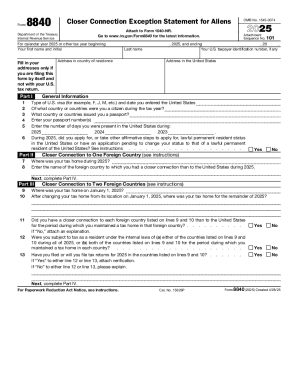

IRS 8840 2024 free printable template

Instructions and Help about IRS 8840

How to edit IRS 8840

How to fill out IRS 8840

Latest updates to IRS 8840

About IRS 8 previous version

What is IRS 8840?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 8840

What should I do if I made a mistake on my IRS 8840 form?

If you've made a mistake on your IRS 8840 form, you can correct it by filing an amended return. Make sure to clearly indicate that it's an amendment to avoid confusion. It's also advisable to contact the IRS to confirm receipt of the correction for your peace of mind.

How can I verify the status of my IRS 8840 submission?

To verify the status of your IRS 8840 submission, you can use the IRS online tools available for tracking your forms. Alternatively, check the confirmation receipt after your e-filing, which can assure you that your submission has been processed without issues.

What should I do if my IRS 8840 e-filing is rejected?

If your IRS 8840 e-filing is rejected, carefully review the error codes provided. Common issues include incorrect personal information or unaccepted formats. After correcting the errors, you can resubmit the form electronically or by mail as necessary.

Are there any legal nuances I should be aware of regarding IRS 8840?

Yes, when filing the IRS 8840, you should consider the acceptability of electronic signatures and the retention period for your records. Understanding these legal aspects can ensure compliance and help protect your data privacy.

What common errors should I avoid when filing IRS 8840?

Common errors to avoid while filing IRS 8840 include failing to double-check identification numbers and not providing complete addresses. Additionally, ensure that your form is signed and dated, as missing information can lead to processing delays.

See what our users say