ACS IDR 2018-2026 free printable template

Show details

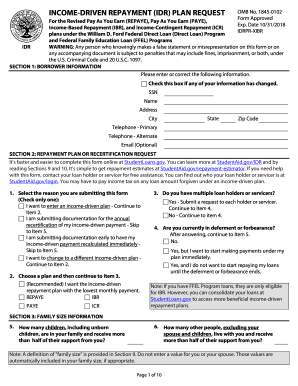

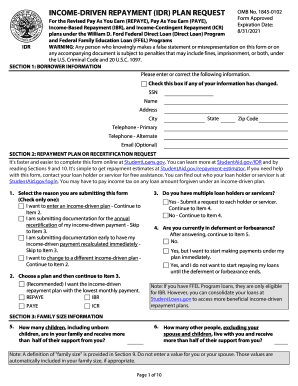

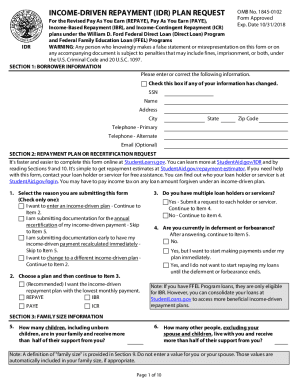

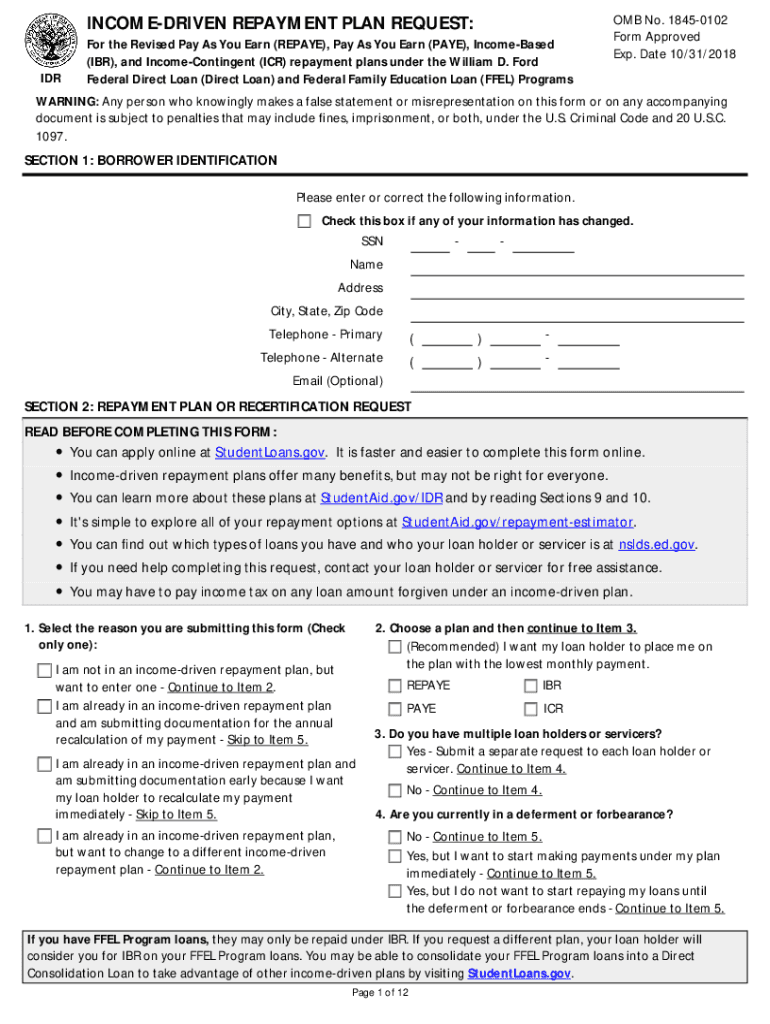

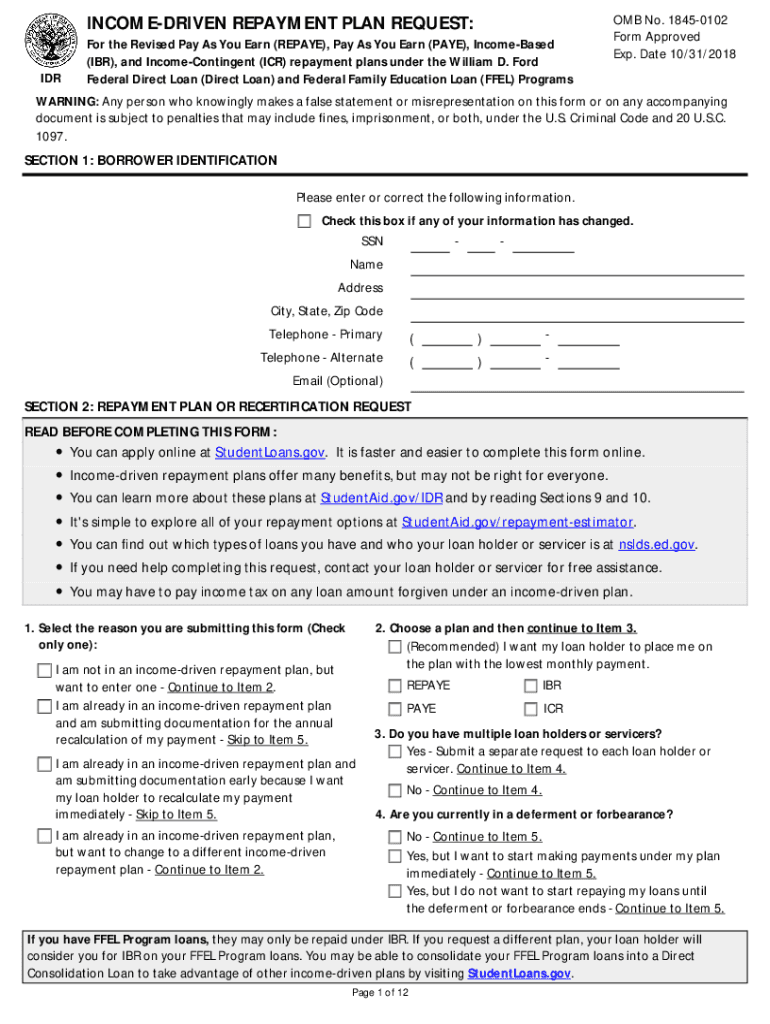

Gov. It is faster and easier to complete this form online. Income-driven repayment plans offer many benefits but may not be right for everyone. I understand that If I do not provide my loan holder with this completed form and any other required documentation I will not be placed on the plan that I requested. I may choose a different repayment plan for any student loans that are not eligible for income-driven repayment. If I am requesting an income-driven repayment plan or seeking to change...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign idr income driven request form

Edit your repayment plan form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your idr driven request form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing idr plan online

To use the professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit idr driven repayment form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out idr income request form

How to fill out ACS IDR

01

Gather necessary documents such as identification and relevant personal information.

02

Start the ACS IDR form by entering your personal details in the designated fields.

03

Fill out the education section, including the name of institutions and qualifications obtained.

04

Provide details of your employment history, including job titles, responsibilities, and duration of employment.

05

Ensure you answer all questions accurately, supporting your claims with documentation if needed.

06

Review your filled-out form to check for errors or omissions.

07

Submit the ACS IDR form electronically or by the specified method.

Who needs ACS IDR?

01

Individuals seeking assessment for skills recognition in the Australian migration process.

02

Professionals applying for employment or education opportunities in Australia.

03

Students planning to migrate to Australia for further studies.

Fill

idr application pdf

: Try Risk Free

People Also Ask about idr form

What is a repayment plan?

A repayment plan is a structured way to make up your missed mortgage loan payments over a period of time. If you are behind on your mortgage payments, your lender or servicer may allow you to enter into a repayment plan.

What form is needed for IRS payment plan?

Use Form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you).

What is an IBR form?

The Income-Based Repayment (IBR) plan is a repayment plan with monthly payments that are generally equal to 15% (10% if you are a new borrower) of your discretionary income, divided by 12.

What is an example of a standard repayment plan?

So, borrowers with low loan balances may repay their loans in less than 10 years using a standard repayment plan. For example, a $2,500 loan at 5% interest will have the calculated loan payment, $26.52, rounded up to $50, causing the debt to be paid off in only 57 payments (4.8 years).

How do I make a repayment plan?

How do I make a debt payment plan? Work out the total amount you have to repay your debts each month. Work out what percentage of your total debt you owe each creditor. Divide your total based on what you owe each creditor as a percentage of your total debts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute income driven repayment plan request form online?

pdfFiller makes it easy to finish and sign income driven repayment plan form online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit idr application pdf 2025 in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing idr plan request form and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I create an electronic signature for signing my idr forms in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your income driven repayment plan application pdf and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is ACS IDR?

ACS IDR stands for the Automated Commercial System Import Data Request. It is a document required by customs authorities to collect information related to goods imported into a country.

Who is required to file ACS IDR?

Importers or their agents are required to file ACS IDR when bringing goods into the country. This includes customs brokers and other representatives acting on behalf of the importer.

How to fill out ACS IDR?

To fill out ACS IDR, gather the necessary information about the shipment, including the description of goods, value, quantity, and any relevant documentation. Follow the specific guidelines provided by the customs authority and ensure all fields are completed accurately before submission.

What is the purpose of ACS IDR?

The purpose of ACS IDR is to facilitate the monitoring of imported goods by customs authorities, ensuring compliance with trade regulations, and collecting necessary data for revenue and statistical purposes.

What information must be reported on ACS IDR?

Information that must be reported on ACS IDR includes the consignee's details, description of the imported goods, value, quantity, shipping details, and any applicable tariff codes. Additional documentation may also be required depending on the nature of the goods.

Fill out your ACS IDR online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Idr Form Pdf is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.