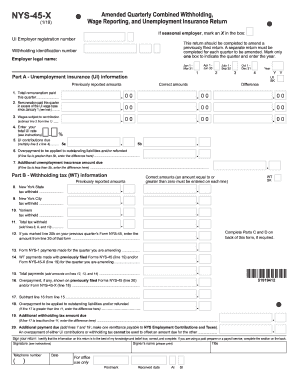

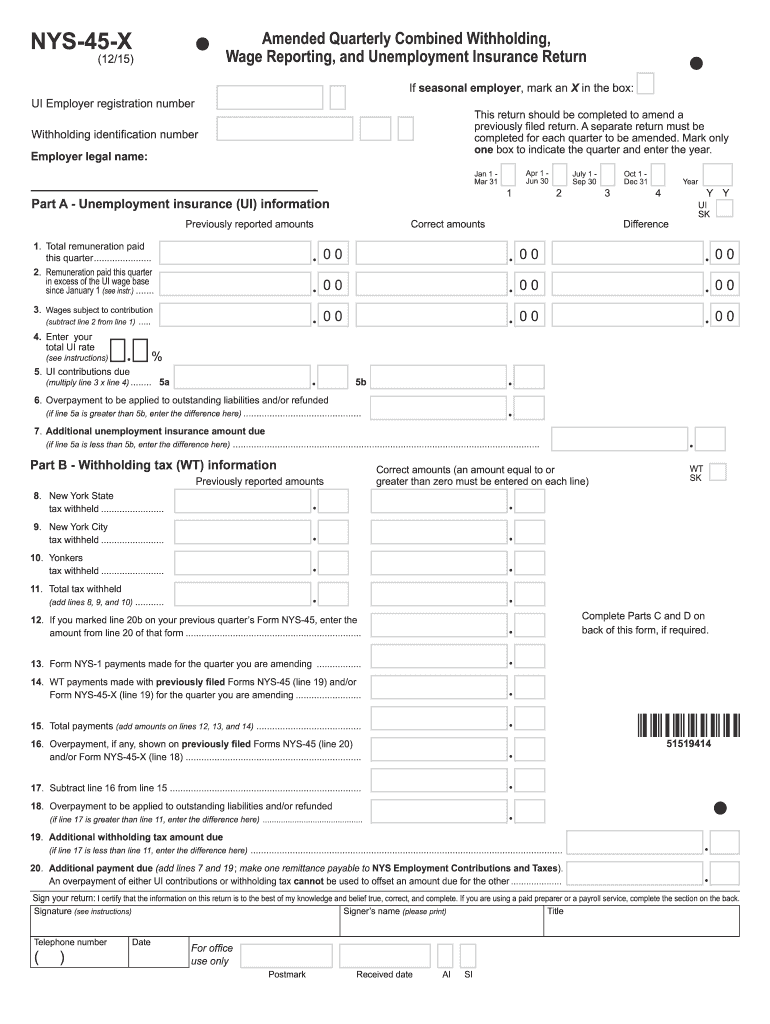

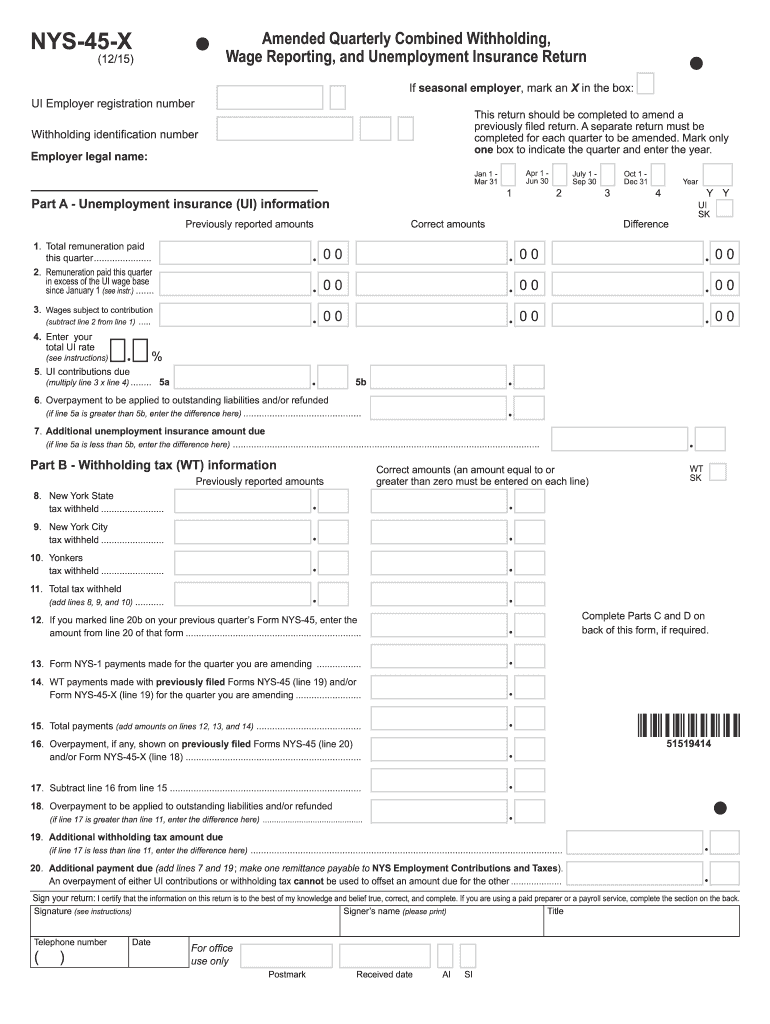

NY NYS-45-X 2015 free printable template

Show details

15. Total payments add amounts on lines 12 13 and 14. 51519414 and/or Form NYS-45-X line 18. 17. Subtract line 16 from line 15. 3. Form NYS-1 payments made for the quarter you are amending. 14. WT payments made with previously filed Forms NYS-45 line 19 and/or Form NYS-45-X line 19 for the quarter you are amending. See Form NYS-45-X-I Instructions for Form NYS 45 X. a Original last payroll date reported on Form NYS-1 line A mmdd total withheld reported on Form NYS-1 line 4 Correct mmdd d Note...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY NYS-45-X

Edit your NY NYS-45-X form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY NYS-45-X form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY NYS-45-X online

Follow the steps below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit NY NYS-45-X. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY NYS-45-X Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY NYS-45-X

How to fill out NY NYS-45-X

01

Gather employee information including names, Social Security numbers and wages.

02

Fill in the employer information at the top of the form including name, address, and employer identification number (EIN).

03

Indicate the reason for filing the NYS-45-X on the form.

04

Complete the sections detailing the employee wages, taxes withheld, and any corrections needed.

05

Review the form for accuracy.

06

Sign and date the form before submitting.

07

Submit the completed form to the New York State Department of Taxation and Finance.

Who needs NY NYS-45-X?

01

Employers who need to correct or amend a previously filed NYS-45 or NYS-45-ATT form.

02

Businesses that have made errors in employee wage reporting or tax submissions.

03

Employers who are required to reconcile or provide updated information regarding their payroll taxes.

Fill

form

: Try Risk Free

People Also Ask about

What are the due dates for filing the NYS form 45?

Your browser will need to support JavaScript to use this site completely.Forms NYS-45 and NYS-45-ATT. QuarterDue date*January 1 through March 31April 30April 1 through June 30July 31July 1 through September 30October 31October 1 through December 31January 31 Dec 16, 2022

What is the NYS-45 form?

NYS-45, Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return. All employers required to withhold tax from wages must file Form NYS-45, Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return, each calendar quarter.

What is the difference between NYS 1 and NYS-45?

Form NYS-1, Return of Tax Withheld, must be filed and the total tax withheld paid after each payroll that caused the total accumulated withholding tax to equal or exceed $700. If you withhold less than $700 during a calendar quarter, remit the taxes withheld with your quarterly return, Form NYS-45.

How do I get a copy of my NYS-45?

You may also contact the NYS Department of Taxation and Finance at (518) 457-5431 for a paper copy of the form.

How do I get NYS-45?

You may also contact the NYS Department of Taxation and Finance at (518) 457-5431 for a paper copy of the form.

Can I file a NYS-45 X online?

If you're an employer, you can Web File Form NYS-45 through your Business Online Services account.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find NY NYS-45-X?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the NY NYS-45-X in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit NY NYS-45-X online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your NY NYS-45-X to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I complete NY NYS-45-X on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your NY NYS-45-X. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is NY NYS-45-X?

NY NYS-45-X is a correction form used by employers in New York to correct previously filed quarterly payroll tax forms (NYS-45) for the period December 31, 2020, and onwards.

Who is required to file NY NYS-45-X?

Employers who have made errors in their previously filed NYS-45 forms, including mistakes in reported wages, taxes owed, or employee information, are required to file NY NYS-45-X.

How to fill out NY NYS-45-X?

To fill out NY NYS-45-X, employers must provide corrected information for the relevant periods, including the corrected wages, tax calculations, and any applicable employee information. The form must be signed and dated by an authorized representative.

What is the purpose of NY NYS-45-X?

The purpose of NY NYS-45-X is to allow employers to amend their previously submitted NYS-45 forms to ensure accurate reporting of payroll taxes and to rectify any discrepancies or errors.

What information must be reported on NY NYS-45-X?

NY NYS-45-X requires employers to report corrected wages, tax amounts, employee information, and any other relevant data that needs amendment based on previous filings.

Fill out your NY NYS-45-X online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY NYS-45-X is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.