OH SOS 523A 2013 free printable template

Show details

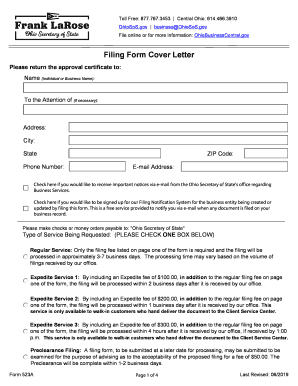

00. The Makes checks payable to Ohio Secretary of State Form 523A Prescribed by JON HUSTED Mail this form to one of the following Regular Filing non expedite P. Provide the name and address of at least one general partner. NOTE Pursuant to OAG 89-081 if a general partner is a foreign corporation/limited liability company it must be licensed to transact business in Ohio if a general partner is a foreign corporation/limited liability company licensed in Ohio under an assumed name please provide...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OH SOS 523A

Edit your OH SOS 523A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OH SOS 523A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit OH SOS 523A online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit OH SOS 523A. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OH SOS 523A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OH SOS 523A

How to fill out OH SOS 523A

01

Begin by downloading the OH SOS 523A form from the Ohio Secretary of State website.

02

Fill in your personal information, including your name, address, and contact details at the top of the form.

03

In the appropriate section, specify the type of filing you are requesting (e.g., corporation, partnership, etc.).

04

Provide the business name as well as any previous names used, if applicable.

05

Complete the section regarding the business address and principal office location.

06

List the names and addresses of the members or managers of the entity.

07

Ensure that you include any necessary additional information required for your specific business type.

08

Review all information for accuracy before signing and dating the form.

09

Submit the completed form according to the instructions provided, either by mail or online.

Who needs OH SOS 523A?

01

Ohio SOS 523A is needed by individuals or entities looking to register or update a business in Ohio.

02

This includes business owners, corporations, partnerships, or any legal entities seeking to comply with state registration requirements.

Fill

form

: Try Risk Free

People Also Ask about

Do I have to renew my LLC every year in Ohio?

There are no Annual Reports for Ohio LLCs. The Ohio Secretary of State doesn't require you to file any annual information form or pay any annual fee for your LLC. Ohio is one of only 5 states that have a true “No Annual Report Due”.

How long does it take for LLC to process in Ohio?

Mail filings: In total, mail filing approvals for Ohio LLCs take about 1 week. This accounts for the 1 business day processing time, plus the time your documents are in the mail. Online filings: In total, online filing approvals for Ohio LLCs take 1 business day.

What is the annual fee for an LLC in Ohio?

Bare Minimum Cost to Start an LLC in Ohio You'll also need to pay a $50 annual fee to maintain your LLC. In addition to the filing and annual fees, you'll also need to pay a $500 Ohio franchise tax. This tax is paid annually, and it covers the costs of registering your LLC with the state of Ohio.

What is the Ohio business Gateway?

Gateway services offer Ohio's businesses a time- and money-saving online filing and payment system that helps simplify business' relationship with government agencies. Ohio businesses can use the Gateway to access various services and submit transactions and payments with many state agencies.

Do I need to register my business in Ohio?

Who is required to register with the Ohio Secretary of State? Any business entity, domestic or foreign, planning to transact business within Ohio, using a name other than their own personal name, must register with this office. Business entities must file the appropriate formation documents to register their business.

Does Ohio require annual reports for LLC?

Do I have to file an annual report? Business entities in Ohio are not required to file an annual report.

How do I find out who owns an LLC in Ohio?

To look up who owns an LLC in Ohio, search the company records of the Ohio Secretary of State. These data are available online and include information on the owners and officials of LLCs registered in the state.

How do I verify a business in Ohio?

You can use the Ohio Secretary of State's Business Search portal to see if a business is registered to do business in Ohio.

How do I verify a business license in Ohio?

You can use the Ohio Secretary of State's Business Search portal to see if a business is registered to do business in Ohio.

Is it free to start an LLC in Ohio?

The filing fee is $99.00. At the time the entity registers, the limited liability company must appoint a statutory agent to accept service of process on behalf of the limited liability company within Ohio. The statutory agent must sign the form to accept appointment.

Do you have to renew your LLC every year in Ohio?

There are no Annual Reports for Ohio LLCs. The Ohio Secretary of State doesn't require you to file any annual information form or pay any annual fee for your LLC. Ohio is one of only 5 states that have a true “No Annual Report Due”.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send OH SOS 523A for eSignature?

Once your OH SOS 523A is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I fill out the OH SOS 523A form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign OH SOS 523A and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I complete OH SOS 523A on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your OH SOS 523A. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is OH SOS 523A?

OH SOS 523A is a form used in Ohio for reporting certain financial information and corporate activities to the Secretary of State.

Who is required to file OH SOS 523A?

Entities engaged in business activities in Ohio, such as corporations and limited liability companies (LLCs), are required to file OH SOS 523A.

How to fill out OH SOS 523A?

To fill out OH SOS 523A, provide the required details such as entity name, registration number, reporting period, and other financial data as specified in the instructions provided with the form.

What is the purpose of OH SOS 523A?

The purpose of OH SOS 523A is to ensure transparency and compliance with state regulations by collecting financial and operational information from businesses operating in Ohio.

What information must be reported on OH SOS 523A?

The information that must be reported on OH SOS 523A includes entity identification details, financial statements, income, expenditures, and any other relevant business activities during the reporting period.

Fill out your OH SOS 523A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OH SOS 523a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.