IL CTPF 770 2015-2025 free printable template

Show details

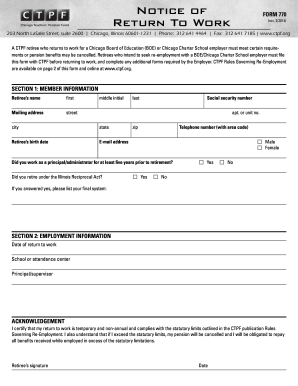

Ctpf.org A CTPF retiree who returns to work for a Chicago Board of Education BOE or a Chicago Charter School employer must not exceed re-employment limits or pension benefits and health insurance subsidies will be cancelled. Retirees who intend to seek re-employment with a BOE/Chicago Charter School employer must file this form with CTPF before returning to work and complete any additional forms required by the Employer. Notice of Return to Work P Chicago Teachers Pension Fund FORM 770 rev*...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign illinois ctpf form work online

Edit your illinois ctpf return work form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ctpf return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit il ctpf notice online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit IL CTPF 770. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL CTPF 770 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL CTPF 770

How to fill out IL CTPF 770

01

Start by gathering all necessary personal information such as your name, address, and Social Security number.

02

Obtain the IL CTPF 770 form from the Illinois Teachers' Pension Fund website or your school district.

03

Carefully read the instructions provided with the form to ensure you understand each section.

04

Fill out Section 1 with your personal details, including your job title and the school district.

05

In Section 2, provide information regarding your employment history, including dates of service and any previous retirement contributions.

06

Complete Section 3, where you'll disclose any other pension systems you are part of.

07

If required, attach additional documentation that supports your application or clarifies your service history.

08

Review all information for accuracy and completeness before signing the form.

09

Submit the form to the appropriate address as indicated in the instructions.

Who needs IL CTPF 770?

01

Teachers and educators who are members of the Illinois Teachers' Pension Fund and are applying for retirement benefits.

02

Individuals who have worked within the public schools of Illinois and wish to receive pension benefits upon retirement.

Fill

form

: Try Risk Free

People Also Ask about

What are the vesting requirements for CTPF?

The CTPF vesting requirement is 5 years of service for employees who joined CTPF or a reciprocal system before January 1, 2011, and 10 years of service for employees who joined on or after January 1, 2011.

What is the death benefit for CTPF?

Designated beneficiaries of active members (or members who pass away within a year of separation) receive a benefit based on the member's monthly salary and service credit, with a $10,000 maximum.

What is the rate of CTPF contribution?

CTPF is an employer-sponsored retirement plan where employee benefits are computed using a formula that considers factors such as length of employment and salary history. Total 9% Contribution. The employer portion is called the “pension pick up”.

How do I change my address with the Chicago Teachers Pension Fund?

For address change or direct deposit changes, please contact Member Services at 312-641-4464.

What is the designation of beneficiary for CTPF?

The Designation of Beneficiary form allows CTPF members to designate individuals who will be paid any available lump-sum death benefits at their death. It does not affect or determine survivor benefits, which are only payable to an eligible spouse or minor child.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit IL CTPF 770 from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your IL CTPF 770 into a dynamic fillable form that can be managed and signed using any internet-connected device.

Where do I find IL CTPF 770?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the IL CTPF 770 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I complete IL CTPF 770 online?

Easy online IL CTPF 770 completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

What is IL CTPF 770?

IL CTPF 770 is a form used by certain employers in Illinois to report contributions to the Chicago Teachers' Pension Fund.

Who is required to file IL CTPF 770?

Employers who participate in the Chicago Teachers' Pension Fund and are required to report contributions and related information must file IL CTPF 770.

How to fill out IL CTPF 770?

To fill out IL CTPF 770, employers need to provide accurate information regarding employee contributions, pension calculations, and any applicable deductions as per the guidelines set by the Chicago Teachers' Pension Fund.

What is the purpose of IL CTPF 770?

The purpose of IL CTPF 770 is to ensure compliance with reporting requirements to the Chicago Teachers' Pension Fund, facilitating accurate tracking of pension contributions and benefits.

What information must be reported on IL CTPF 770?

IL CTPF 770 must report details including the amount of contributions made for each employee, periods of service, and any other relevant data required by the Chicago Teachers' Pension Fund.

Fill out your IL CTPF 770 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL CTPF 770 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.