ED IDR 2016 free printable template

Show details

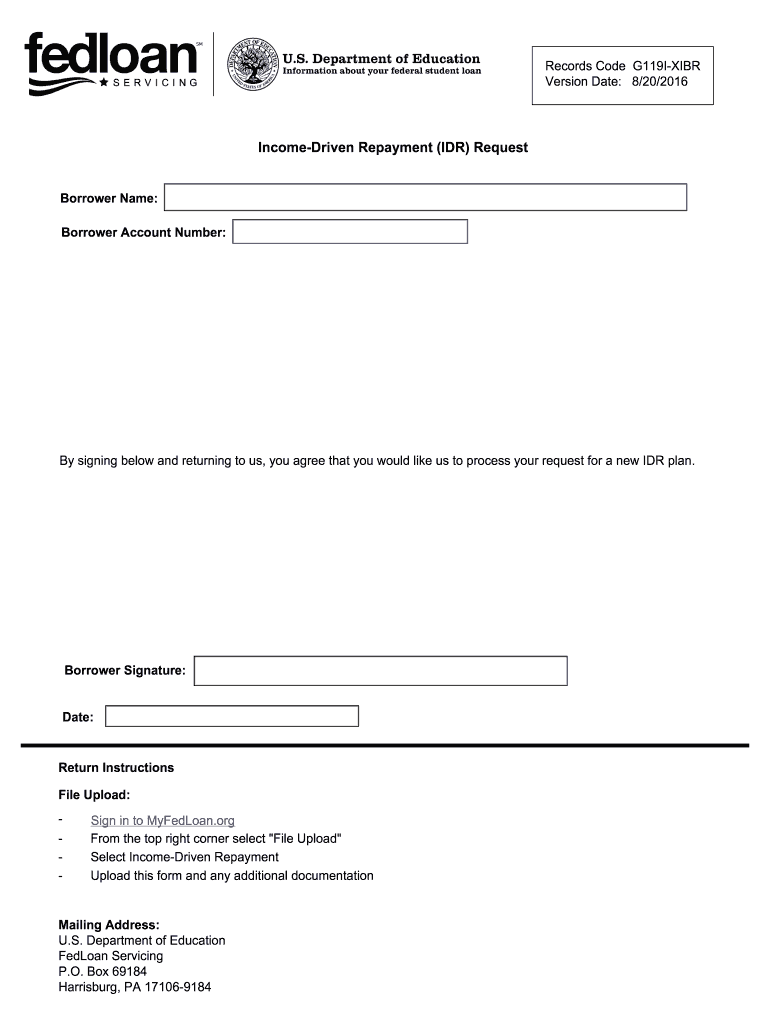

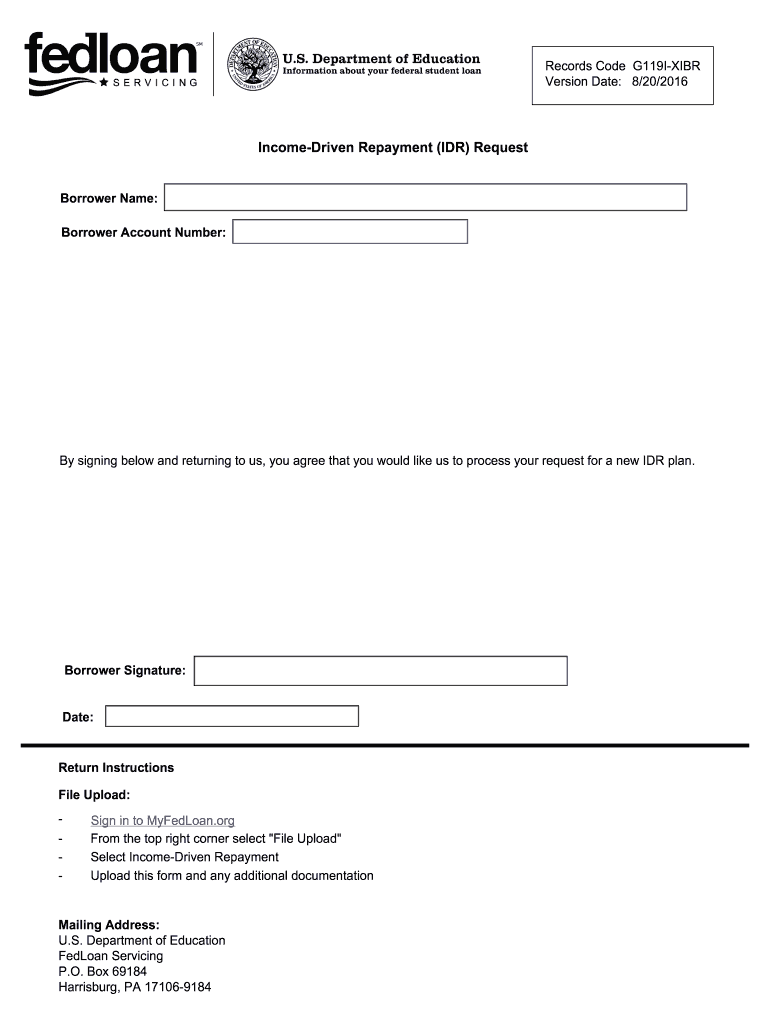

Records Code G119I-XIBR Version Date 8/20/2016 Income-Driven Repayment IDR Request Borrower Name Borrower Account Number By signing below and returning to us you agree that you would like us to process your request for a new IDR plan. Borrower Signature Date Return Instructions File Upload - Sign in to MyFedLoan.org From the top right corner select File Upload Select Income-Driven Repayment Upload this form and any additional documentation Mailing Address U.S. Department of Education FedLoan...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ED IDR

Edit your ED IDR form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ED IDR form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ED IDR online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ED IDR. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ED IDR Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ED IDR

How to fill out ED IDR

01

Gather all necessary information regarding your income and expenses.

02

Access the ED IDR form online or obtain a physical copy from the relevant agency.

03

Fill in your personal information at the top of the form, including your name, address, and social security number.

04

Input your total household income from all sources for the previous year.

05

List all eligible expenses that may affect your repayment plan, such as housing costs and other financial obligations.

06

Review the instructions provided on the form to ensure compliance with all requirements.

07

Double-check all entries for accuracy and completeness.

08

Submit the completed ED IDR form by the specified deadline, either online or by mailing it to the appropriate office.

Who needs ED IDR?

01

Students or graduates with federal student loans seeking a manageable repayment plan.

02

Individuals experiencing financial hardship looking for lower monthly payment options.

03

Borrowers interested in income-driven repayment plans to make their loans more affordable.

Fill

form

: Try Risk Free

People Also Ask about

What is proof of income for IDR?

Proof of income: You must submit your most recent tax return to show your updated income. If you don't have your tax return, you may submit alternative documentation, such as recent pay stubs or a letter from your employer. Signature: Your signature is your guarantee that all information is accurate.

What documents are needed for income-driven repayment?

Documentation will usually include a pay stub or letter from your employer listing your gross pay. Write on your documentation how often you receive the income, for example, “twice per month” or “every other week." • You must provide at least one piece of documentation for each source of taxable income.

How do I enroll in income-driven repayment plan?

To apply, you must submit an application called the Income-Driven Repayment Plan Request. You can submit the application online or on a paper form, which you can get from your loan servicer.

What are IDR documents?

IDR stands for Information Document Request. An IDR is issued on IRS Form 4564. It is a form that the IRS uses during a tax audit to request information from the taxpayer.

What is an IDR request?

Income-driven repayment (IDR) plans are designed to make your student loan debt more manageable by giving you a monthly payment based on your income and family size. If your outstanding federal student loan debt represents a significant portion of your annual income, an IDR plan might be right for you.

How long does it take to process an income driven repayment plan request?

These income-driven repayment (IDR) plans can make your monthly payment as little as 10 percent of your income. Despite the right to an IDR plan, borrowers still struggle to enroll. Generally, processing your IDR application should take no more than two weeks.

How long does it take to get IDR approval?

It usually takes about two weeks for your servicer to process an IDR application or recertification — however, some borrowers have experienced longer delays.

How do I get my student loan IDR?

You can apply for an IDR plan request on our website. Log in to your account and go to the Income-Driven Repayment (IDR) Plan Request page to complete an IDR application. providing proof of income.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my ED IDR directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your ED IDR along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

Can I edit ED IDR on an iOS device?

You certainly can. You can quickly edit, distribute, and sign ED IDR on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I edit ED IDR on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share ED IDR on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is ED IDR?

ED IDR stands for 'Electronic Data Interchange Initial Data Report'. It is a submission process used by various entities to provide essential data electronically in a standardized format.

Who is required to file ED IDR?

Entities involved in specific regulated activities or transactions that require data reporting are mandated to file ED IDR. This often includes businesses in industries such as finance, healthcare, and education.

How to fill out ED IDR?

To fill out ED IDR, users must access the designated electronic platform, review the instructions provided, and enter the required data into the appropriate fields accurately. It’s crucial to follow the specified format and guidelines.

What is the purpose of ED IDR?

The purpose of ED IDR is to ensure accurate, timely, and standardized reporting of important data between entities. This facilitates compliance, transparency, and data accuracy necessary for regulatory oversight.

What information must be reported on ED IDR?

The information reported on ED IDR typically includes entity identification, transaction specifics, financial details, compliance data, and other relevant metrics as specified by the governing body or regulation.

Fill out your ED IDR online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ED IDR is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.