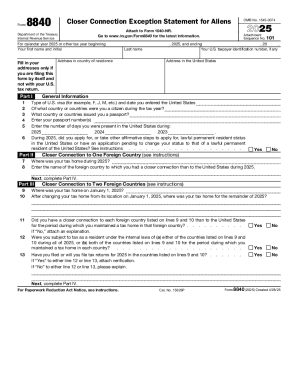

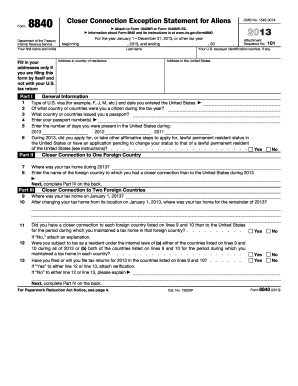

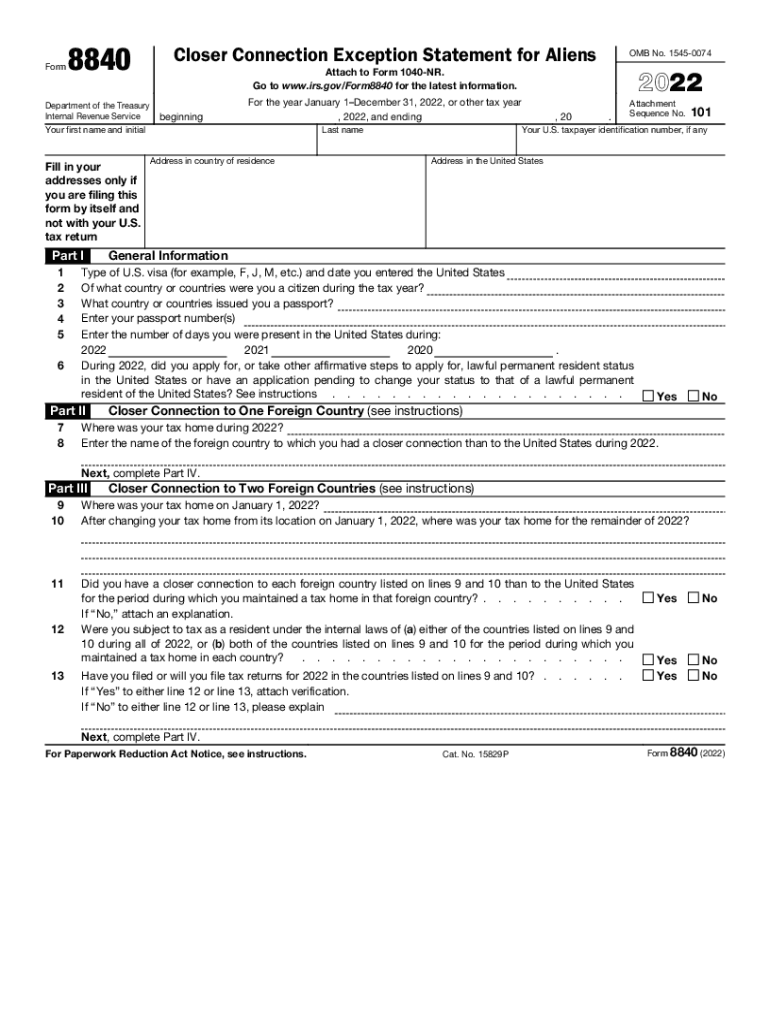

IRS 8840 2022 free printable template

Instructions and Help about IRS 8840

How to edit IRS 8840

How to fill out IRS 8840

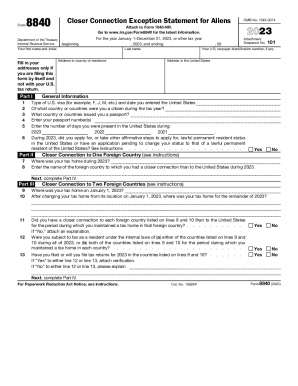

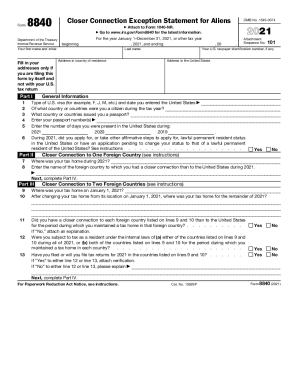

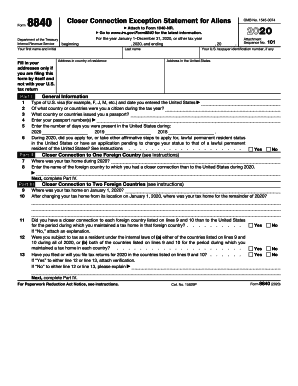

About IRS 8 previous version

What is IRS 8840?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 8840

What should I do if I realize I made an error after filing the IRS 8840?

If you discover a mistake after you've submitted the IRS 8840, you can file an amended return to correct the error. It's important to clearly indicate the changes made and provide any necessary documentation to support your amendments. Also, ensure your amended submission is made before any deadlines to avoid complications.

How can I verify the IRS received my IRS 8840 filing?

To confirm receipt of your IRS 8840, you can check your IRS account online or contact the IRS directly for confirmation. Keep an eye on any correspondence from them, as it may indicate whether your form has been processed successfully or if any issues have arisen.

What should I do if my e-filed IRS 8840 is rejected?

If your IRS 8840 e-filing gets rejected, carefully review the error messages provided by the IRS. Common rejection codes usually point to specific issues that can be corrected. Fix the problem and resubmit your form promptly, ensuring all the required information is accurate and complete to avoid delays.

Are there specific legal considerations when filing the IRS 8840 for nonresidents?

When nonresidents file the IRS 8840, they must be mindful of their eligibility criteria and the implications of their residency status. It’s crucial to provide accurate information regarding any income sources and to understand how their filing affects their tax obligations. Seeking guidance from a tax professional experienced in international tax matters can be beneficial.

See what our users say