on an Android device?

What is CA FTB Pub 1067?

Who is required to file CA FTB Pub 1067?

How to fill out CA FTB Pub 1067?

What is the purpose of CA FTB Pub 1067?

What information must be reported on CA FTB Pub 1067?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.