SC ST-388 2007 free printable template

Show details

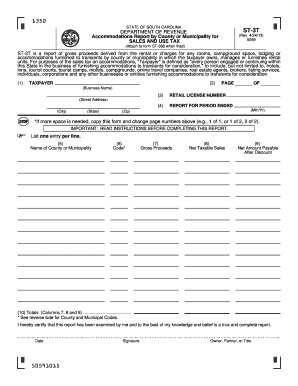

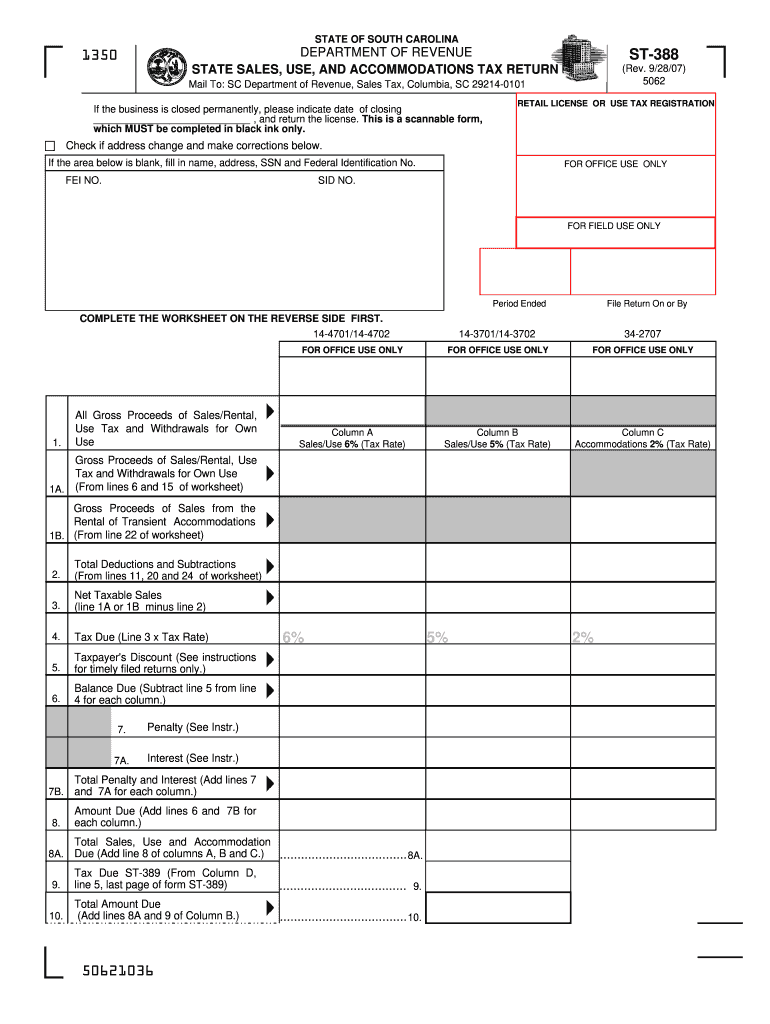

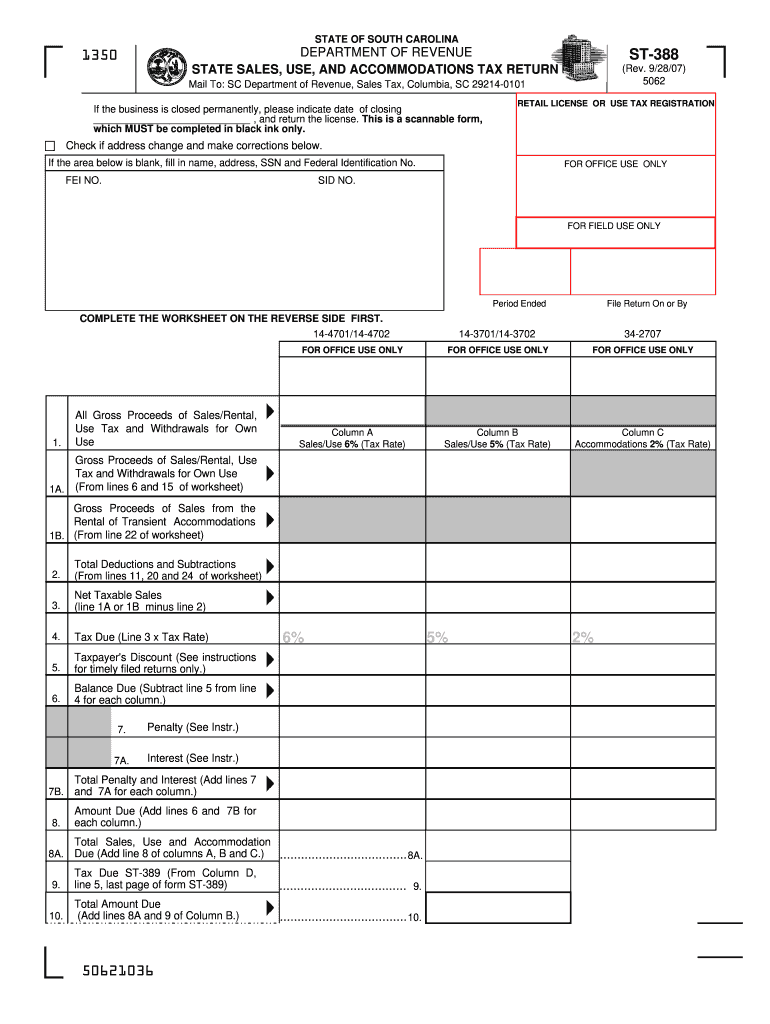

STATE OF SOUTH CAROLINA 1350 DEPARTMENT OF REVENUE STATE SALES, USE, AND ACCOMMODATIONS TAX RETURN Mail To: SC Department of Revenue, Sales Tax, Columbia, SC 29214-0101 ST-388 (Rev. 9/28/07) 5062

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SC ST-388

Edit your SC ST-388 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SC ST-388 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit SC ST-388 online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit SC ST-388. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC ST-388 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SC ST-388

How to fill out SC ST-388

01

Obtain the SC ST-388 form from the appropriate state agency or website.

02

Fill out your personal information in the designated sections, including your name, address, and contact details.

03

Provide the required details regarding your income and financial status in the income section.

04

Include any relevant identification numbers or documentation that may be requested.

05

Review the completed form for accuracy and completeness.

06

Submit the form as per the instructions, either online or in-person, ensuring you retain a copy for your records.

Who needs SC ST-388?

01

Individuals seeking to claim specific state benefits related to income eligibility.

02

Residents who need to verify their income status for eligibility in state assistance programs.

Fill

form

: Try Risk Free

People Also Ask about

What is the average sales tax in South Carolina?

South Carolina has a 6.00 percent state sales tax rate, a max local sales tax rate of 3.00 percent, and an average combined state and local sales tax rate of 7.44 percent. South Carolina's tax system ranks 31st overall on our 2022 State Business Tax Climate Index.

Is South Carolina a good tax state?

South Carolina has a 6.00 percent state sales tax rate, a max local sales tax rate of 3.00 percent, and an average combined state and local sales tax rate of 7.44 percent. South Carolina's tax system ranks 31st overall on our 2022 State Business Tax Climate Index.

Which state is more tax-friendly North or South Carolina?

South Carolina has higher income tax rates however, its retirement income exemption levels are more tax-friendly than North Carolina's. Neither North nor South Carolina taxes social security. The sales tax in North Carolina is 1.25% lower but local taxes could narrow the difference.

What taxes do you pay living in South Carolina?

South Carolina Tax Rates, Collections, and Burdens South Carolina has a 6.00 percent state sales tax rate, a max local sales tax rate of 3.00 percent, and an average combined state and local sales tax rate of 7.44 percent. South Carolina's tax system ranks 31st overall on our 2022 State Business Tax Climate Index.

At what age do you stop paying state taxes in South Carolina?

If you have resided in South Carolina as your permanent home and legal residence for a full calendar year (January 1-December 31) and you are 65 years or older, legally blind, or permanently and totally disabled, you are eligible for a Homestead Exemption of $50,000 from the value of your home for tax purposes.

Are there tax advantages to living in South Carolina?

Financial benefits South Carolina is in the top 10 lowest taxed states, so living here offers lower real estate taxes, sales tax, and personal income tax.

How do you calculate South Carolina sales tax?

How 2022 Sales taxes are calculated in South Carolina. The state general sales tax rate of South Carolina is 6%. Cities and/or municipalities of South Carolina are allowed to collect their own rate that can get up to 1% in city sales tax.

What is SC tax rate 2022?

Individual Income Tax rates range from 0% to a top rate of 7% on taxable income for tax years 2021 and prior and from 0% to a top rate of 6.5% on taxable income for tax year 2022.

Is SC income tax higher than NC?

August 15, 2022 For later comparisons, SC's top tax rate for 2022 is 6.5% and NC's is 4.99%.

At what age do you stop paying taxes in SC?

The state of South Carolina has special provisions on property taxes for home owners who are 65 years of age or older and who have resided in the state for at least one year. These benefits are usually available for a surviving spouse if the deceased spouse was 65 or older.

What is the federal tax rate in South Carolina?

Your Income Taxes Breakdown TaxMarginal Tax RateEffective Tax RateFederal22.00%12.71%FICA7.65%7.65%State5.97%5.03%Local3.88%3.30%4 more rows • 1 Jan 2021

What is my state income tax rate South Carolina?

South Carolina Income Tax Calculator 2021. If you make $70,000 a year living in the region of South Carolina, USA, you will be taxed $12,409. Your average tax rate is 11.98% and your marginal tax rate is 22%.

What is the South Carolina tax rate?

South Carolina's general state Sales and Use Tax rate is 6%. In certain counties, local Sales and Use Taxes are imposed in addition to the 6% state rate. The general local Sales and Use Tax collected on behalf of local jurisdictions is for school projects, road improvements, capital projects, and other purposes.

Do you have to pay income tax after age 75?

There is no age when a senior gets to stop filing a tax return, and most seniors are required to file taxes. The taxpayer's taxable income determines whether a tax return is required. The rules for seniors are slightly different than those for people under the age of 65.

Do seniors pay state income tax in South Carolina?

South Carolina taxpayers ages 65 and older do not need to file a state income tax return. In addition, Social Security benefits are not taxed by the state of South Carolina. Overall, Kiplinger rates South Carolina as a tax-friendly state for retirees.

What is SC special tax?

South Carolina has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 3%. There are a total of 118 local tax jurisdictions across the state, collecting an average local tax of 1.666%.South Carolina City and Locality Sales Taxes. City NameTax RateRavenel, SC9%186 more rows

What is the restaurant tax in SC?

The hospitality tax is a uniform tax of 2% on the gross proceeds derived from the sales of prepared meals, food, and beverages sold in or by establishments, or those licensed for on-premises consumption of alcoholic beverages, beer, or wine.

What is the sales tax in South Carolina 2022?

What is Sales Tax? Sales tax is imposed on the sale of goods and certain services in South Carolina. The statewide sales and use tax rate is six percent (6%). Counties may impose an additional one percent (1%) local sales tax if voters in that county approve the tax.

Is South Carolina a tax friendly state?

Residents who file a 2021 South Carolina income tax return by February 15, 2023, may also get a tax rebate (all rebate checks are expected to be issued by March 31, 2023). Unfortunately, sales taxes are on the high end in South Carolina, with an average combined state and local rate of 7.44%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit SC ST-388 from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including SC ST-388, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I send SC ST-388 to be eSigned by others?

Once your SC ST-388 is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I edit SC ST-388 straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing SC ST-388, you need to install and log in to the app.

What is SC ST-388?

SC ST-388 is a form used for reporting sales and use tax for certain businesses in South Carolina.

Who is required to file SC ST-388?

Businesses that are registered to collect sales tax in South Carolina and are responsible for reporting sales and use tax must file SC ST-388.

How to fill out SC ST-388?

To fill out SC ST-388, obtain the form from the South Carolina Department of Revenue website, complete all required fields accurately, and submit it along with any payment due by the specified deadline.

What is the purpose of SC ST-388?

The purpose of SC ST-388 is to provide the South Carolina Department of Revenue with a clear account of taxable sales and to ensure compliance with sales and use tax regulations.

What information must be reported on SC ST-388?

Information that must be reported on SC ST-388 includes total taxable sales, total sales tax collected, any exempt sales, and details about any deductions or credits applicable.

Fill out your SC ST-388 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC ST-388 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.