OH SOS 523A 2014 free printable template

Show details

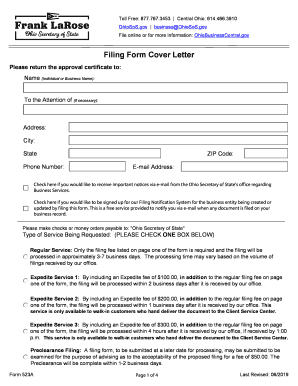

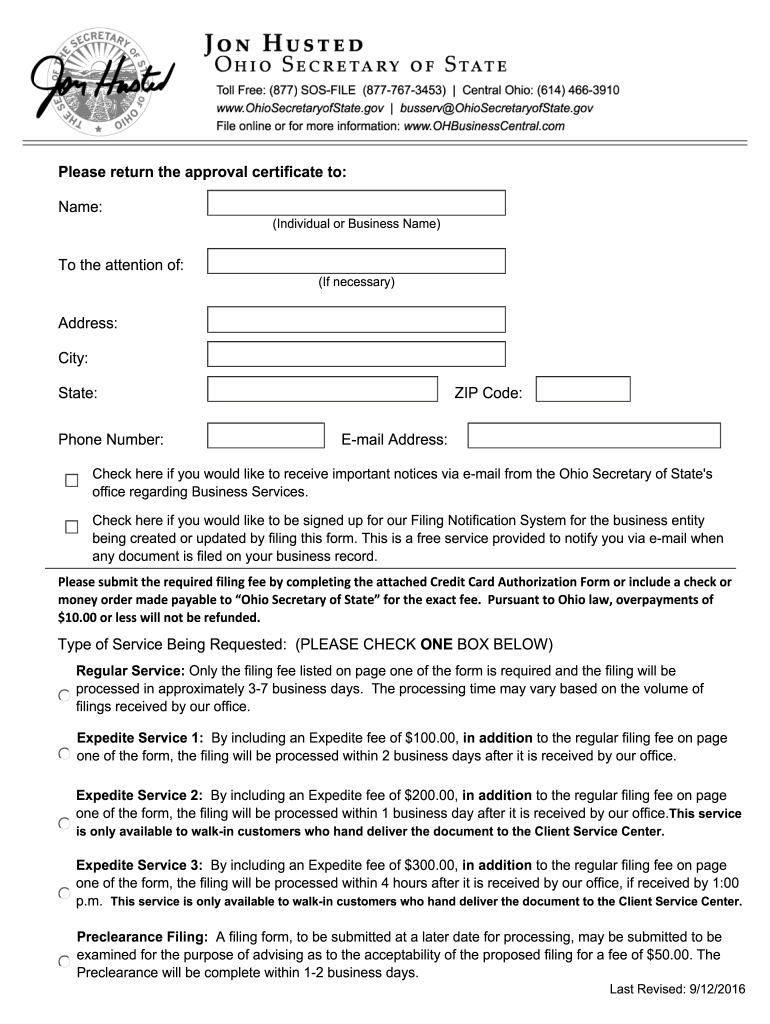

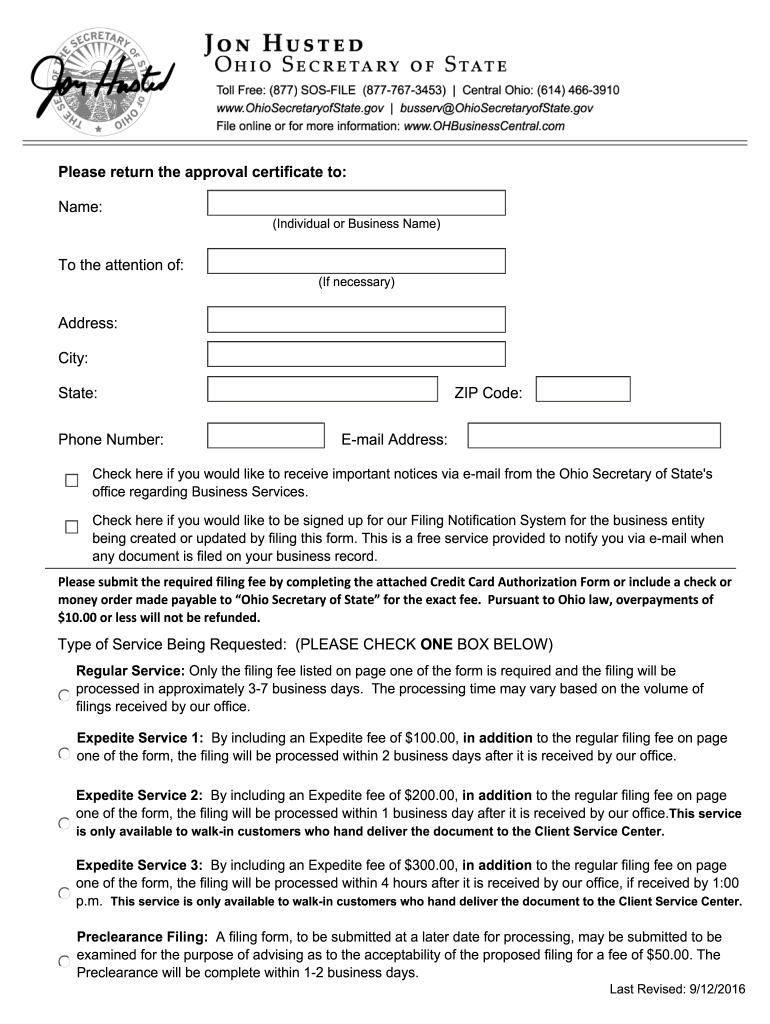

00. The Last Revised 4/21/2014 Form 523A Prescribed by Renewal of Trade Name or Fictitious Name Registration Filing Fee 25 CHECK ONLY ONE 1 BOX Renewal of Fictitious Name 159-NFR Reg. No. Trade Name or Fictitious Name to be Renewed Name of Registrant Renewing Name Registrant s Entity Number if registered with Ohio Secretary of State Complete if the registrant is a general partnership and has not provided an entity number above. Provide the name and address of at least one general partner....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OH SOS 523A

Edit your OH SOS 523A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OH SOS 523A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing OH SOS 523A online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit OH SOS 523A. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OH SOS 523A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OH SOS 523A

How to fill out OH SOS 523A

01

Obtain Form OH SOS 523A from the Ohio Secretary of State's website or office.

02

Fill in your name and contact information in the designated fields.

03

Provide details about the organization, including its official name, address, and purpose.

04

Indicate whether the organization is a new entity or an existing one by checking the appropriate box.

05

For existing organizations, include the registration number if applicable.

06

List the names and addresses of the organization's officers or directors as required.

07

Review the form to ensure all information is accurate and complete.

08

Sign and date the form at the bottom.

09

Submit the completed form by mail or in person to the Ohio Secretary of State's office, along with any required fees.

Who needs OH SOS 523A?

01

Organizations that are registering or updating their status with the Ohio Secretary of State.

02

Nonprofits, corporations, and other entities seeking legal recognition in Ohio.

03

Groups needing to file for exemption or chartering under Ohio law.

Instructions and Help about OH SOS 523A

Fill

form

: Try Risk Free

People Also Ask about

Do I have to renew my LLC every year in Ohio?

There are no Annual Reports for Ohio LLCs. The Ohio Secretary of State doesn't require you to file any annual information form or pay any annual fee for your LLC. Ohio is one of only 5 states that have a true “No Annual Report Due”.

How long does it take for LLC to process in Ohio?

Mail filings: In total, mail filing approvals for Ohio LLCs take about 1 week. This accounts for the 1 business day processing time, plus the time your documents are in the mail. Online filings: In total, online filing approvals for Ohio LLCs take 1 business day.

What is the annual fee for an LLC in Ohio?

Bare Minimum Cost to Start an LLC in Ohio You'll also need to pay a $50 annual fee to maintain your LLC. In addition to the filing and annual fees, you'll also need to pay a $500 Ohio franchise tax. This tax is paid annually, and it covers the costs of registering your LLC with the state of Ohio.

What is the Ohio business Gateway?

Gateway services offer Ohio's businesses a time- and money-saving online filing and payment system that helps simplify business' relationship with government agencies. Ohio businesses can use the Gateway to access various services and submit transactions and payments with many state agencies.

Do I need to register my business in Ohio?

Who is required to register with the Ohio Secretary of State? Any business entity, domestic or foreign, planning to transact business within Ohio, using a name other than their own personal name, must register with this office. Business entities must file the appropriate formation documents to register their business.

Does Ohio require annual reports for LLC?

Do I have to file an annual report? Business entities in Ohio are not required to file an annual report.

How do I find out who owns an LLC in Ohio?

To look up who owns an LLC in Ohio, search the company records of the Ohio Secretary of State. These data are available online and include information on the owners and officials of LLCs registered in the state.

How do I verify a business in Ohio?

You can use the Ohio Secretary of State's Business Search portal to see if a business is registered to do business in Ohio.

How do I verify a business license in Ohio?

You can use the Ohio Secretary of State's Business Search portal to see if a business is registered to do business in Ohio.

Is it free to start an LLC in Ohio?

The filing fee is $99.00. At the time the entity registers, the limited liability company must appoint a statutory agent to accept service of process on behalf of the limited liability company within Ohio. The statutory agent must sign the form to accept appointment.

Do you have to renew your LLC every year in Ohio?

There are no Annual Reports for Ohio LLCs. The Ohio Secretary of State doesn't require you to file any annual information form or pay any annual fee for your LLC. Ohio is one of only 5 states that have a true “No Annual Report Due”.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify OH SOS 523A without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your OH SOS 523A into a dynamic fillable form that can be managed and signed using any internet-connected device.

Can I sign the OH SOS 523A electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your OH SOS 523A in minutes.

Can I edit OH SOS 523A on an iOS device?

You certainly can. You can quickly edit, distribute, and sign OH SOS 523A on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is OH SOS 523A?

OH SOS 523A is a form used by organizations in Ohio to report information related to their business activities and compliance with state regulations.

Who is required to file OH SOS 523A?

Entities that are registered to do business in Ohio and meet certain criteria related to their organizational structure and activities are required to file OH SOS 523A.

How to fill out OH SOS 523A?

To fill out OH SOS 523A, you must provide accurate information about your organization, including its name, registered address, and specific business activities. Follow the instructions provided with the form for details on each section.

What is the purpose of OH SOS 523A?

The purpose of OH SOS 523A is to ensure that the state maintains accurate records of businesses operating within its jurisdiction and to facilitate compliance with legal requirements.

What information must be reported on OH SOS 523A?

Information that must be reported on OH SOS 523A includes the organization's name, address, type of entity, officers or directors, and a description of business activities.

Fill out your OH SOS 523A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OH SOS 523a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.