ED IDR 2021 free printable template

Show details

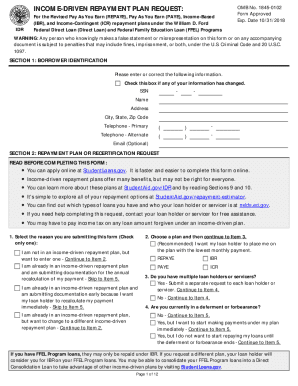

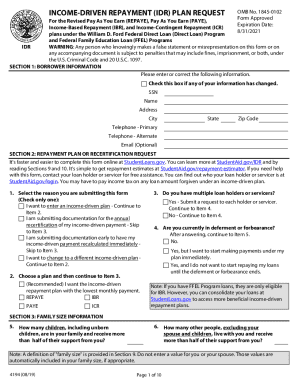

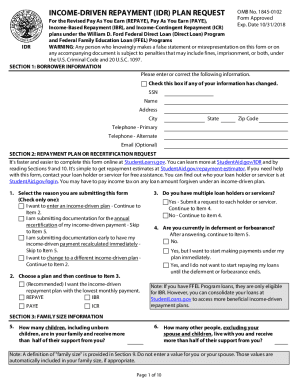

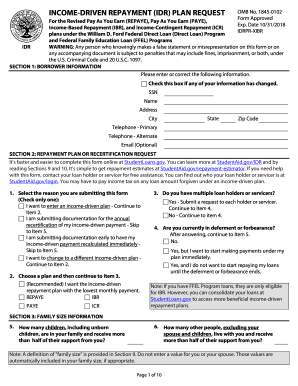

INCOMEDRIVEN REPAYMENT (IDR) PLAN REQUEST OMB No. 18450102

Form Approved

Expiration Date:

8/31/2021For the Revised Pay As You Earn (REPAY), Pay As You Earn (PAY),

Increased Repayment (IBR), and IncomeContingent

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ED IDR

Edit your ED IDR form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ED IDR form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ED IDR online

Follow the steps below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ED IDR. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ED IDR Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ED IDR

How to fill out ED IDR

01

Gather all necessary financial documents, including tax returns and income statements.

02

Visit the ED IDR application website or access the appropriate form.

03

Fill out personal identification information such as name, social security number, and contact details.

04

Provide information about your household size and the income of all members.

05

Detail your monthly expenses and any other financial obligations.

06

Review all provided information for accuracy.

07

Submit your completed ED IDR application form online or via mail.

Who needs ED IDR?

01

Students seeking income-driven repayment plans for their federal student loans.

02

Borrowers experiencing financial hardship who require lower monthly payments.

03

Individuals aiming to qualify for loan forgiveness programs based on their income.

Fill

form

: Try Risk Free

People Also Ask about

How long does it take to get IDR approval?

It usually takes about two weeks for your servicer to process an IDR application or recertification — however, some borrowers have experienced longer delays.

What is the best income driven repayment plan?

So, which is the best income-driven repayment plan? For most borrowers, REPAYE, PAYE, or IBR are better options than ICR, since they could give you lower monthly payments. And PAYE seems to have a slight edge over REPAYE and IBR, since it lowers your payments to 10% and sets your term at 20 years, rather than 25.

What are IDR documents?

IDR stands for Information Document Request. An IDR is issued on IRS Form 4564. It is a form that the IRS uses during a tax audit to request information from the taxpayer.

Is pay as you earn better than IBR?

IBR is easier to qualify for than PAYE While PAYE may further reduce your student loan bills and get you out of debt faster than IBR, it imposes stricter eligibility requirements. To get on the PAYE plan, you can't have had any unpaid Direct or FFEL student loans as of Oct.

Is income-driven repayment good?

Income-driven repayment plans provide multiple payment options that help lower the monthly payments on federal student loans. This is a great solution for borrowers who can't afford their loan repayments. However, this may not be the best solution for all borrowers.

Is income based repayment better?

Lower monthly payments IBR typically lowers your monthly payment more than ICR does. It limits payments to either 10% or 15% of your discretionary income, depending on the type of loan, whereas ICR caps payments at 20%.

What is the downside of income-driven repayment?

Cons of income-driven repayment plans You might pay more interest with IDR: Smaller payments are great for your budget, but you could end up spending more interest over the life of your loan. That's because you'll be accruing and paying interest for an additional 10 to 15 years.

How is IBR calculated?

On an Income-Based Repayment plan (IBR), your monthly payment is set at 10% to 15% of your discretionary income. The Department of Education guarantees that your new payment will never be more than what you paid through the Standard Repayment Plan. IBR periods are 20 to 25 years, depending on when you borrowed money.

Why am I not eligible for income based repayment?

PAYE and IBR Plans If the amount you would have to pay under the PAYE or IBR plan (based on your income and family size) is more than what you would have to pay under the 10-year Standard Repayment Plan, you wouldn't benefit from having your monthly payment amount based on your income, so you don't qualify.

What is the best income-driven repayment plan?

So, which is the best income-driven repayment plan? For most borrowers, REPAYE, PAYE, or IBR are better options than ICR, since they could give you lower monthly payments. And PAYE seems to have a slight edge over REPAYE and IBR, since it lowers your payments to 10% and sets your term at 20 years, rather than 25.

How to calculate student loan formula?

You first take the annual interest rate on your loan and divide it by 365 to determine the amount of interest that accrues on a daily basis. Say you owe $10,000 on a loan with 5% annual interest. You'd divide that 5% rate by 365: 0.05 ÷ 365 = 0.000137 to arrive at a daily interest rate of 0.000137.

Which is an example of an income-driven repayment plan for student?

For example, if the monthly interest that accrues on your subsidized loans is $40, but your monthly PAYE or IBR plan payment covers only $25 of this amount, the government will pay the remaining $15 for the first three consecutive years from the date you began repaying your loans under the PAYE or IBR plan.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify ED IDR without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including ED IDR, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I edit ED IDR on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit ED IDR.

Can I edit ED IDR on an Android device?

The pdfFiller app for Android allows you to edit PDF files like ED IDR. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is ED IDR?

ED IDR stands for Educational Data Integrated Reporting, which is a framework used to capture and report data related to educational institutions and their performance.

Who is required to file ED IDR?

Educational institutions that receive federal funding or participate in federal programs are required to file ED IDR.

How to fill out ED IDR?

To fill out ED IDR, institutions must gather the required data, complete the standardized reporting forms, and submit them to the relevant educational authority by the specified deadlines.

What is the purpose of ED IDR?

The purpose of ED IDR is to provide a consistent and comprehensive way of reporting educational data to ensure accountability and facilitate decision-making.

What information must be reported on ED IDR?

ED IDR must include information such as student enrollment numbers, graduation rates, financial aid details, and other metrics related to educational outcomes.

Fill out your ED IDR online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ED IDR is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.