SC ST-388 2015 free printable template

Show details

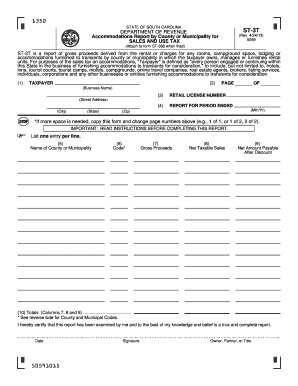

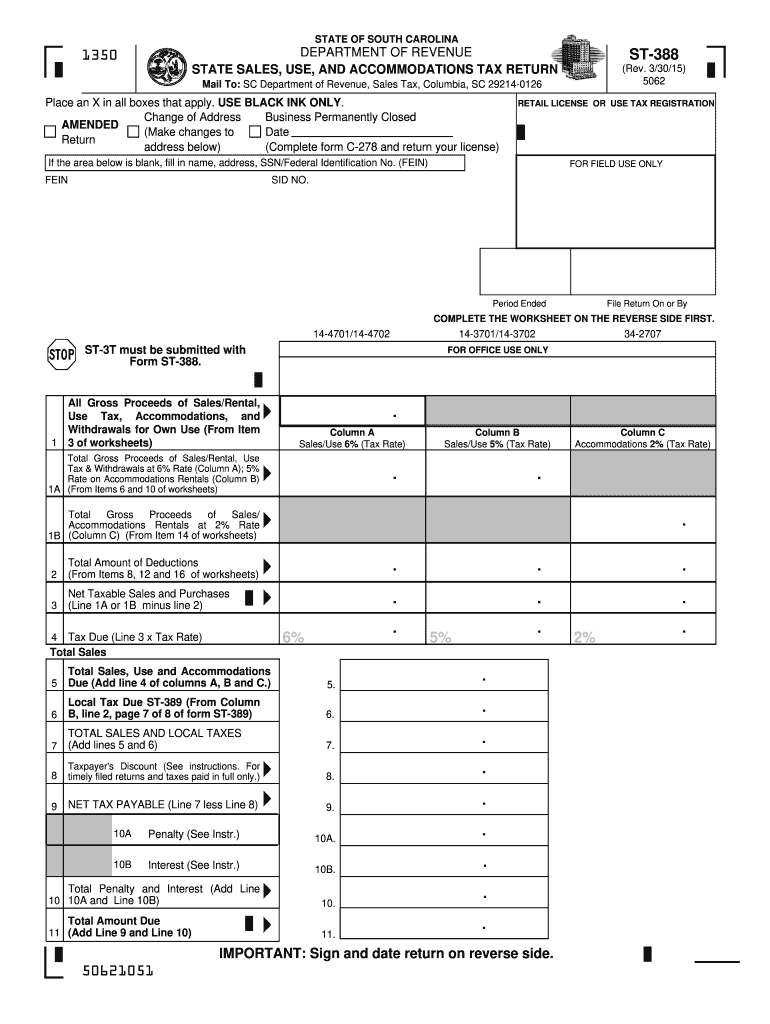

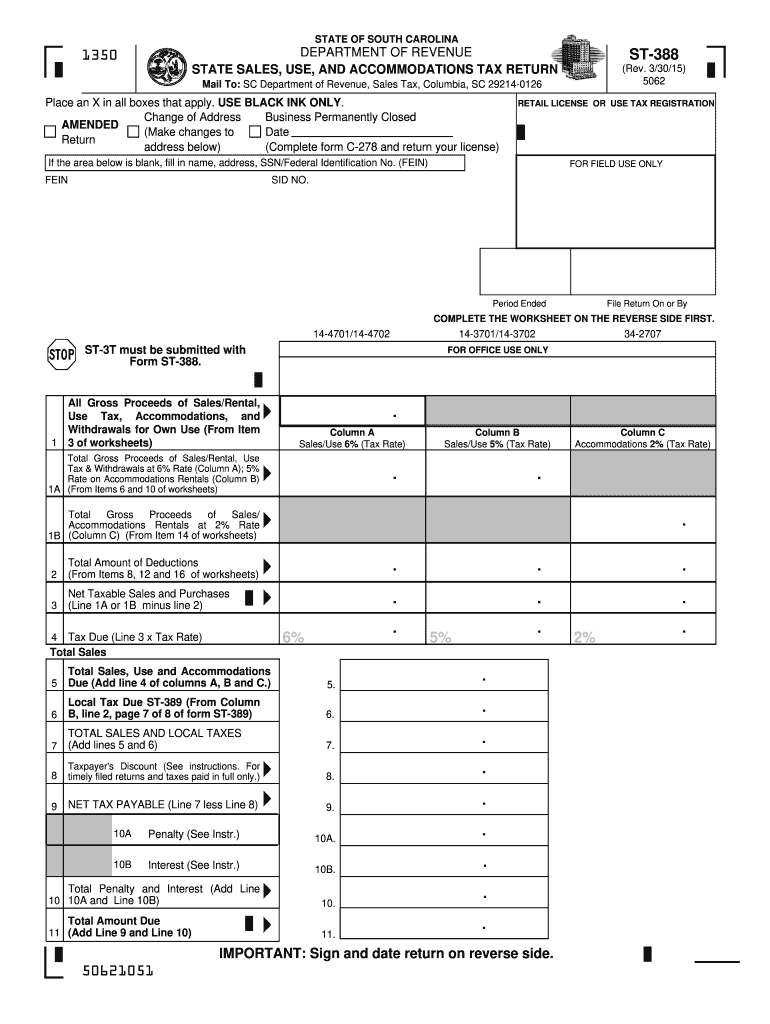

Period Ended File Return On or By COMPLETE THE WORKSHEET ON THE REVERSE SIDE FIRST. 14-4701/14-4702 ST-3T must be submitted with Form ST-388. Enter total amount of deductions here and on line 2 Column C on front of ST-388. Item 14 minus Item16 should agree with line 3 of Column C on front of ST-388. Total Amount of Deductions Enter total amount of deductions here and on line 2 Column B on front of ST-388. Out-of-State Purchases Subject to Use Tax for Own Use Add Items 1 and 2. Enter total...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SC ST-388

Edit your SC ST-388 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SC ST-388 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit SC ST-388 online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit SC ST-388. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC ST-388 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SC ST-388

How to fill out SC ST-388

01

Obtain the SC ST-388 form from the appropriate government or online sources.

02

Read the instructions carefully to understand the requirements for filling out the form.

03

Fill in your personal information such as name, address, and contact details in the designated sections.

04

Provide details about your employment status and history as required in the form.

05

Include any necessary documentation or proofs required to support your application, such as income statements or identification.

06

Review the form for accuracy and completeness to ensure all necessary information is provided.

07

Sign and date the form where indicated before submission.

08

Submit the completed SC ST-388 form to the designated office or authority as per the instructions.

Who needs SC ST-388?

01

Individuals who are applying for state or local government programs or benefits that require proof of income or financial status.

02

Those seeking assistance that is conditional on income qualifications or in need of certification for educational financial aid.

Instructions and Help about SC ST-388

Fill

form

: Try Risk Free

People Also Ask about

What is the average sales tax in South Carolina?

South Carolina has a 6.00 percent state sales tax rate, a max local sales tax rate of 3.00 percent, and an average combined state and local sales tax rate of 7.44 percent. South Carolina's tax system ranks 31st overall on our 2022 State Business Tax Climate Index.

Is South Carolina a good tax state?

South Carolina has a 6.00 percent state sales tax rate, a max local sales tax rate of 3.00 percent, and an average combined state and local sales tax rate of 7.44 percent. South Carolina's tax system ranks 31st overall on our 2022 State Business Tax Climate Index.

Which state is more tax-friendly North or South Carolina?

South Carolina has higher income tax rates however, its retirement income exemption levels are more tax-friendly than North Carolina's. Neither North nor South Carolina taxes social security. The sales tax in North Carolina is 1.25% lower but local taxes could narrow the difference.

What taxes do you pay living in South Carolina?

South Carolina Tax Rates, Collections, and Burdens South Carolina has a 6.00 percent state sales tax rate, a max local sales tax rate of 3.00 percent, and an average combined state and local sales tax rate of 7.44 percent. South Carolina's tax system ranks 31st overall on our 2022 State Business Tax Climate Index.

At what age do you stop paying state taxes in South Carolina?

If you have resided in South Carolina as your permanent home and legal residence for a full calendar year (January 1-December 31) and you are 65 years or older, legally blind, or permanently and totally disabled, you are eligible for a Homestead Exemption of $50,000 from the value of your home for tax purposes.

Are there tax advantages to living in South Carolina?

Financial benefits South Carolina is in the top 10 lowest taxed states, so living here offers lower real estate taxes, sales tax, and personal income tax.

How do you calculate South Carolina sales tax?

How 2022 Sales taxes are calculated in South Carolina. The state general sales tax rate of South Carolina is 6%. Cities and/or municipalities of South Carolina are allowed to collect their own rate that can get up to 1% in city sales tax.

What is SC tax rate 2022?

Individual Income Tax rates range from 0% to a top rate of 7% on taxable income for tax years 2021 and prior and from 0% to a top rate of 6.5% on taxable income for tax year 2022.

Is SC income tax higher than NC?

August 15, 2022 For later comparisons, SC's top tax rate for 2022 is 6.5% and NC's is 4.99%.

At what age do you stop paying taxes in SC?

The state of South Carolina has special provisions on property taxes for home owners who are 65 years of age or older and who have resided in the state for at least one year. These benefits are usually available for a surviving spouse if the deceased spouse was 65 or older.

What is the federal tax rate in South Carolina?

Your Income Taxes Breakdown TaxMarginal Tax RateEffective Tax RateFederal22.00%12.71%FICA7.65%7.65%State5.97%5.03%Local3.88%3.30%4 more rows • 1 Jan 2021

What is my state income tax rate South Carolina?

South Carolina Income Tax Calculator 2021. If you make $70,000 a year living in the region of South Carolina, USA, you will be taxed $12,409. Your average tax rate is 11.98% and your marginal tax rate is 22%.

What is the South Carolina tax rate?

South Carolina's general state Sales and Use Tax rate is 6%. In certain counties, local Sales and Use Taxes are imposed in addition to the 6% state rate. The general local Sales and Use Tax collected on behalf of local jurisdictions is for school projects, road improvements, capital projects, and other purposes.

Do you have to pay income tax after age 75?

There is no age when a senior gets to stop filing a tax return, and most seniors are required to file taxes. The taxpayer's taxable income determines whether a tax return is required. The rules for seniors are slightly different than those for people under the age of 65.

Do seniors pay state income tax in South Carolina?

South Carolina taxpayers ages 65 and older do not need to file a state income tax return. In addition, Social Security benefits are not taxed by the state of South Carolina. Overall, Kiplinger rates South Carolina as a tax-friendly state for retirees.

What is SC special tax?

South Carolina has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 3%. There are a total of 118 local tax jurisdictions across the state, collecting an average local tax of 1.666%.South Carolina City and Locality Sales Taxes. City NameTax RateRavenel, SC9%186 more rows

What is the restaurant tax in SC?

The hospitality tax is a uniform tax of 2% on the gross proceeds derived from the sales of prepared meals, food, and beverages sold in or by establishments, or those licensed for on-premises consumption of alcoholic beverages, beer, or wine.

What is the sales tax in South Carolina 2022?

What is Sales Tax? Sales tax is imposed on the sale of goods and certain services in South Carolina. The statewide sales and use tax rate is six percent (6%). Counties may impose an additional one percent (1%) local sales tax if voters in that county approve the tax.

Is South Carolina a tax friendly state?

Residents who file a 2021 South Carolina income tax return by February 15, 2023, may also get a tax rebate (all rebate checks are expected to be issued by March 31, 2023). Unfortunately, sales taxes are on the high end in South Carolina, with an average combined state and local rate of 7.44%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit SC ST-388 from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your SC ST-388 into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I fill out the SC ST-388 form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign SC ST-388. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

Can I edit SC ST-388 on an Android device?

With the pdfFiller Android app, you can edit, sign, and share SC ST-388 on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is SC ST-388?

SC ST-388 is a tax form used in South Carolina to report sales and use tax information.

Who is required to file SC ST-388?

Businesses that make sales subject to South Carolina sales and use tax are required to file SC ST-388.

How to fill out SC ST-388?

To fill out SC ST-388, taxpayers should provide their tax identification number, report overall sales and taxable sales, and calculate the total tax due.

What is the purpose of SC ST-388?

The purpose of SC ST-388 is to help collect and report the sales and use taxes collected by retailers in South Carolina.

What information must be reported on SC ST-388?

SC ST-388 requires reporting of gross sales, taxable sales, exempt sales, and the total amount of sales and use tax collected.

Fill out your SC ST-388 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC ST-388 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.