VA DoT FWV 2015 free printable template

Show details

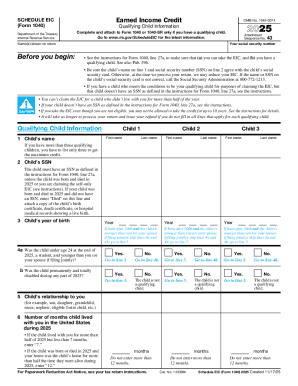

IMPORTANT All business taxpayers should be registered with the Department before completing Form FWV. Application for Farm Wineries and Vineyards Tax Credit VIRGINIA Form FWV Tax Year Submit this form by April 1. When to Submit Application Form FWV and any attachments must be completed and mailed no later than April 1 to claim expenditures for the preceding taxable year. To apply for the credit taxpayers must submit Form FWV at the beginning of each calendar year for qualified capital...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign VA DoT FWV

Edit your VA DoT FWV form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your VA DoT FWV form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VA DoT FWV Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out VA DoT FWV

How to fill out VA DoT FWV

01

Obtain the VA DoT FWV form from the official VA website or your local VA office.

02

Review the form instructions carefully to understand the required information.

03

Fill in your personal information, including your full name, social security number, and contact details.

04

Provide details about your military service, including service dates and branch.

05

Fill out the specific information related to your disability or condition as required by the form.

06

Attach any necessary documentation or evidence that supports your claim.

07

Review your completed form for accuracy and completeness.

08

Submit the form either online, by mail, or in person to the appropriate VA office.

Who needs VA DoT FWV?

01

Veterans seeking benefits or compensation for service-related disabilities.

02

Veterans who require assistance in obtaining healthcare services through the VA.

03

Survivors of veterans looking for support or benefits related to the veteran's service.

Fill

form

: Try Risk Free

People Also Ask about

What are Maryland tax credits?

The State of Maryland developed a program which allows credits against the homeowner's property tax bill if the property taxes exceed a fixed percentage of the person's gross income. In other words, it sets a limit on the amount of property taxes. Application timeline: February 2023 - October 1, 2023.

What qualifies as a farm in VA?

You're a farmer, grower, rancher or someone else engaged in agricultural production for market. You have a soil conservation plan in place that was approved by your local soil and water conservation district. You have a nutrient management plan developed by a certified nutrient management planner.

Is a winery considered agriculture?

A winery is a perfect example of an agricultural operation that provides diversification and stability to farm incomes while bringing people to share in the bounty of the land.

What is the Virginia Farm Winery tax credit?

An individual and corporate income tax credit is available for Virginia farm wineries and vineyards in an amount equal to 25% of the cost of all qualified capital expenditures made in connection with the establishment of new Virginia farm wineries and vineyards and capital improvements made to existing Virginia farm

How to get child tax credit in Maryland?

To claim your 2021 Child Tax Credit, you must file a 2021 tax return by April 18, 2025.There are three main requirements to claim the CTC: Income: You need to have more than $2,500 in earnings. Qualifying Child: Children claimed for the CTC must be a “qualifying child”.

Are vineyards tax deductible?

ing to the IRS, vineyard costs including land preparation, labor and rootstock can be expensed under section 179 in the year in which the vineyard is placed in service (producing a marketable crop.) Land, which is not depreciable, does not qualify for depreciation or the special deduction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is VA DoT FWV?

VA DoT FWV stands for Virginia Department of Transportation Form for Virginia's Fuel Use Tax, which is a form used to report fuel consumption for vehicles operating within Virginia.

Who is required to file VA DoT FWV?

Individuals or businesses that operate vehicles in Virginia and are subject to the state's fuel use tax are required to file the VA DoT FWV.

How to fill out VA DoT FWV?

To fill out the VA DoT FWV, you need to provide vehicle identification information, fuel usage details, and pay any applicable taxes as specified in the form guidelines.

What is the purpose of VA DoT FWV?

The purpose of VA DoT FWV is to ensure compliance with Virginia's fuel use tax regulations by accurately reporting fuel consumption for vehicles operating within the state.

What information must be reported on VA DoT FWV?

The information required on VA DoT FWV includes the number of miles traveled, the amount of fuel consumed, vehicle identification details, and total tax owed.

Fill out your VA DoT FWV online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

VA DoT FWV is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.